Last Updated on February 3, 2025 by Arif Chowdhury

Ever found yourself staring at your trading screen, wondering, “How much should I risk on this trade?”

Or maybe you’ve felt that gut-wrenching anxiety when your positions swing against you.

I’ve been there too, and as a seasoned Forex trader since 2015, I’ve learned that calculating and adjusting your risk per trade dynamically is crucial for sustainable success.

Let’s break it down, step by step.

Understanding Risk Per Trade

Risk per trade is simply the amount of capital you’re willing to lose on a single trade.

It’s a key component in your overall trading plan.

Why does it matter?

- Preservation of Capital: You can’t trade if you’re out of money.

- Consistency: Helps you stick to your strategy without emotional hiccups.

- Long-term Success: Allows you to weather the inevitable storms of the market.

The 1% Rule

One popular approach is the 1% rule.

This means you risk no more than 1% of your trading capital on a single trade.

For example, if you have a $10,000 account, you’d risk $100 on each trade.

This simple rule can prevent catastrophic losses and keep you in the game longer.

Calculating Your Risk

Calculating your risk involves a few key factors:

- Account Size: Know your total trading capital.

- Risk Percentage: Decide what percentage of your account you’re willing to risk.

- Stop-Loss Distance: Determine how far your stop-loss will be from your entry point.

Risk Calculation Formula

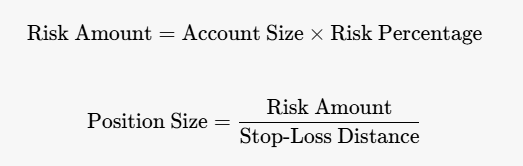

Here’s the formula:

Let’s say you have a $10,000 account, you’re risking 1%, and your stop-loss is 50 pips away.

- Risk Amount = $10,000 x 0.01 = $100

- Position Size = $100 / (50 pips x $10 per pip) = 0.2 lots

This means you’d trade 0.2 lots for that position.

Adjusting Your Risk Dynamically

Market conditions change, and so should your risk.

Here’s how to adjust dynamically:

- Monitor Volatility: Use indicators like Average True Range (ATR) to gauge market volatility. Higher volatility means you might want to reduce your risk.

- Account Growth: As your account grows, you can increase your risk percentage slightly, while still staying within your comfort zone.

- Loss Recovery: If you experience a drawdown, consider reducing your risk until you regain consistency.

Real-World Example

I remember a trade on GBP/USD that wasn’t going my way.

Initially, I had set my stop-loss based on previous support levels.

But as the trade progressed, I noticed increased volatility.

Instead of sticking to my original plan, I adjusted my stop-loss closer to my entry point and reduced my position size.

This decision saved me from a larger loss and allowed me to fight another day.

Statistical Insights

Did you know that traders who manage their risk properly have a 50% higher chance of long-term success?

Another study showed that over 70% of retail traders suffer losses, many due to poor risk management.

These stats are a wake-up call.

Tools to Help You

To make risk management easier, consider using trading bots.

With my trading bots, you can automate your trades, allowing you to focus on calculating and adjusting your risk dynamically without the emotional pressure.

Each of my 16 bots is designed to trade major currency pairs like EUR/USD and USD/JPY, leveraging sophisticated algorithms to maximize profit while minimizing risk.

Final Thoughts

Dynamic risk management is not just a skill; it’s an art.

By understanding your risk per trade and being adaptable, you can navigate the markets more confidently.

And remember, it’s not about how much money you make but how well you protect what you have.

If you’re looking to enhance your trading journey, consider checking out the best Forex brokers I’ve tested and my sophisticated trading bots.

They can be game-changers for your trading strategy.