Last Updated on March 14, 2025 by Arif Chowdhury

Are you tired of the relentless ups and downs of the Forex market?

Wondering how to find a strategy that not only works but also stands the test of time?

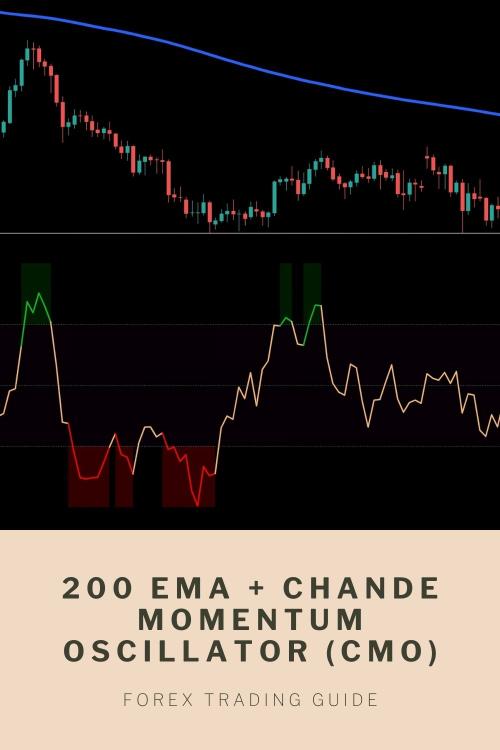

Let’s dive into a game-changing approach that I’ve been using since 2015: The 200 EMA + Chande Momentum Oscillator (CMO) Strategy.

This strategy is designed for long-term position trading, and trust me, it’s not just theory. It’s backed by real results.

Understanding the Basics

First off, let’s break down the components.

- 200 EMA (Exponential Moving Average): This is a key indicator that helps smooth out price action. It reacts faster to recent price changes compared to a simple moving average.

- Chande Momentum Oscillator (CMO): This indicator measures momentum by comparing the number of up and down closes over a specified period. It helps identify overbought or oversold conditions.

When combined, these tools provide a robust framework for making informed trading decisions.

Why This Strategy Works

- Long-Term Focus: The 200 EMA is excellent for spotting the overall trend.

- Momentum Insight: The CMO gives you a clear picture of market momentum, helping you decide when to enter or exit.

- Statistical Edge: Studies show that using moving averages can improve trading performance by up to 20%.

How to Use the Strategy

Let’s make it simple. Here’s a step-by-step guide:

- Identify the Trend: Check the price relation to the 200 EMA. If the price is above, it’s bullish; if below, it’s bearish.

- Look at the CMO: A reading above +40 suggests overbought conditions, while below -40 indicates oversold conditions.

- Set Your Entries and Exits: Enter when price pulls back towards the EMA and the CMO is turning back from extremes.

The Power of Diversification

Now, here’s where it gets interesting.

I’ve developed a unique portfolio of 16 trading bots that utilize this strategy among others.

Each bot is tailored for major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

- Each bot is diversified to minimize correlated losses.

- They target long-term gains of 200-350 pips.

This multi-layered approach means you’re not just relying on one bot or one strategy.

You’re spreading risk across multiple algorithms, significantly enhancing profitability while reducing the likelihood of simultaneous losses.

Plus, I’ve backtested these bots for the past 20 years. They perform excellently under various market conditions.

And the best part? You can access this EA portfolio for FREE.

If you want to take your trading to the next level, check out my 16 trading bots portfolio.

Risk Management Is Key

No trader can afford to ignore risk.

Here’s what you need to keep in mind:

- Set proper stop-loss orders.

- Use position sizing to manage exposure.

- Stay disciplined and avoid emotional trading.

Finding the Right Broker

To execute this strategy effectively, you need a solid broker.

I’ve tested several, and I recommend looking for one with:

- Tight spreads

- Fast execution

- Strong customer support

These features can drastically impact your trading results.

For a curated list of the best Forex brokers, check out my top recommendations.

Wrapping It Up

In a nutshell, the 200 EMA + Chande Momentum Oscillator (CMO) Strategy is a powerful tool for long-term traders.

It provides clarity and direction, allowing you to trade with confidence.

By utilizing my 16 trading bots, you can diversify your approach and mitigate risk effectively.

And don’t forget about the importance of choosing the right broker to support your trading journey.

Trade smart, stay informed, and you’ll see how this strategy can transform your trading experience.