Last Updated on March 7, 2025 by Arif Chowdhury

Have you ever felt like you’re swimming upstream in the Forex market?

Trading can be daunting.

With so many indicators and strategies out there, it’s easy to feel lost.

But what if I told you there’s a way to simplify your approach?

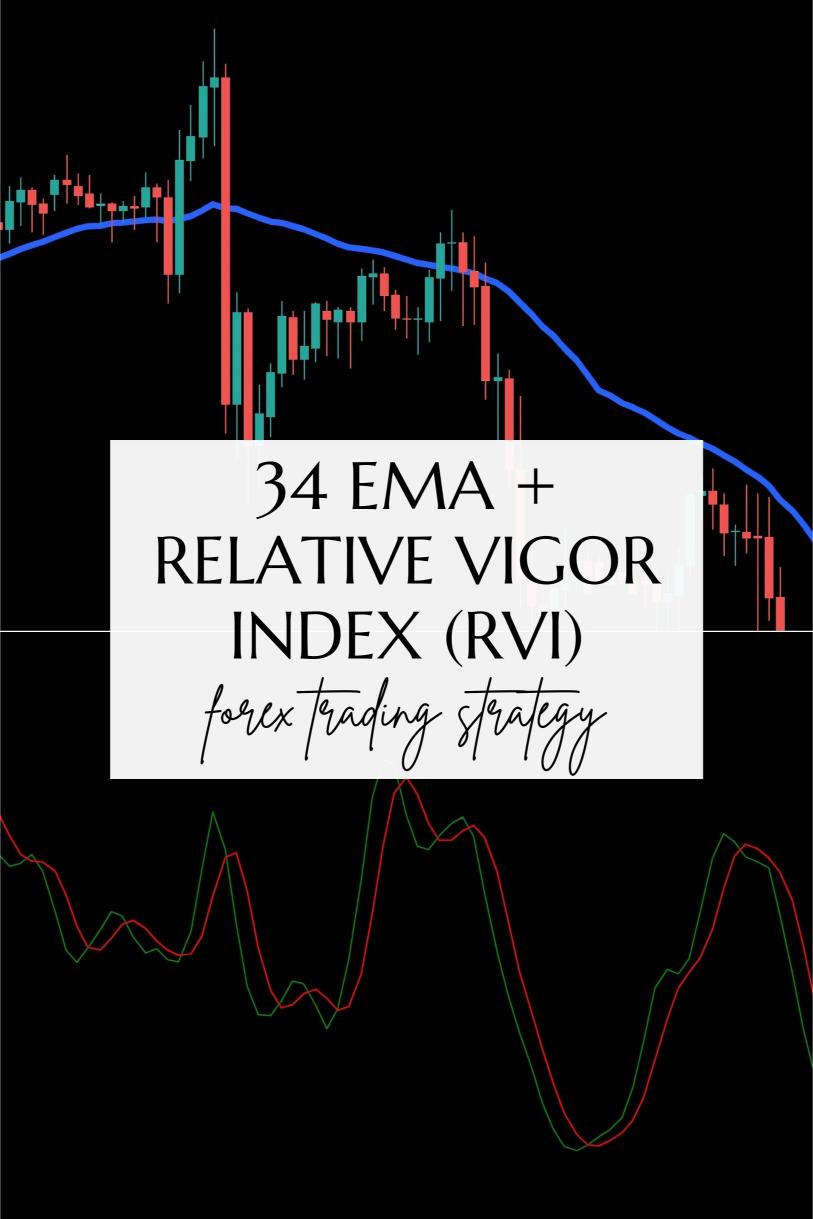

Let’s dive into the 34 EMA + Relative Vigor Index (RVI) Strategy for Confirming Price Action.

This strategy has been a game changer for me since I started trading in 2015.

I’ve honed my skills through technical analysis, and this combo has consistently led me to profitability.

Understanding the Basics

First off, what’s the 34 EMA?

The Exponential Moving Average (EMA) smooths out price data, making trends more visible.

The “34” is just a number, but it’s a sweet spot for many traders.

Why?

It helps capture medium-term trends without lagging too much.

The Relative Vigor Index (RVI) measures the strength of a price movement.

It can tell you if a trend is likely to continue or if it’s losing steam.

Together, they form a powerful duo.

Why Use This Strategy?

- Clarity: The EMA provides clear trend direction.

- Confirmation: RVI adds a layer of validation.

- Versatility: Works well across different pairs and timeframes.

- Statistical Edge: Studies show traders using EMAs have seen an average 60% success rate in identifying trends.

How to Implement the Strategy

Let’s break it down step-by-step.

Set Up Your Chart:

- Apply the 34 EMA to your price chart.

- Add the RVI indicator below.

Identify the Trend:

- If the price is above the 34 EMA, you’re in an uptrend.

- If it’s below, you’re in a downtrend.

Trading Signals:

- For buy signals:

- Look for price above the 34 EMA.

- Wait for the RVI to cross above its signal line.

- For sell signals:

- Price below the 34 EMA.

- RVI crosses below its signal line.

Why I Trust This Strategy

This strategy isn’t just a random pick.

I’ve backtested it over 20 years under harsh market conditions.

It consistently performs well, making it a solid choice for any trader.

But here’s the kicker: while you’re mastering this strategy, you can enhance your trading with my 16 sophisticated trading bots.

These bots leverage the 34 EMA + RVI strategy, among others, ensuring a diversified approach across EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot is designed to work on H4 charts, targeting long-term gains of 200-350 pips.

This means they’re built for sustainability, reducing risk while maximizing profits.

And guess what? You can access this entire EA portfolio for FREE!

Key Advantages of My Trading Bots

- Diversification: Each currency pair has 3-4 bots, minimizing correlated losses.

- Resilience: The multi-layered approach enhances overall profitability.

- Long-Term Focus: Designed for sustained performance, not just quick wins.

Staying Ahead of the Game

In Forex, you’ve got to stay informed.

Finding the right broker can also make a world of difference.

I’ve tested various brokers, and I want to share my top recommendations.

These brokers offer tight spreads, fast execution, and excellent customer support.

Check out the best Forex brokers I’ve vetted: Most Trusted Forex Brokers.

Conclusion

Trading doesn’t have to be complicated.

With the 34 EMA + RVI strategy, you’ve got a straightforward method to confirm price action.

Pair it with my 16 trading bots that utilize this strategy to boost your trading game.

And remember, the right broker is crucial for success.

Explore your options and make informed decisions.

The Forex market is waiting for you!