Last Updated on March 7, 2025 by Arif Chowdhury

Are you tired of guessing when to enter or exit a trade?

Do you find yourself overwhelmed by market noise and conflicting signals?

I get it. As a seasoned Forex trader since 2015, I’ve been in the trenches, navigating the ups and downs of the market.

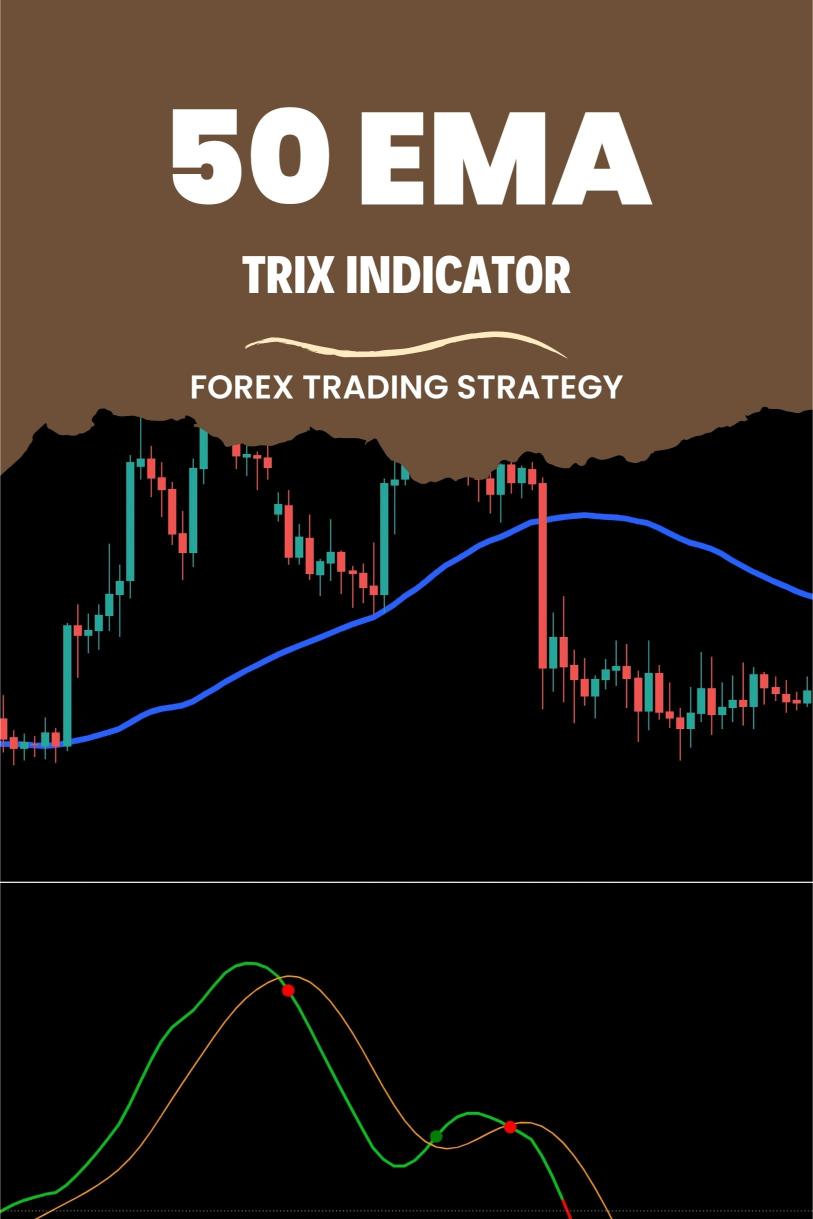

Let’s talk about a powerful strategy that has helped me identify market cycles with confidence: The 50 EMA + TRIX Indicator Strategy.

What is the 50 EMA + TRIX Indicator Strategy?

The 50 Exponential Moving Average (EMA) and the TRIX (Triple Exponential Average) are two powerful tools in technical analysis.

The 50 EMA smooths out price data to help identify the trend direction over a longer period.

The TRIX, on the other hand, is designed to filter out market noise, providing a clearer signal of momentum.

Together, they form a dynamic duo that can enhance your trading decisions significantly.

Why Use This Strategy?

- Trend Identification: The 50 EMA helps you spot whether the market is in an uptrend or downtrend.

- Momentum Confirmation: TRIX adds an extra layer of confirmation to your trades, ensuring you’re not just following the price but also the momentum behind it.

- Cycle Detection: This combo is particularly effective at identifying market cycles, allowing you to anticipate potential reversals.

How to Implement This Strategy

- Set Up Your Charts:

- Add the 50 EMA to your chart.

- Add the TRIX indicator.

- Identify the Trend:

- If the price is above the 50 EMA, you’re in an uptrend.

- If it’s below, you’re in a downtrend.

- Look for TRIX Crossovers:

- A bullish signal occurs when the TRIX line crosses above the zero line.

- A bearish signal happens when it crosses below.

- Enter Trades:

- Enter a long position when both conditions align: price is above the 50 EMA and TRIX crosses above zero.

- Enter a short position when the price is below the 50 EMA and TRIX crosses below zero.

Real-World Application

Let’s get into the nitty-gritty.

Studies show that using a combination of indicators can improve your win rate significantly.

For example, traders using the EMA strategy can have win rates of up to 60% when combined with other indicators like TRIX.

This strategy isn’t just theory; it’s actionable.

When I started using this combo, my trading success skyrocketed.

Enhance Your Trading with EAs

Now, while the 50 EMA + TRIX strategy is powerful, you can supercharge your trading even further with my 16 trading EAs.

These bots are specifically designed to work across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each EA in the portfolio utilizes the 50 EMA + TRIX strategy alongside other proven methods to diversify risk and maximize profit.

This multi-layered approach minimizes correlated losses, ensuring that even when the market is volatile, you’re covered.

I’ve backtested these bots for 20 years, and they consistently perform well under various conditions.

And guess what? I’m offering this entire EA portfolio for FREE.

If you want to elevate your trading game, check out my trading bots portfolio.

Final Thoughts on Brokers

Before you dive into trading, make sure you pick the right broker.

Choose one that offers tight spreads, excellent customer support, and a solid trading platform.

I’ve tested various brokers, and I recommend checking out some of the best. You can find my top picks here: Most Trusted Forex Brokers.

Conclusion

The 50 EMA + TRIX Indicator Strategy is a game-changer for identifying market cycles.

It provides clarity in your trading decisions and can enhance your overall success.

Pair it with my 16 trading EAs for a robust trading experience, and you’re set for success in the Forex market.