Last Updated on March 22, 2025 by Arif Chowdhury

Are you tired of unpredictable returns in Forex trading?

Struggling with how much to risk on each trade?

You’re not alone.

Many traders face the same dilemmas.

As a seasoned Forex trader since 2015, I’ve delved deep into both fundamental and technical analysis, primarily focusing on the latter.

My journey has led me to create a unique and proven trading strategy that has consistently delivered profits.

Today, I want to share insights on building a quantitative Forex model using the Kelly Criterion for risk optimization.

Let’s dive in! 🚀

What is the Kelly Criterion?

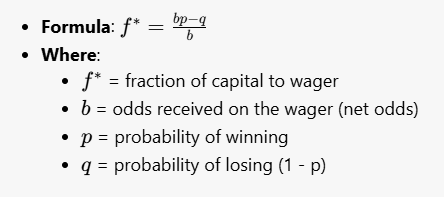

The Kelly Criterion is a mathematical formula used to determine the optimal size of a series of bets.

In Forex, it helps traders figure out how much of their capital to risk on each trade based on expected returns.

Here’s how it works:

Using this formula can significantly enhance your risk management strategy.

Why Use the Kelly Criterion?

- Optimizes Growth: It maximizes the growth of your capital over time.

- Reduces Risk of Ruin: Helps you avoid risking too much on any single trade.

- Adapts to Market Conditions: Can adjust based on your win rate and payout ratio.

Understanding Your Win Rate

Before applying the Kelly Criterion, you need to estimate your win rate accurately.

Let’s say you have a win rate of 60% on your trades:

- This means you win 6 out of every 10 trades.

- Your probability of losing is 40%.

If you’re confident in your analysis and strategies, applying the Kelly Criterion can help you make smart, calculated risks.

Diversification: The Key to Stability

As I mentioned earlier, I’ve developed a portfolio of 16 sophisticated trading bots across four major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each currency pair has 3-4 bots, internally diversified to minimize correlated losses.

This multi-layered diversification creates a robust system that enhances profitability while mitigating risk.

Advantages of My Trading Bots

- Long-Term Performance: Designed to trade for 200-350 pips.

- Backtested for 20 Years: Proven results under various market conditions.

- Free EA Portfolio: I’m offering this entire portfolio for FREE!

Using these bots can complement your application of the Kelly Criterion by automating your trading strategy and managing risk effectively.

For more details on these bots, check out my 16 trading bots portfolio.

Applying the Kelly Criterion in Practice

Here’s how to practically implement the Kelly Criterion in your trading:

- Calculate Your Win Rate: Determine how often you win trades based on historical data.

- Estimate Payout Ratios: Understand the average profit of your winning trades versus the losses of your losing trades.

- Use the Formula: Plug your numbers into the Kelly formula to determine the optimal trade size.

For example, if you have a win rate of 60% with an average profit of $1.50 for every $1 lost, you would calculate your optimal bet size accordingly.

The Importance of Choosing the Right Broker

To effectively implement a quantitative Forex model, you need a reliable broker.

Choosing the right broker can make all the difference in your trading success.

Here’s what to look for:

- Tight Spreads: Lower costs mean higher profitability.

- Fast Execution: Speed is crucial in Forex.

- Customer Support: You need help when things go south.

I’ve tested several brokers and found some that stand out.

You can check out the best options on my recommended Forex brokers page.

Conclusion

Building a quantitative Forex model using the Kelly Criterion is a game changer.

It not only helps you manage risk but also optimizes your potential for growth.

By incorporating automation through my 16 trading bots and selecting a reliable broker, you can enhance your trading journey.

Remember, Forex trading is a marathon, not a sprint.

Stay disciplined, keep learning, and watch your efforts pay off!