Last Updated on March 2, 2025 by Arif Chowdhury

Are you tired of unpredictable market swings?

Wondering how to make sense of all the noise in Forex trading?

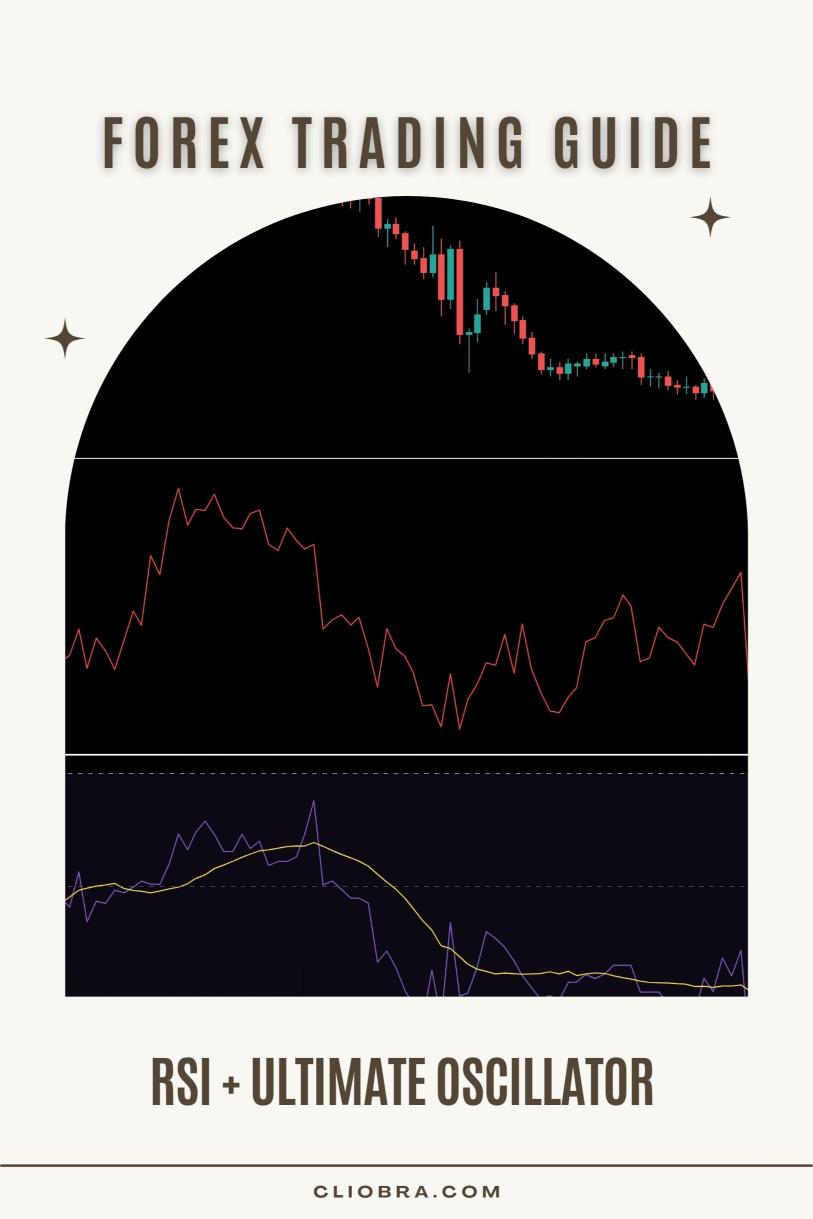

Let’s talk about a solid strategy that has transformed my trading game: the RSI + Ultimate Oscillator Strategy.

As a seasoned Forex trader since 2015, I’ve faced the highs and lows of the market.

I’ve explored countless strategies, but this one stands out for its simplicity and effectiveness.

Let’s break it down together.

What’s the RSI and Ultimate Oscillator?

First up, the Relative Strength Index (RSI).

This is a momentum oscillator that measures the speed and change of price movements.

- Ranges from 0 to 100.

- Values above 70 indicate overbought conditions.

- Values below 30 signal oversold conditions.

Next, we have the Ultimate Oscillator.

This combines three different timeframes to give a more comprehensive view of market momentum.

- It’s a bit like having three perspectives instead of one.

- Helps smooth out price action and reduces false signals.

Why Use Them Together?

Combining these two tools gives you a multi-timeframe confirmation.

Here’s the deal:

- RSI shows you potential reversals.

- Ultimate Oscillator confirms those signals by analyzing different timeframes.

This combo can significantly improve your win rate.

Statistically, traders using multi-timeframe strategies often see a 20-30% increase in their success rate.

Setting Up Your Strategy

Now, let’s dive into how to set this up.

- Choose Your Timeframes:

- Use three different timeframes, like H1, H4, and D1.

- This gives you a broader perspective on market trends.

- Identify Trends:

- Look for alignment between the RSI and Ultimate Oscillator.

- For example, if the RSI is above 70 and the Ultimate Oscillator confirms it, you might want to consider a sell signal.

- Entry and Exit Points:

- Entry: Enter when both indicators align.

- Exit: Use a trailing stop or set a fixed target based on your risk tolerance.

- Risk Management:

- Always have a stop-loss in place.

- This strategy is powerful, but no strategy is foolproof.

Multi-Layered Diversification

While we’re on the topic, let me share how I incorporate this strategy into my 16 trading bots.

These bots utilize the RSI + Ultimate Oscillator strategy among other techniques, giving them an edge in the market.

- Each bot is designed for a specific currency pair: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

- They’re diversified internally, which minimizes correlated losses.

This means if one bot faces a downturn, others can still perform well.

I’ve backtested these bots for 20 years, and they shine even in harsh market conditions.

And guess what? I’m offering this entire EA portfolio for FREE.

You can check it out here.

How to Implement the Strategy

Let’s summarize how to make this strategy work for you.

- Combine Indicators: Use RSI for momentum and Ultimate Oscillator for confirmation.

- Timeframes Matter: Don’t just stick to one timeframe—diversify.

- Stay Updated: Market conditions change, so adapt your strategy accordingly.

- Keep Learning: The Forex market is always evolving. Stay ahead of trends.

The Best Forex Brokers

To execute this strategy effectively, you need a reliable broker.

I’ve tested several, and I recommend checking out the best options for your trading needs.

You can find trusted brokers here.

Conclusion

The RSI + Ultimate Oscillator Strategy is a game-changer.

It gives you the clarity and confirmation you need to make informed trading decisions.

Combine this with my 16 trading bots, and you’ll be well on your way to achieving consistent profitability.

Remember, the key to success in Forex is not just having a great strategy but also using the right tools and resources.

So, what are you waiting for? Dive into this strategy and check out my bots for a more hands-off approach.