Last Updated on March 16, 2025 by Arif Chowdhury

Ever felt overwhelmed trying to figure out Forex trading?

You’re not alone.

Many traders, especially newbies, face anxiety when deciding how to interpret market signals.

Should you trust the indicators, or is it all just noise?

I get it.

As a seasoned Forex trader since 2015, I’ve been through the trenches.

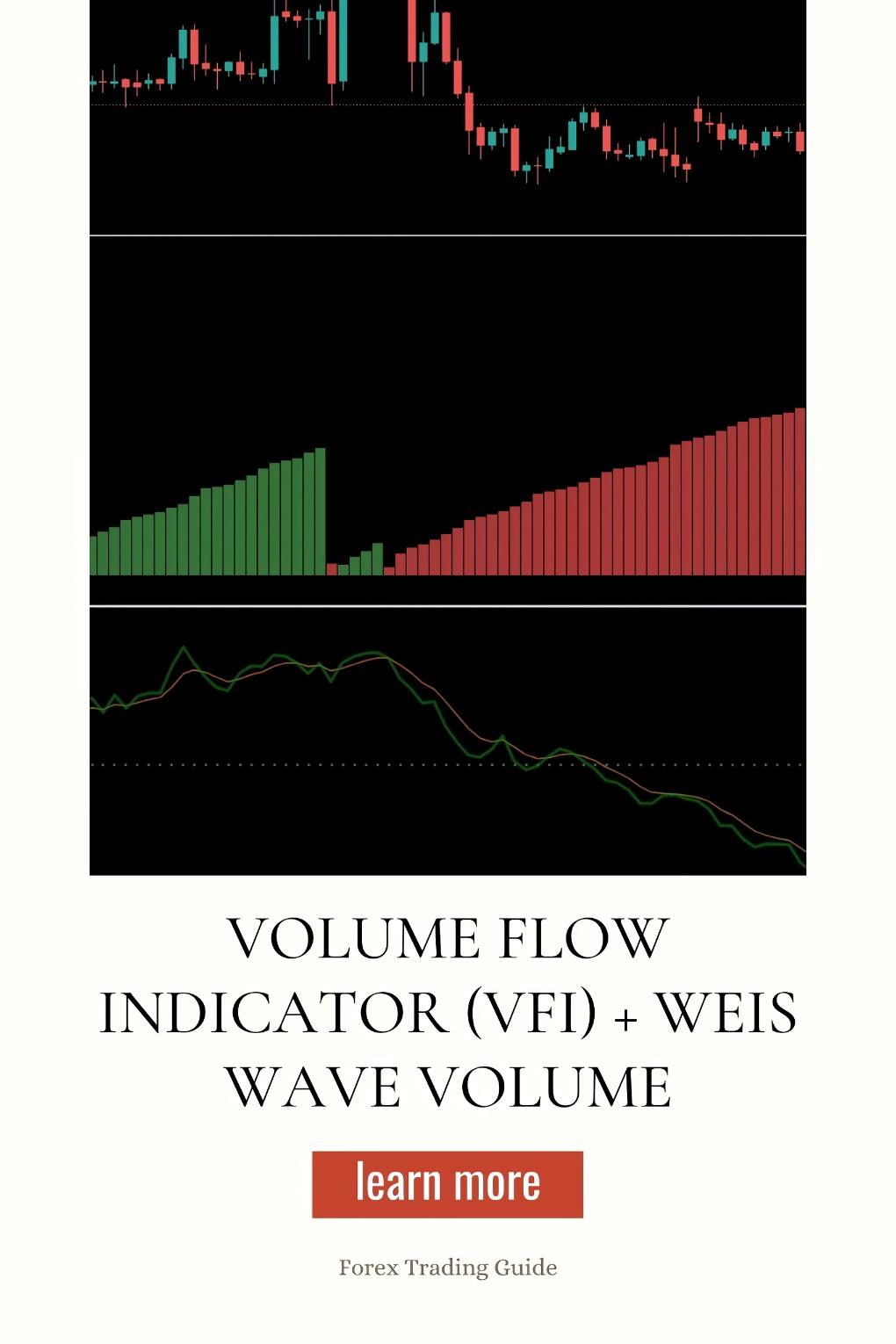

I’ve refined my strategy, focusing on technical analysis, particularly using the Volume Flow Indicator (VFI) and Weis Wave Volume.

Let’s break down how you can leverage these tools effectively.

What is the Volume Flow Indicator (VFI)?

The VFI measures the flow of volume in the market.

It helps identify whether buying or selling pressure is dominating.

When the VFI is rising, it indicates strong buying pressure, while a falling VFI suggests selling pressure.

This gives you a clear sense of market sentiment.

Weis Wave Volume: The Game Changer

Now, let’s add another layer with Weis Wave Volume.

This tool analyzes volume and price action, helping you spot trends and reversals.

It breaks down trading volume into waves, offering insights into institutional behavior.

By combining VFI and Weis Wave Volume, you create a powerful duo for tracking institutional movements.

Why Use VFI and Weis Wave Volume Together?

- Enhanced Accuracy:

Using both indicators increases your chances of making informed decisions. - Identifying Market Trends:

These indicators help you spot whether the market is bullish or bearish. - Risk Management:

They provide insights that can help you set better stop losses and entry points.

How to Implement VFI and Weis Wave Volume in Your Trading

- Step 1: Set Up Your Chart

- Use a reliable trading platform (MT4 or MT5).

- Add the VFI and Weis Wave Volume indicators to your chart.

- Step 2: Analyze the Indicators

- Look for divergences between VFI and price.

- If price is making new highs but VFI isn’t, it may signal a reversal.

- Step 3: Confirm with Other Analysis

- Always cross-reference your findings with market news or fundamental analysis.

- Step 4: Execute Your Trade

- Enter when both indicators align with your analysis.

- Set your stop loss just below the last swing low for protection.

My Trading Bots: The Secret Weapon

Now, let’s talk about a little something I created.

I’ve developed 16 sophisticated trading bots that utilize the VFI and Weis Wave Volume strategy, among others.

These bots are strategically diversified across four major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot is designed to minimize risk while maximizing returns.

- Multi-layered Diversification:

Each currency pair has 3-4 bots, ensuring you’re not overly exposed to any single market movement. - Long-Term Performance:

My bots target 200-350 pips, which is why they excel over time. - Proven Track Record:

Backtested for 20 years, they perform well even in tough market conditions.

And the best part? You can access my EA portfolio for FREE!

Check out my 16 trading bots and see how they can enhance your trading strategy.

Tips for Success in Forex Trading

- Stay Educated:

Keep learning about indicators and market trends. - Practice Patience:

Don’t rush your trades. Wait for the right signals. - Manage Your Risk:

Always use stop losses and never risk more than you can afford to lose.

Finding the Right Broker

Choosing a solid broker is crucial.

A good broker can make or break your trading experience.

I’ve tested several, and I highly recommend checking out the best Forex brokers that I’ve vetted personally.

They offer tight spreads, excellent support, and the tools you need to succeed.

Conclusion

Trading Forex can be daunting, but with the right tools and strategies, it becomes manageable.

The Volume Flow Indicator and Weis Wave Volume are excellent starting points for tracking institutional movements.

Combine that with my robust trading bots, and you’re well on your way to a successful trading journey.

Don’t forget to explore the best Forex brokers to ensure you have a strong foundation for your trading endeavors.