Last Updated on March 1, 2025 by Arif Chowdhury

Ever wondered how to make your scalping game stronger?

Are you tired of missing out on quick trades that could boost your profits?

I get it.

In the fast-paced world of Forex, every second counts.

I’ve been in the trenches since 2015, navigating both fundamental and technical analysis.

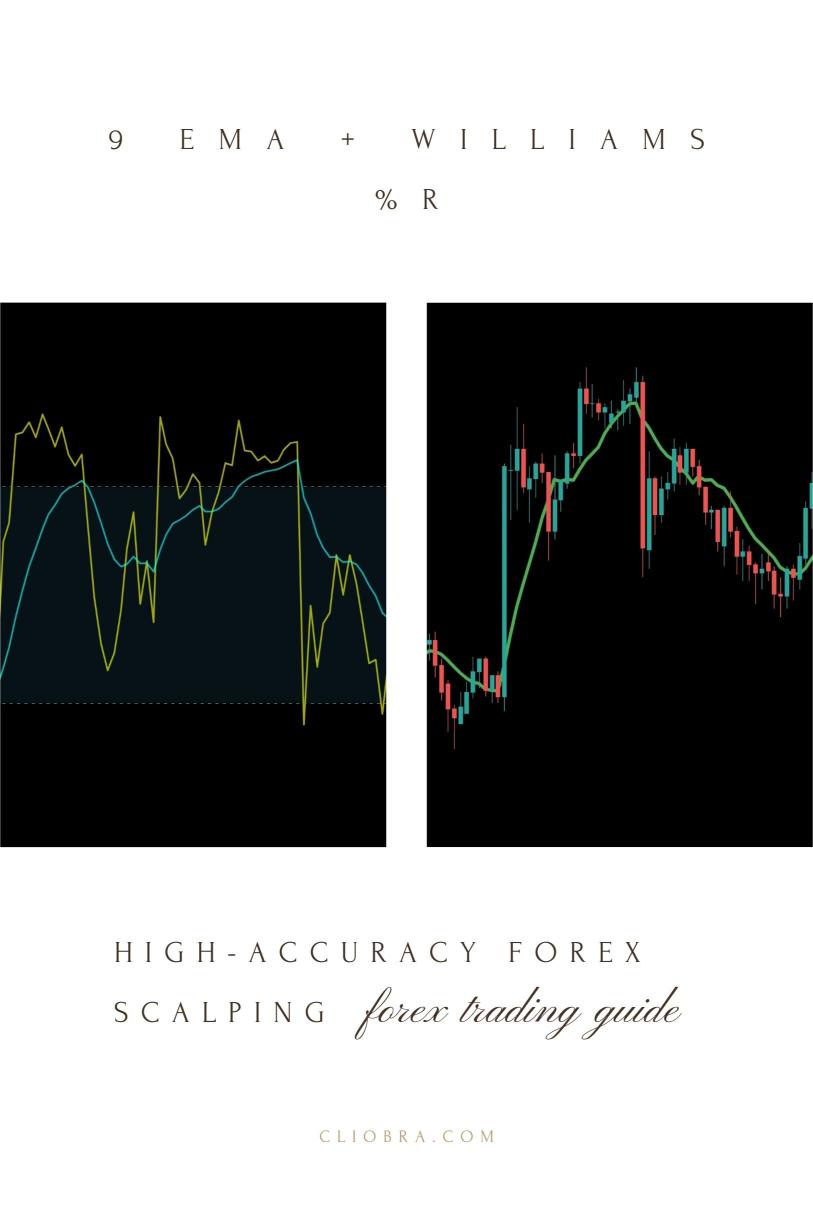

Today, let’s dive deep into using the 9 EMA (Exponential Moving Average) combined with the Williams %R indicator for high-accuracy scalping.

This strategy has served me well and can work for you too.

Let’s break it down.

Understanding the 9 EMA and Williams %R

First off, what are these indicators?

- 9 EMA: This is a trend-following indicator that gives more weight to recent prices. It reacts quickly to price changes, making it perfect for scalping.

- Williams %R: This momentum indicator helps identify overbought and oversold conditions. It ranges from -100 to 0, where readings below -80 signal oversold conditions and above -20 indicate overbought.

Why Use Both Together?

Combining these two indicators helps you pinpoint high-probability trades.

Here’s how:

- 9 EMA: It signals the trend direction.

- Williams %R: It tells you when to jump in or out based on market conditions.

Using them together increases your chances of making profitable trades. Statistics show that effective scalping can yield up to 90% accuracy when you use the right indicators.

Setting Up Your Chart

Ready to set up? Here’s a quick guide:

- Choose a Trading Platform: I recommend using MetaTrader 4 or 5.

- Add the 9 EMA:

- Navigate to indicators.

- Select “Moving Average” and set it to 9 periods and “Exponential”.

- Add the Williams %R:

- Find it under oscillators.

- The default settings work fine, but you can tweak it to suit your style.

Trading Signals

Now, let’s talk about what to look for:

Bullish Signal:

- Price crosses above the 9 EMA.

- Williams %R is below -80, indicating an oversold condition.

Bearish Signal:

- Price crosses below the 9 EMA.

- Williams %R is above -20, indicating an overbought condition.

Risk Management

Scalping can be rewarding, but it’s crucial to manage your risks.

Here’s how:

- Set Stop Loss: Keep it tight, around 10-20 pips depending on volatility.

- Take Profit: Aim for 20-30 pips to start. Adjust as you gain more confidence.

- Position Sizing: Don’t risk more than 1-2% of your account on any single trade.

My 16 Trading Bots: A Secret Weapon

Now, let’s talk about something that can elevate your trading game even further.

I’ve developed a portfolio of 16 sophisticated trading bots that utilize various strategies, including the 9 EMA + Williams %R.

Each bot is designed to trade specific currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

These bots are:

- Strategically diversified to minimize risk.

- Backtested over 20 years to ensure stability and profitability.

By using these bots, you can automate your scalping strategy, allowing you to trade even when you’re not at the screen.

And the best part?

I’m offering this EA portfolio for FREE!

Check it out here and see how it can work for you.

Choosing the Right Broker

Don’t forget, the broker you choose can impact your scalping success.

Look for brokers with:

- Tight spreads.

- Fast execution times.

- No commission fees.

I’ve tested several brokers, and you can find my top recommendations here.

They offer the kind of trading environment that can enhance your scalping experience.

Conclusion

Scalping with the 9 EMA + Williams %R is not just a strategy; it’s a mindset.

With the right setup, risk management, and support from my trading bots, you can achieve consistent profitability.

Remember, trading is all about adapting and improving.

Stay sharp, keep learning, and don’t hesitate to utilize tools that make your life easier.

You’ve got this!