Last Updated on March 13, 2025 by Arif Chowdhury

Are you struggling to make consistent profits in Forex trading?

Feeling overwhelmed by all the indicators and strategies out there?

You’re not alone.

As a seasoned Forex trader since 2015, I’ve been there.

I’ve spent countless hours exploring fundamental and technical analysis.

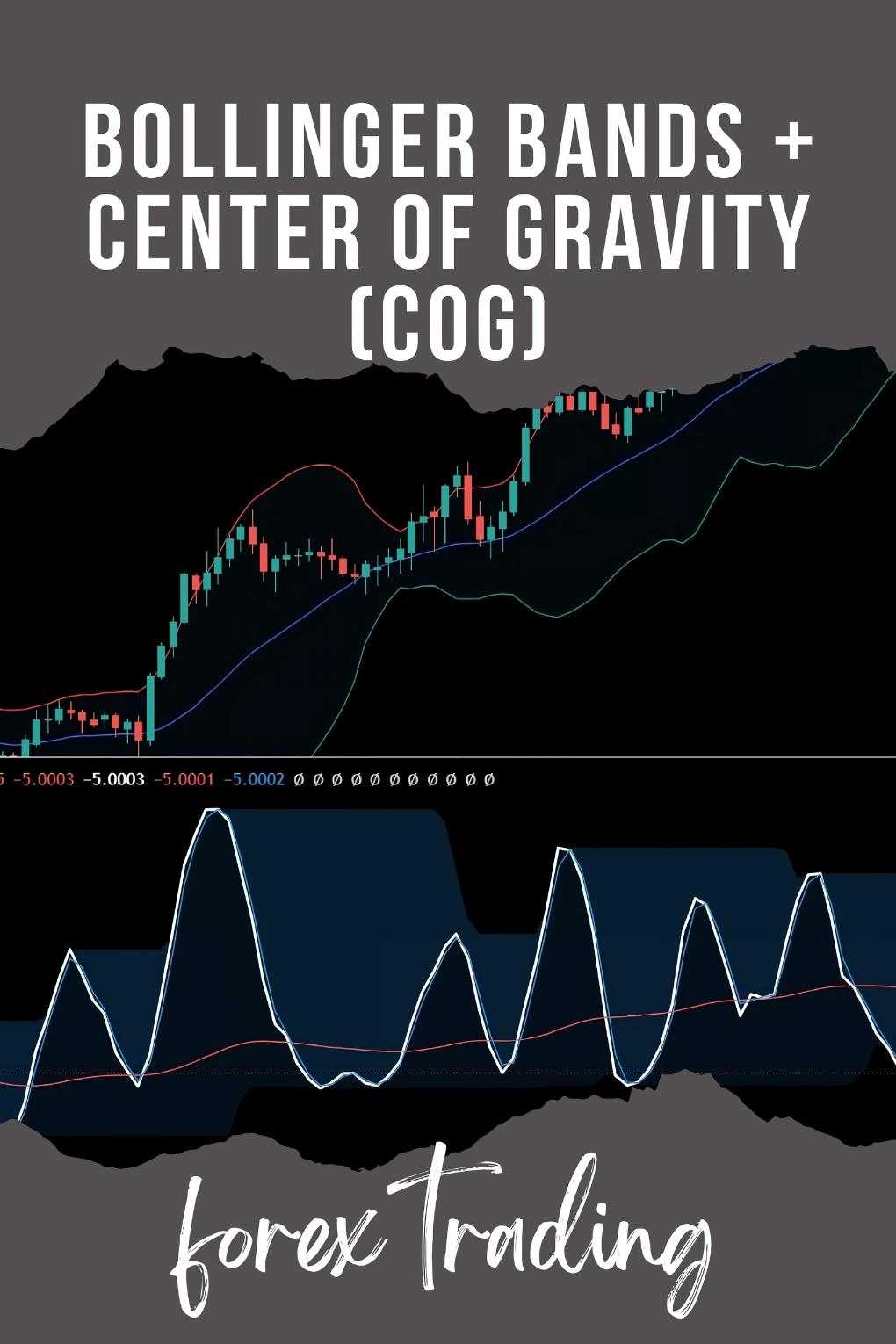

Today, I want to share a game-changing strategy: using Bollinger Bands alongside the Center of Gravity (CoG) Indicator.

Let’s break it down.

What Are Bollinger Bands?

Bollinger Bands are a popular technical analysis tool that consists of three lines:

- Middle Band: The simple moving average (SMA).

- Upper Band: The SMA plus two standard deviations.

- Lower Band: The SMA minus two standard deviations.

These bands expand and contract based on market volatility.

When the price is near the upper band, it might be overbought.

When it’s close to the lower band, the asset might be oversold.

What Is the Center of Gravity (CoG) Indicator?

The CoG indicator helps identify potential reversal points by smoothing price data.

It shows the average price over a specific period, helping traders visualize where the market is likely to head next.

Why Combine Bollinger Bands and CoG?

Combining these two indicators creates a powerful trading strategy.

- Volatility and Trend Confirmation: Bollinger Bands show volatility while CoG confirms the trend direction.

- Better Entry and Exit Points: Using both indicators helps you pinpoint when to enter or exit trades for maximum profit.

How to Use This Strategy

Here’s a step-by-step guide to implementing this strategy:

- Set Up Your Charts:

- Use H4 (4-hour) charts for long-term trades.

- Apply Bollinger Bands with a 20-period SMA.

- Add the CoG indicator with a similar timeframe.

- Identify Market Conditions:

- Look for price touching the upper or lower bands.

- Check the CoG for confirmation of a trend reversal.

- Make Your Move:

- Buy Signal: Price hits the lower Bollinger Band and the CoG shows a bullish reversal.

- Sell Signal: Price touches the upper Bollinger Band and the CoG indicates a bearish reversal.

- Set Your Risk Management:

- Always use stop-loss orders to protect your capital.

- Consider the volatility indicated by the Bollinger Bands when setting your stop-loss.

Enhancing Your Trading with EAs

Now, let me introduce a little secret that has transformed my trading journey: my portfolio of 16 sophisticated trading bots.

These bots are designed to trade based on various strategies, including the Bollinger Bands + CoG strategy.

Each bot operates on major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

- Diversification: Each currency pair hosts 3-4 bots, minimizing correlated losses.

- Long-Term Performance: They target between 200-350 pips, designed for long-term trades.

- Proven Success: Backtested over 20 years, these bots perform excellently even in tough market conditions.

And the best part? I’m offering this EA portfolio completely FREE.

You can check it out here.

Statistical Insights

- Did you know that 70% of retail traders lose money in Forex?

- By using proven strategies like Bollinger Bands and CoG, your chances of success can significantly increase.

Selecting the Right Broker

Your trading experience also heavily depends on your broker.

Choosing a trusted broker ensures tight spreads, fast execution, and excellent customer support.

I’ve tested several brokers and highly recommend checking out the best Forex brokers here.

Final Thoughts

Trading Forex can be daunting, but with the right tools and strategies, you can turn it into a profitable venture.

Using Bollinger Bands alongside the CoG indicator gives you a robust framework for identifying opportunities.

And don’t forget about my 16 trading bots that incorporate this strategy—designed to enhance your trading while minimizing risks.

Ready to elevate your Forex game?

Let’s make it happen!