Last Updated on March 17, 2025 by Arif Chowdhury

Ever sat in front of your trading screen and thought, “How do I know if this trend is gonna keep going?”

Or maybe you’ve wondered, “What tools can help me ride the waves of market momentum without getting wiped out?”

I’ve been there. Since 2015, I’ve dived deep into both fundamental and technical analysis. I’ve crafted a unique trading strategy that keeps me consistently profitable.

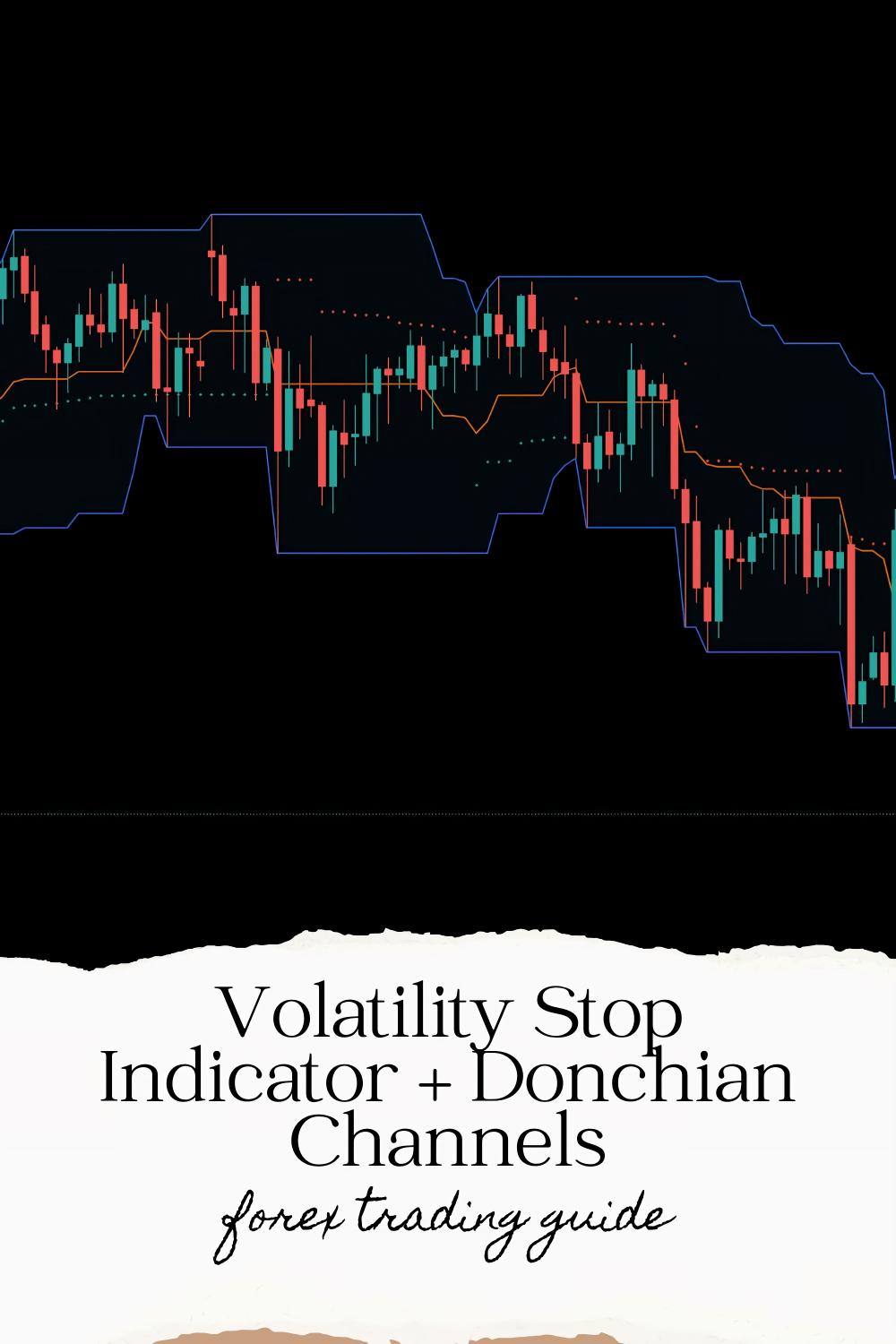

Let’s break down how to use the Volatility Stop Indicator and Donchian Channels to help you catch those sweet trend continuations.

Understanding the Basics

First off, what’s the deal with these indicators?

Volatility Stop Indicator

- This tool helps identify potential reversal points in the market.

- It adapts to market volatility, meaning it gets tighter during calm periods and expands during wild swings.

- Use it to set trailing stops that lock in profits while giving your trades room to breathe.

Donchian Channels

- This is a trend-following indicator that shows the highest high and lowest low over a set period (typically 20 periods).

- If the price breaks above the upper channel, it signals a continuation of the uptrend.

- Conversely, if it drops below the lower channel, it indicates a potential downtrend.

Setting Up Your Chart

Here’s how to get started with these indicators:

- Add the Volatility Stop Indicator to your chart.

- Overlay the Donchian Channels.

- Set both indicators to a time frame that suits your trading style — I prefer using H4 charts.

Identifying Trend Continuation

Now, let’s talk strategy:

- Look for Breakouts:

- If the price breaks above the upper Donchian Channel and the Volatility Stop is below the price, that’s your cue to potentially enter a buy.

- Confirm with Volume:

- Check if there’s increased volume during the breakout. Higher volume can signal strength in the move.

- Set Your Stops:

- Use the Volatility Stop as your trailing stop. As the price moves, adjust your stop to lock in profits.

Why This Works

Statistically, using the right indicators can improve your win rate. Studies suggest that traders using a combination of trend-following indicators can see an increase in profitability by up to 15%.

My Trading Bots

Now, let me share a little secret: I’ve developed a portfolio of 16 sophisticated trading bots that utilize strategies like the Volatility Stop Indicator + Donchian Channels among others.

These bots are designed for the long haul, targeting moves of 200-350 pips.

They’re internally diversified to minimize correlated losses and ensure robust performance across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

And guess what? I’m offering this entire EA portfolio completely FREE.

If you’re serious about boosting your trading game, check it out here: my trading bots portfolio.

Managing Risks

Let’s face it, Forex trading isn’t all sunshine and rainbows. Market conditions can turn on a dime.

- Use Proper Risk Management:

- Never risk more than 1-2% of your capital on a single trade.

- Be Prepared for Volatility:

- Understand that even the best strategies can falter. Stay adaptable.

Choosing the Right Broker

If you want to maximize your trading experience, you need a solid broker. The right broker can mean the difference between a smooth trading journey and a bumpy ride.

Here are a few qualities to look for:

- Tight Spreads:

- Look for brokers that offer competitive spreads to enhance your profitability.

- Fast Execution:

- Ensure your broker has a proven track record of quick order execution.

- Excellent Support:

- A responsive customer service team can save you headaches down the line.

I’ve tested several brokers and can confidently recommend the best ones for Forex traders. Check them out here: top forex brokers.

Final Thoughts

Using the Volatility Stop Indicator + Donchian Channels can significantly enhance your ability to identify trend continuations.

Pairing these tools with a solid risk management strategy and a trustworthy broker can set you on the path to success.

Remember, trading is a journey, not a sprint.

Stay informed, stay disciplined, and always keep learning.

You got this! 🚀