Last Updated on November 1, 2025 by Arif Chowdhury

Are you struggling to find a solid Forex strategy that actually works?

Do you feel overwhelmed by the sheer amount of indicators and methods out there?

Trust me, I’ve been there.

As a seasoned Forex trader since 2015, I’ve explored every corner of fundamental and technical analysis.

Through my journey, I developed a powerful Grid trading system called Golden Grid.

This system captures market volatility and delivers impressive results.

With Golden Grid, I achieve 2-5% ROI daily and 60-150% monthly.

But enough about me. Let’s dive into how you can build your own Forex strategy using Envelopes and the Momentum Indicator.

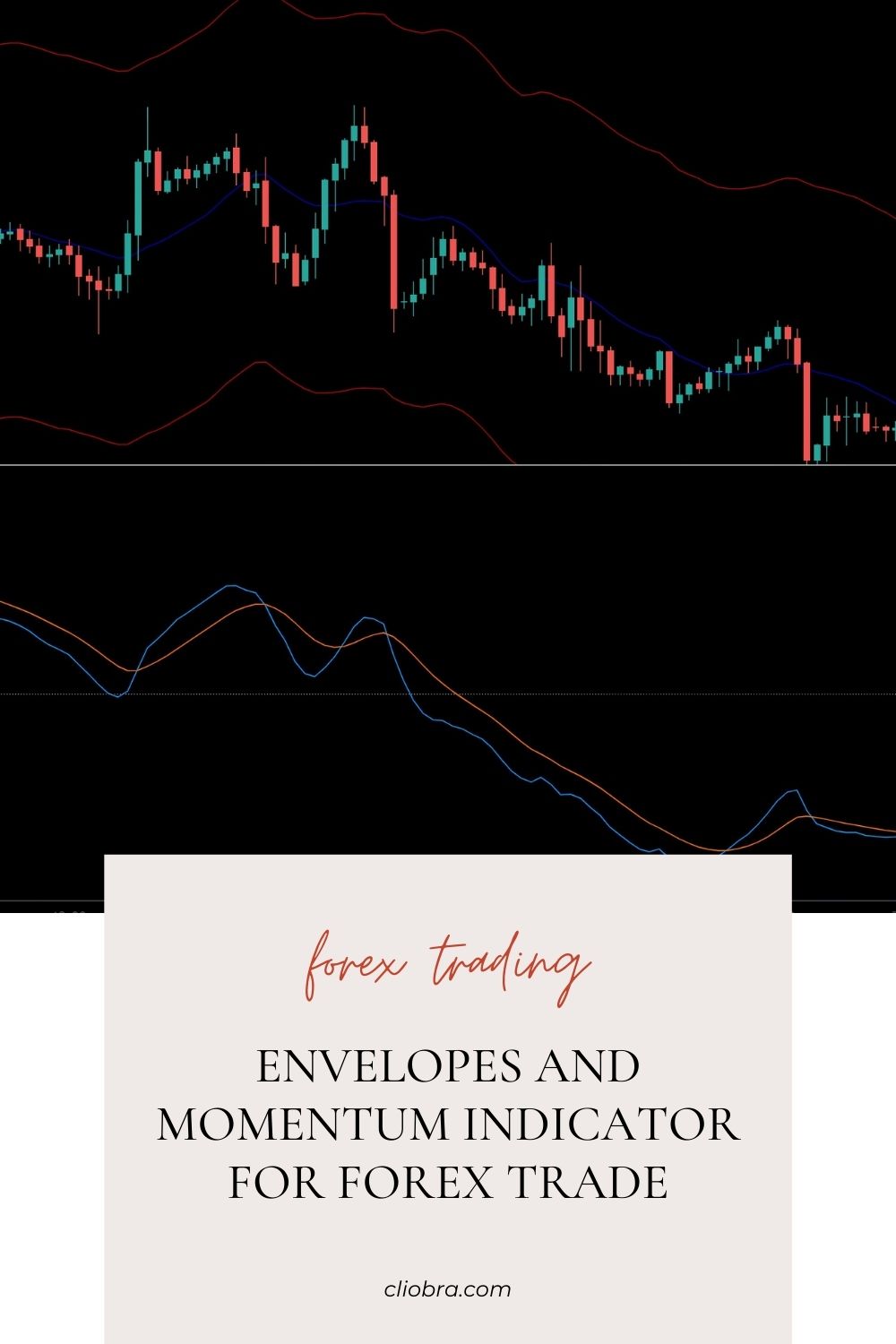

Understanding Envelopes

Envelopes are a technical analysis tool that helps traders identify potential price reversals.

They consist of two lines plotted above and below a moving average.

Here’s why they’re effective:

- Identify Overbought/Oversold Levels: When prices hit the upper envelope, it might be time to sell. Conversely, the lower envelope signals a potential buy.

- Visual Clarity: Envelopes provide a clear visual representation of price movement.

Using the Momentum Indicator

The Momentum Indicator measures the speed of price changes.

This tool is essential for traders looking to identify the strength of a trend.

Key benefits include:

- Confirming Trends: A rising momentum indicates a strong uptrend, while falling momentum suggests a downtrend.

- Entry and Exit Points: Use momentum to time your trades better.

Combining Envelopes and Momentum

Now that we understand both tools, let’s see how they work together.

- Set Up Your Charts:

- Use a 20-period moving average for Envelopes.

- Set your Momentum Indicator to a 14-period.

- Identify Trends:

- Look for price hitting the upper or lower envelope.

- Check the Momentum Indicator. If it’s rising and the price is near the lower envelope, consider buying. If it’s falling and the price is near the upper envelope, think about selling.

- Confirm with Volume:

- Volume can provide additional confirmation. High volume during a breakout increases the reliability of your signals.

The Golden Grid Advantage

While building your strategy is crucial, having the right tools makes a world of difference.

That’s where my Golden Grid EA comes in.

It’s designed to capture quick profits across all currency pairs.

On Gold (XAU/USD), the returns can be even higher.

Imagine not having to wait for trading signals.

With Golden Grid, you can start trading immediately, often capturing 20-40 pips in just a couple of hours.

This system is tailored to maximize your ROI, typically around 2-3% of your capital daily.

And guess what?

You can try it completely for free!

Check it out here.

Risk Management

No strategy is complete without solid risk management.

Here are a few tips:

- Use Stop-Loss Orders: Always set a stop-loss to protect your capital.

- Risk Only What You Can Afford to Lose: Don’t overexpose yourself.

- Test on a Demo Account First: Always practice before diving into live trading.

Choosing the Right Forex Broker

The right broker can make all the difference in your trading journey.

Look for brokers that offer:

- Tight Spreads: This reduces your cost per trade.

- Fast Execution: Time is money in Forex.

- Great Customer Support: You want someone reliable to help you.

After extensive testing, I recommend checking out some of the most trusted Forex brokers.

You can find them here.

Final Thoughts

Building a Forex strategy using Envelopes and the Momentum Indicator can be straightforward.

By combining these tools, you can gain insights into market trends and improve your trading decisions.

And don’t forget the power of the Golden Grid EA.

With this tool, you can trade efficiently and potentially increase your profits without the stress of manual trading.

Start your trading journey today, and embrace the world of Forex with confidence!