Last Updated on March 8, 2025 by Arif Chowdhury

Ever felt lost in the sea of Forex strategies?

You’re not alone.

Navigating the Forex market can feel like trying to find your way in a maze.

With so many indicators and methods, it’s easy to get overwhelmed.

But what if I told you there’s a simple, effective way to trade?

I’ve been in this game since 2015, and I’ve found that using the 100 Simple Moving Average (SMA) along with the Volume Oscillator is a game changer.

Let’s break it down together.

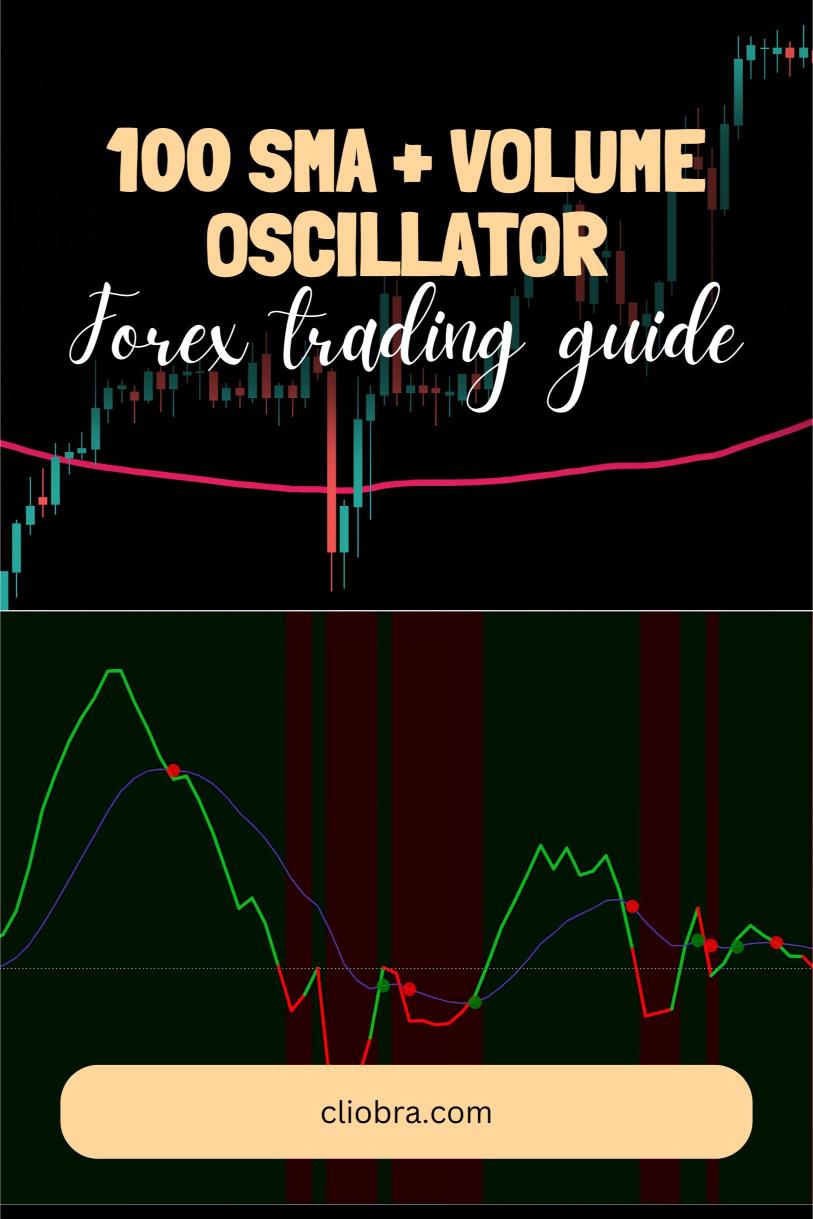

Understanding the 100 SMA

The 100 SMA is a trend-following indicator.

It smooths out price fluctuations to help you see the overall trend.

Here’s how it helps:

- Identifies Trend Direction: If the price is above the 100 SMA, it’s generally a bullish trend. If it’s below, we’re in a bearish trend.

- Dynamic Support/Resistance: The SMA can act as a support level in an uptrend and a resistance level in a downtrend.

What’s the Volume Oscillator?

Now, let’s talk about the Volume Oscillator.

This tool measures the difference between two volume moving averages.

Here’s why it’s important:

- Confirms Trends: Rising volume indicates strong trends. If the price is moving up and volume is increasing, it’s a strong signal to buy.

- Spotting Reversals: If the price is up but volume is dropping, it could signal a reversal.

Combining the Two

So, how do you put these two indicators to work?

- Check the Trend: Start with the 100 SMA. Determine if you’re in a bullish or bearish market.

- Volume Confirmation: Look at the Volume Oscillator. If it’s also moving in the same direction as the trend, you’re good to go.

- Entry Points: Enter trades when both indicators align. For instance, if the price is above the 100 SMA and volume is increasing, consider buying.

Why This Strategy Works

Statistically, many traders miss the mark because they overcomplicate their strategies.

In fact, nearly 70% of retail traders lose money due to poor risk management and complex setups.

By using the 100 SMA and Volume Oscillator, you simplify your approach and increase your chances of success.

I’ve designed my 16 trading bots to utilize this strategy, among others, to create a robust trading portfolio.

These bots are diversified across major pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

They’re designed to trade for long-term gains, often targeting 200-350 pips per trade.

What’s even better? You can access this entire EA portfolio for FREE!

Check it out here: 16 Trading Bots Portfolio.

Tips for Success

- Practice: Use a demo account to get comfortable with the indicators.

- Stay Informed: Keep an eye on economic news that might impact your trades.

- Risk Management: Always use stop-loss orders to protect your capital.

Finding the Right Broker

As you dive into Forex trading, choosing the right broker is crucial.

I’ve tested several top brokers and can confidently recommend you check out the best options available.

Look for brokers with:

- Tight Spreads: Helps minimize your costs.

- Fast Execution: Ensures your trades go through quickly.

- Solid Support: You want a broker that’s there when you need help.

You can find some of the most trusted brokers here: Best Forex Brokers.

Conclusion

Trading Forex doesn’t have to be complicated.

With the 100 SMA and Volume Oscillator, you have a powerful duo to confirm trends and make informed decisions.

Add in a solid trading bot strategy, and you’re well on your way to consistent profitability.

Remember, the key is to keep it simple and stay disciplined.

Happy trading! 🚀