Last Updated on March 17, 2025 by Arif Chowdhury

Ever felt like you’re trapped in a cycle of whipsaws?

You think you’ve spotted the perfect entry point, only to watch your trade reverse and eat away at your profits.

Frustrating, right?

As a seasoned Forex trader since 2015, I’ve been there.

I’ve navigated the choppy waters of the Forex market, armed with an arsenal of strategies.

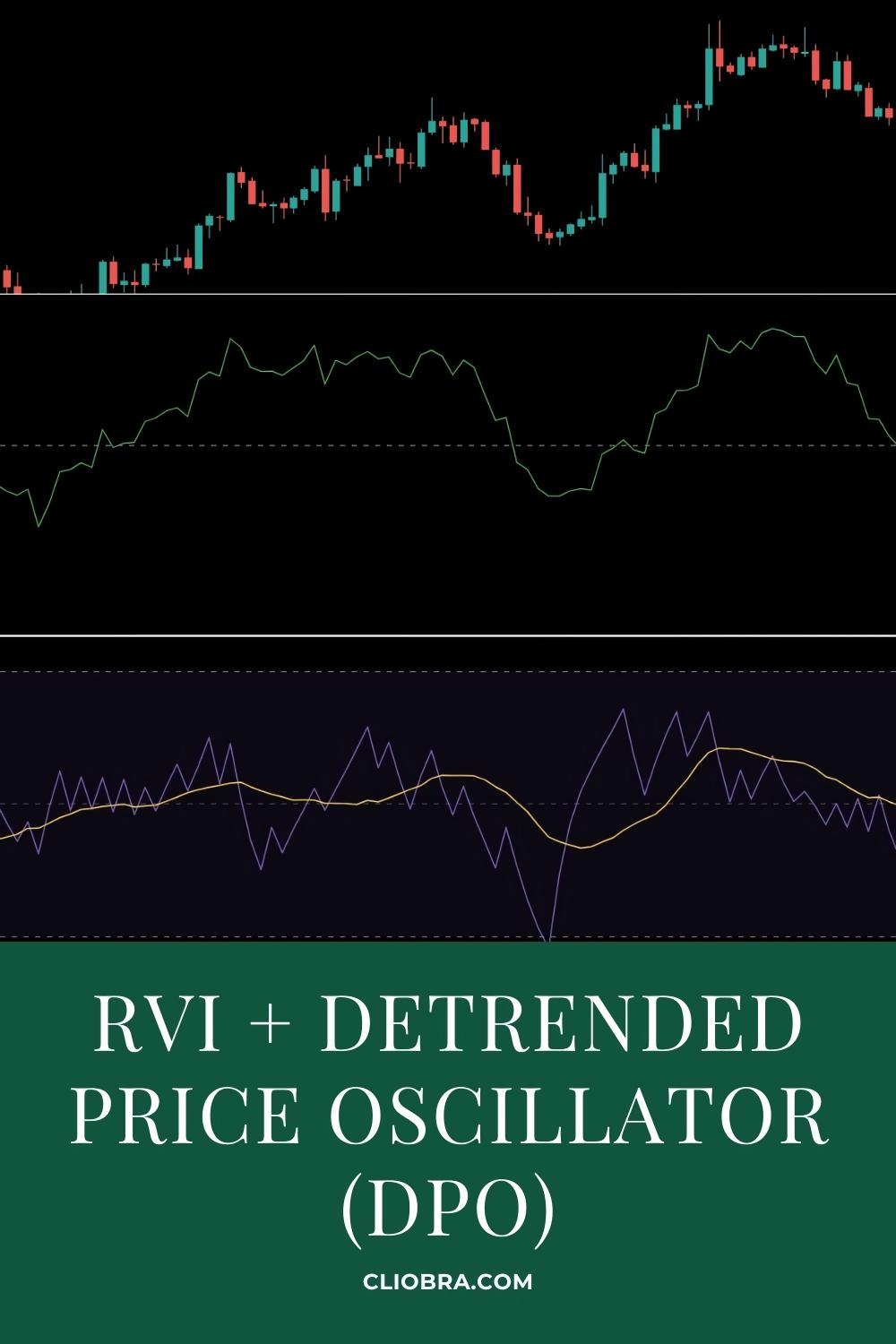

One of the most effective strategies I’ve discovered is the RVI + Detrended Price Oscillator (DPO) strategy.

Let’s break it down.

What is the RVI?

The Relative Vigor Index (RVI) is a momentum oscillator that helps traders identify the strength of a trend.

- It compares the closing price to its price range over a specific period.

- This helps determine whether the market is bullish or bearish.

In simple terms, if the RVI is above zero, the bulls are in charge.

Below zero? The bears are ruling the roost.

This clarity is essential for cutting through the market noise.

What’s the Detrended Price Oscillator?

Now, let’s talk about the Detrended Price Oscillator (DPO).

- The DPO helps traders eliminate the impact of long-term trends.

- It focuses on short-term price movements, giving you a clearer picture of potential reversals.

By removing the noise from long-term trends, the DPO allows you to spot opportunities more easily.

Why Combine RVI and DPO?

Combining the RVI and DPO is like having the best of both worlds.

- RVI gives you the trend direction.

- DPO highlights potential reversals.

This combination helps you avoid those pesky whipsaws that can derail your trading strategy.

How to Implement the Strategy

Here’s how you can effectively use the RVI + DPO strategy:

- Identify the Trend with RVI:

- Look for RVI readings above or below zero.

- Only consider trades in the direction of the trend.

- Check for Reversals with DPO:

- Use the DPO to spot potential reversal points.

- When the DPO crosses above or below zero, it may signal a change in price direction.

- Confirm with Other Indicators:

- It’s always smart to use additional indicators for confirmation.

- Look at volume or other momentum indicators to strengthen your decision.

This method not only minimizes whipsaws but also helps you trade with confidence.

My Trading Bot Portfolio

Now, let’s talk about my 16 trading bots that utilize this strategy among others.

These bots are designed for long-term trading, focusing on major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each currency pair has its unique set of bots, internally diversified to minimize correlated losses.

- Each of these algorithms has been backtested for over 20 years.

- They excel under various market conditions and are designed to capture 200-350 pips.

This level of diversification significantly enhances overall profitability while reducing risk.

What’s even better? I’m offering this EA portfolio for FREE.

Check it out here!

Why Traders Need This Strategy

Statistics show that nearly 70% of traders lose money in Forex.

This isn’t just bad luck; it’s often due to poor strategy and emotional trading decisions.

By adopting the RVI + DPO strategy, you can significantly increase your chances of success.

It helps you stay disciplined and focused, reducing the emotional rollercoaster that comes with trading.

Choose the Right Brokers

A solid strategy deserves a reliable broker.

I’ve tested and handpicked the best Forex brokers that align with this strategy.

Using a broker with low spreads and high execution speed can enhance your trading experience.

Take a look at my top recommendations here to find a broker that fits your trading style.

Conclusion

The Forex market can be daunting, but with the right tools and strategies, you can navigate it successfully.

The RVI + Detrended Price Oscillator (DPO) strategy is a powerful method to eliminate whipsaws and enhance your trading performance.

Don’t forget to leverage my FREE EA portfolio that incorporates this strategy and more.

And remember, choosing the right broker is crucial for your trading success.

Let’s conquer the Forex market together!