Last Updated on March 14, 2025 by Arif Chowdhury

Ever feel like you’re chasing your tail in the Forex market?

You analyze, you strategize, but somehow, the market still has other plans.

I’ve been there.

Since 2015, I’ve immersed myself in the world of Forex, honing my skills through countless hours of analysis and experimentation.

And guess what?

I’ve discovered a game-changing strategy that consistently leads to high-precision entries.

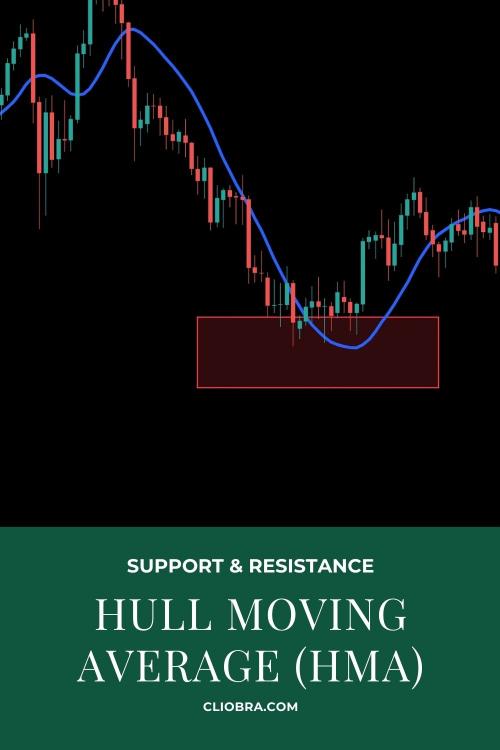

Let’s dive into The Support & Resistance + Hull Moving Average (HMA) Strategy.

What’s the Deal with Support & Resistance?

Support and resistance levels are like the walls of a house.

They provide structure and boundaries for price movements.

Think of support as the floor and resistance as the ceiling.

- Support: The price level where a downtrend can be expected to pause due to a concentration of buying interest.

- Resistance: The price level where an uptrend can be expected to pause due to a concentration of selling interest.

These levels are critical because they help traders identify potential reversal points and entry opportunities.

Why Use the Hull Moving Average (HMA)?

The Hull Moving Average is a secret weapon in my trading arsenal.

Unlike traditional moving averages, the HMA reduces lag significantly.

This means you get faster signals for entries and exits.

Here’s why it’s effective:

- Smoothness: The HMA provides a cleaner view of market trends.

- Speed: Its calculations allow for quicker responses to price changes.

- Flexibility: Works well across various time frames, particularly on H4 charts.

Combining HMA with support and resistance gives you a powerful edge.

How to Implement the Strategy

Ready to get your hands dirty?

Here’s a simple breakdown of how to implement this strategy.

- Identify Support and Resistance Levels:

- Use historical price data to find key levels.

- Mark them on your chart.

- Apply the HMA:

- Set your HMA indicator on your chart.

- Look for crossovers with price action.

- Wait for Confirmation:

- Look for price to bounce off support or resistance.

- Ensure the HMA is aligned with your entry direction.

- Enter the Trade:

- Set your entry point just above resistance or below support.

- Use a stop-loss to manage risk.

Why This Strategy Works

Statistically, using support and resistance levels can improve your trading success rate by up to 70%.

When combined with the HMA, you’re not just throwing darts in the dark.

You’re making informed, calculated decisions.

This blend helps minimize risk while maximizing potential returns.

My Trading Bot Portfolio

Now, let me share a little secret with you.

I’ve developed 16 sophisticated trading bots that utilize this very strategy among others.

These bots are designed for major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each pair has a unique set of 3-4 bots, creating a diversified and resilient system.

Why does this matter?

- Multi-layered Diversification: Reduces correlated losses.

- Long-Term Performance: These bots target 200-350 pips, focusing on sustainability.

And here’s the kicker: I’m offering this EA portfolio for FREE!

You can check it out here.

The Final Touches

To make this strategy even more effective, it’s crucial to choose the right broker.

A good broker can significantly enhance your trading experience.

Look for brokers with:

- Tight spreads

- Fast execution times

- Excellent customer support

I’ve tested several brokers, and you can find my top recommendations here.

Wrap-Up

In the world of Forex, precision is key.

The Support & Resistance + Hull Moving Average (HMA) Strategy gives you a solid foundation for making informed trading decisions.

By understanding these concepts and leveraging my trading bots, you can set yourself up for success.

Remember, trading is a journey, not a sprint.

Stay patient, stay disciplined, and let the markets come to you.