Last Updated on March 8, 2025 by Arif Chowdhury

Ever find yourself staring at charts, wondering when to jump in on a trade?

That feeling of uncertainty can be paralyzing.

But what if I told you there’s a way to time your entries with precision?

As a seasoned Forex trader since 2015, I’ve spent countless hours exploring strategies that work.

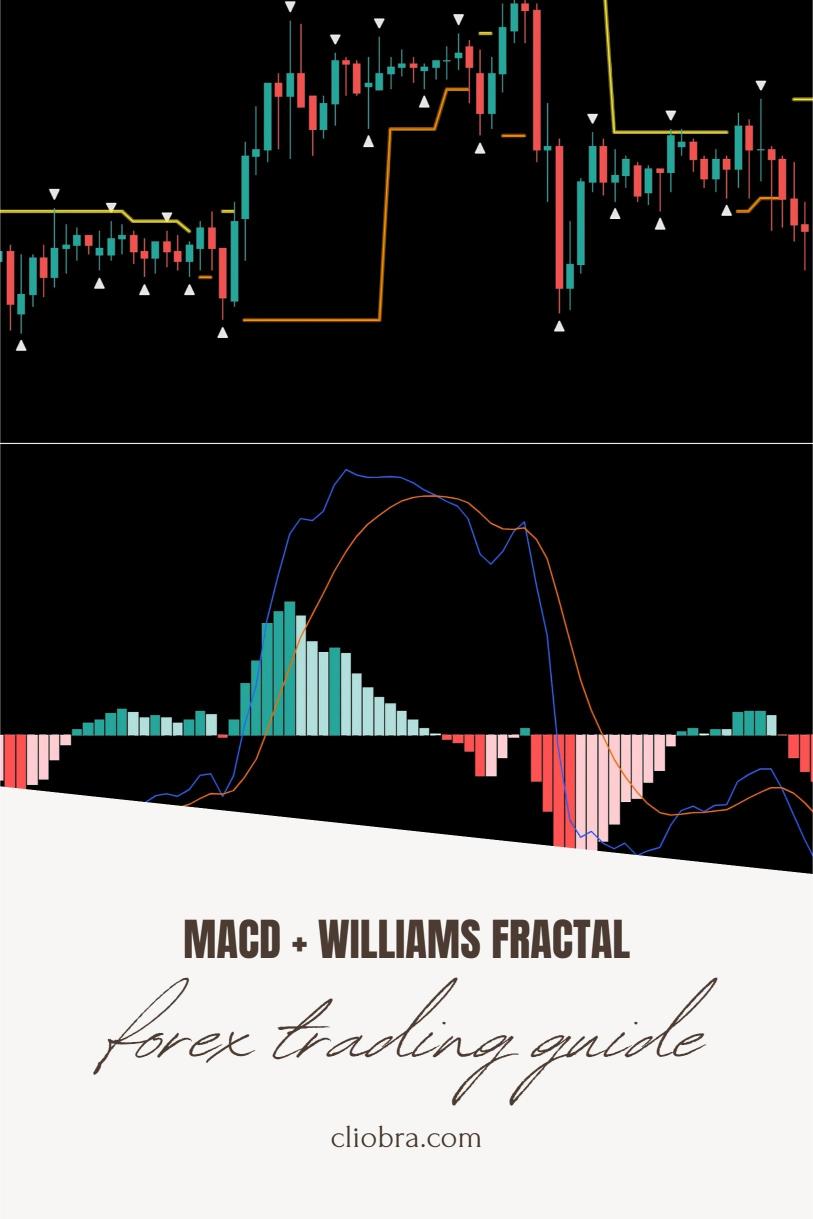

Today, let’s dive into using MACD and Williams Fractal for timing your trade entries.

Understanding MACD and Williams Fractal

MACD (Moving Average Convergence Divergence) is a powerful trend-following momentum indicator.

It helps you spot potential reversals and confirm trends.

Williams Fractal, on the other hand, identifies potential turning points in the market.

Together, they create a dynamic duo for pinpointing entry and exit points.

Why Use These Indicators?

- Proven Effectiveness: According to studies, around 70% of traders find success using a combination of technical indicators.

- Simplicity: Both MACD and Williams Fractal are straightforward and easy to understand.

- Versatility: They work across various timeframes and currency pairs.

Setting Up MACD and Williams Fractal

- Add the MACD Indicator to your chart.

- The default settings (12, 26, 9) work well for most traders.

- Apply the Williams Fractal Indicator.

- You’ll identify fractals when the price forms a high or low surrounded by two lower or higher prices, respectively.

How to Read the Indicators

- MACD Line Crosses:

- Bullish signal when the MACD line crosses above the signal line.

- Bearish signal when it crosses below.

- Fractal Signals:

- Look for a bullish fractal (a low) to signal a potential buy.

- A bearish fractal (a high) indicates a potential sell.

Timing Your Trade Entries

- Wait for Confirmation:

- Look for a bullish crossover on the MACD coinciding with a bullish fractal.

- This alignment suggests a strong buy signal.

- Set Your Stop Loss:

- Place it below the most recent fractal low for buys and above the fractal high for sells.

- Take Profit Strategy:

- Aim for 200-350 pips based on the trend and recent price action.

Why I Rely on These Tools

I’ve developed a unique trading strategy that incorporates MACD and Williams Fractal along with other indicators.

This strategy is part of a larger portfolio of 16 sophisticated trading bots.

These bots are designed to trade on EUR/USD, GBP/USD, USD/CHF, and USD/JPY, ensuring a diversified approach.

Each currency pair has multiple bots working together to minimize risk while maximizing returns.

The Power of Diversification

- Minimized Correlated Losses: My bots are internally diversified to reduce the chance of simultaneous losses.

- Long-Term Performance: They use H4 charts, focusing on longer trades, which historically perform better.

- Backtested Success: These bots have been tested over 20 years, proving their resilience even in challenging market conditions.

You can access my EA portfolio for FREE. That’s right, no strings attached!

Check it out here: Explore my Trading Bots.

Choosing the Right Forex Broker

Now that you have a solid strategy, let’s talk about execution.

A reliable broker can make or break your trading experience.

- Tight Spreads: Look for brokers offering tight spreads to maximize your profits.

- Fast Order Execution: The quicker your trades are executed, the better your chances of capitalizing on market movements.

- Solid Customer Support: You want a broker that’s there when you need them.

I’ve tested several brokers and I recommend checking out the top options here: Find Trusted Forex Brokers.

Final Thoughts

Trading Forex doesn’t have to be a guessing game.

With the MACD and Williams Fractal, you can time your entries like a pro.

And don’t forget about my portfolio of trading bots.

They can enhance your trading journey and help you achieve your financial goals.

Remember, successful trading is about managing risk and making informed decisions.

So, gear up, apply these strategies, and let’s conquer the Forex market together! 🚀