Last Updated on March 14, 2025 by Arif Chowdhury

Are you struggling to make sense of Forex trends?

Wondering how to identify strong market movements?

You’re not alone. Many traders face these challenges.

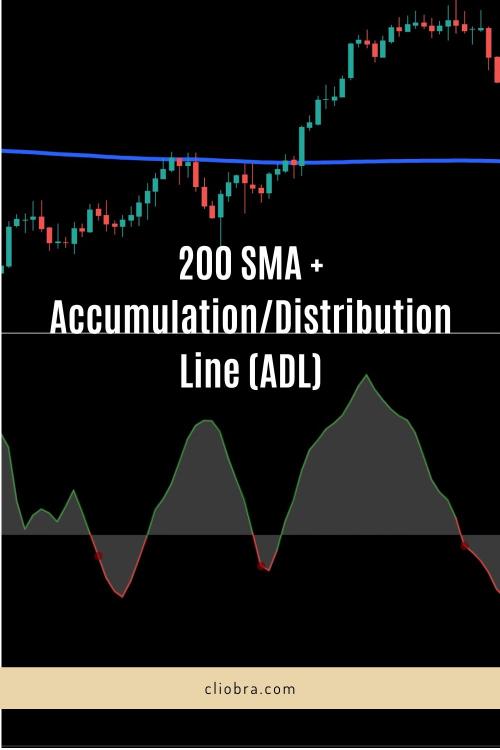

Let’s dive into a strategy that’s been a game changer for me: using the 200 Simple Moving Average (SMA) along with the Accumulation/Distribution Line (ADL).

This combo has helped me navigate the Forex waters since 2015, and I’m here to share how you can do it too.

Understanding the 200 SMA

The 200 SMA is a powerful tool in your trading arsenal.

It smooths out price action over a significant period, helping you identify the overall trend direction.

When the price is above the 200 SMA, it’s generally considered an uptrend.

When it’s below, we’re looking at a downtrend.

Here are some quick facts:

- Statistical Insight: Studies show that around 70% of traders rely on moving averages for trend analysis.

- Visual Clarity: The 200 SMA provides a clear line for entry and exit points.

What is the Accumulation/Distribution Line (ADL)?

The ADL is all about volume.

It measures the cumulative flow of money in and out of a security.

When the ADL is rising, it indicates accumulation—more buyers than sellers.

When it’s falling, it suggests distribution—more sellers than buyers.

It’s a fantastic way to confirm the strength of a trend.

Here’s why you should consider it:

- Volume Matters: Around 80% of price movement is influenced by volume, making ADL a crucial indicator.

- Trend Confirmation: Combining ADL with the 200 SMA can increase your trade success rate.

How to Use the 200 SMA and ADL Together

Here’s how to implement this strategy effectively:

- Identify the Trend:

- Check if the price is above or below the 200 SMA.

- If it’s above, consider looking for buying opportunities.

- If it’s below, focus on selling.

- Analyze the ADL:

- Look for divergences between price and ADL.

- If the price is making new highs but the ADL isn’t, that could signal exhaustion.

- Conversely, if the price is making new lows and the ADL is climbing, that’s a bullish sign.

- Entry and Exit Points:

- Enter trades when both indicators align.

- For buying: Price above 200 SMA and ADL rising.

- For selling: Price below 200 SMA and ADL falling.

- Use previous highs/lows or other indicators for your exit strategy.

My Proven Trading Bots

Now, let’s chat about something that can elevate your trading game: my 16 trading bots.

These bots utilize the 200 SMA and ADL strategy among other dozens of trading strategies.

They’re designed to trade across four major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Here’s what sets them apart:

- Diverse Algorithms: Each currency pair has 3-4 unique bots, minimizing correlated losses.

- Long-Term Focus: They target long-term gains of 200-350 pips, optimizing performance over time.

- Robust Backtesting: I’ve tested these bots over the past 20 years, and they hold up well even in volatile markets.

- Free Access: You can explore my entire EA portfolio for FREE. Check it out here.

The Importance of Choosing the Right Broker

Your strategy can only shine if you have a reliable broker.

Look for features like tight spreads, quick order execution, and strong customer support.

I’ve tested numerous brokers, and I recommend the ones that stand out.

Here’s where you can find the best forex brokers: check this out.

It’s essential to have a solid foundation for successful trading.

Wrapping It Up

Trading Forex doesn’t have to be a daunting task.

With the right tools—like the 200 SMA and ADL—you can identify trends and make more informed decisions.

Pair that with my 16 trading bots, and you’re setting yourself up for success.

The market is full of opportunities; it’s all about leveraging the right strategies.

Remember, consistent success comes from understanding your tools and having a solid trading plan.

Jump in, start experimenting with the 200 SMA and ADL, and don’t forget to explore my trading bots and recommended brokers.

You got this!