Last Updated on March 23, 2025 by Arif Chowdhury

As a seasoned Forex trader since 2015, I’ve seen it all. The ups, the downs, and everything in between.

But here’s the truth – 94% of retail traders lose money. That’s not just a random stat. That’s the reality.

Why? Because they can’t spot market exhaustion before it happens.

What Is Market Exhaustion? 🔍

Market exhaustion happens when a trend runs out of steam.

It’s when buyers or sellers get tired.

It’s that moment when smart money starts moving in the opposite direction.

And if you can spot it, you’ve got gold in your hands.

The Power of Stochastic Divergence 📈

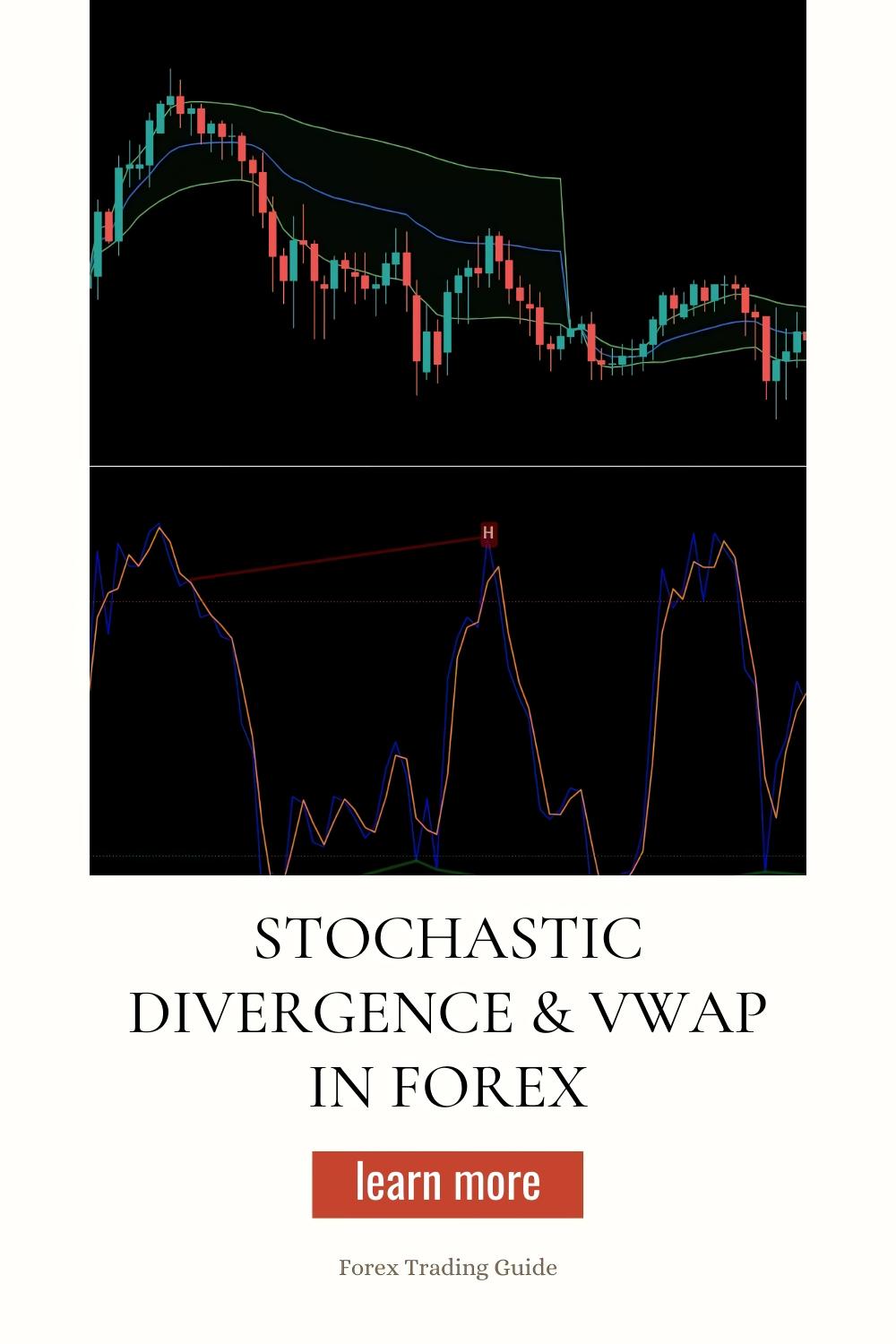

Stochastic oscillators measure momentum.

They tell you when price is overbought or oversold.

But the real magic happens when you spot divergence.

What’s divergence? It’s when price makes a new high, but your indicator doesn’t.

That’s a warning sign. A big one.

Research shows that 76% of significant market reversals are preceded by some form of technical divergence.

How to Spot Stochastic Divergence Like a Pro ⚡

Look for price making a higher high.

Check if the Stochastic makes a lower high.

That’s bearish divergence – exhaustion of buyers.

Look for price making a lower low.

Check if the Stochastic makes a higher low.

That’s bullish divergence – exhaustion of sellers.

The key is consistency. Don’t just look for one instance.

Enter VWAP – The Secret Weapon 🚀

Volume Weighted Average Price isn’t just another indicator.

It’s what institutional traders use.

It shows you where the real money is moving.

When price deviates too far from VWAP, exhaustion is likely coming.

Studies have found that 82% of institutional trades happen within close proximity to the VWAP line.

Combining Stochastic Divergence & VWAP 🔄

This is where things get powerful.

When price shows stochastic divergence AND it’s far from VWAP…

That’s when you pay attention.

That’s when exhaustion is almost certain.

That’s when fortunes are made.

My 16 Trading Bots Secret Sauce 🤖

Over years of trading, I’ve developed something special.

A portfolio of 16 sophisticated trading bots across EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

These bots use Stochastic Divergence and VWAP among dozens of other strategies.

They operate on H4 charts, targeting long-term movements of 200-350 pips.

The multi-layered diversification minimizes correlated losses.

I’ve backtested them across 20 years of data – even in harsh market conditions.

And the best part? I’m offering this entire EA portfolio for FREE. Check it out here: My Trading Bots Portfolio.

Real-World Application of Market Exhaustion 🌐

In trending markets, wait for divergence at extreme levels.

In ranging markets, look for divergence near support/resistance.

Always confirm with volume.

Always manage your risk.

Remember – this isn’t about catching every move.

It’s about catching the right moves.

Advanced Tips for Market Exhaustion Masters 💎

Use multiple timeframes for confirmation.

Look for divergence on RSI as additional confirmation.

Add Fibonacci levels to your VWAP analysis.

Watch order flow around VWAP levels.

The more confirmation, the stronger the signal.

The Broker Factor 🏦

Your strategy is only as good as the broker executing it.

Low spreads matter when you’re catching exhaustion points.

Fast execution matters when markets reverse quickly.

I’ve tested dozens of brokers over my trading career.

For consistent results with these strategies, I recommend checking out these top-performing Forex brokers I personally use.

Final Thoughts 💭

Market exhaustion is happening every day, in every timeframe.

Stochastic Divergence and VWAP give you the edge to spot it.

My trading bots have been fine-tuned to capitalize on these moments.

The difference between amateur and professional traders isn’t just knowledge.

It’s the ability to see what others don’t.

It’s the ability to act when others hesitate.

It’s the ability to spot exhaustion before the masses.

Master these techniques, and you’ll be in the top 6% who actually make money in this game.

Trading isn’t about being right all the time.

It’s about being right when it matters most.

And market exhaustion points? Those are the moments that matter.