Last Updated on March 6, 2025 by Arif Chowdhury

Ever felt lost in the Forex jungle?

Wondering how to spot those big players moving the market?

You’re not alone.

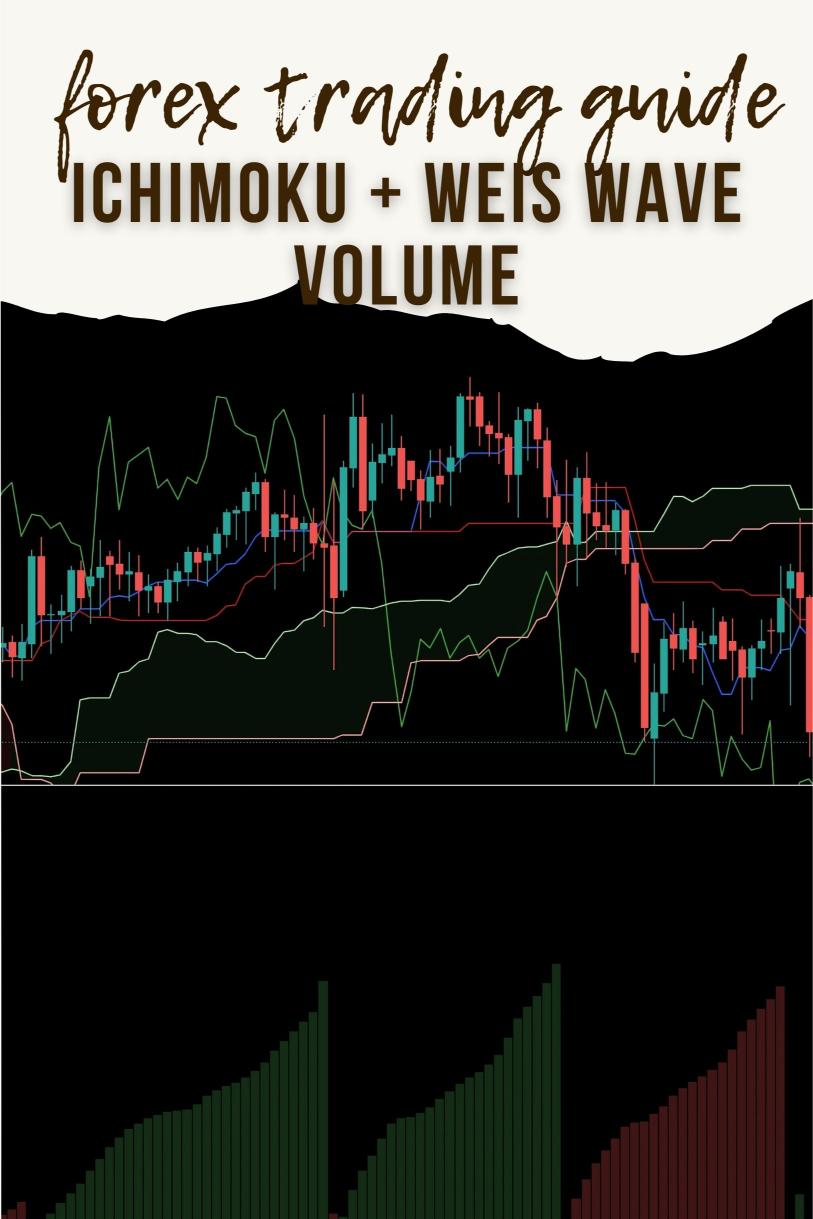

As a seasoned Forex trader since 2015, I’ve been on a mission to decode this fascinating world, and today, I want to share how you can trade Forex using two powerful tools: Ichimoku and Weis Wave Volume.

Let’s dive in.

What Is Ichimoku?

Ichimoku is more than just a fancy indicator.

It’s a comprehensive trading system that gives you a snapshot of price action, trends, and potential support and resistance levels.

Here’s what makes it special:

- Five Components: It consists of five lines—Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and Chikou Span.

- Trend Identification: It helps you determine if the market is in a bullish or bearish trend.

- Support and Resistance: The cloud (Kumo) shows potential areas of support and resistance.

What is Weis Wave Volume?

Weis Wave Volume is your secret weapon for tracking institutional orders.

Why?

Because it focuses on volume in relation to price movements, helping you see where the big money is going.

Here’s what you need to know:

- Volume Analysis: It breaks down volume into waves, allowing you to see the strength of price moves.

- Institutional Insights: Helps you identify buying and selling pressure from institutional traders.

Combining Ichimoku and Weis Wave Volume

When you combine these two, you get a powerful trading strategy.

Here’s how to use them together:

- Identify Trend with Ichimoku: Use the Ichimoku cloud to identify the overall trend.

- Confirm with Volume: Check the Weis Wave Volume to confirm whether the trend has institutional backing.

For example, if the price is above the cloud and the volume shows strong buying pressure, you might have a solid buy signal.

Why This Strategy Works

Statistically speaking, about 70% of market movements are driven by institutional players.

If you can track their moves, you’re already ahead of the game.

And here’s another fact: traders using volume analysis are statistically more successful in identifying market reversals.

My Proven Approach

Over the years, I’ve developed a unique trading strategy that integrates these tools.

With my 16 sophisticated trading bots, I leverage Ichimoku and Weis Wave Volume among other strategies.

These bots are strategically diversified across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Why does this matter?

- Minimized Risk: Each bot is designed to minimize correlated losses.

- Profit Maximization: They focus on longer-term trades, aiming for 200-350 pips, which means they tend to perform better over time.

And the best part?

You can access my entire EA portfolio for FREE.

If you’re serious about trading, check out my trading bots here.

Steps to Get Started

Ready to implement this strategy?

Here’s a quick guide:

- Set Up Ichimoku: Add Ichimoku to your trading platform. Familiarize yourself with its components.

- Analyze Volume: Incorporate Weis Wave Volume to track institutional orders.

- Look for Confluence: Wait for both indicators to align for a clearer trading signal.

- Manage Risk: Always use proper risk management practices.

Choosing the Right Broker

Now, before you dive in, you need a reliable broker.

I’ve tested several and can confidently say that finding one with tight spreads and excellent support is crucial.

Here are my top picks—check them out for a superior trading experience: Best Forex Brokers.

Final Thoughts

Trading Forex doesn’t have to be overwhelming.

By harnessing the power of Ichimoku and Weis Wave Volume, you can significantly improve your trading edge.

And with my 16 EAs, you’re not just trading; you’re trading smart.

So, ready to take your trading to the next level?

Let’s make this journey together.