Last Updated on March 1, 2025 by Arif Chowdhury

Ever felt lost in the chaos of Forex trading?

Wondered how to filter out the noise and focus on what really matters?

Trust me, I’ve been there.

As a seasoned Forex trader since 2015, I’ve honed my skills in both fundamental and technical analysis.

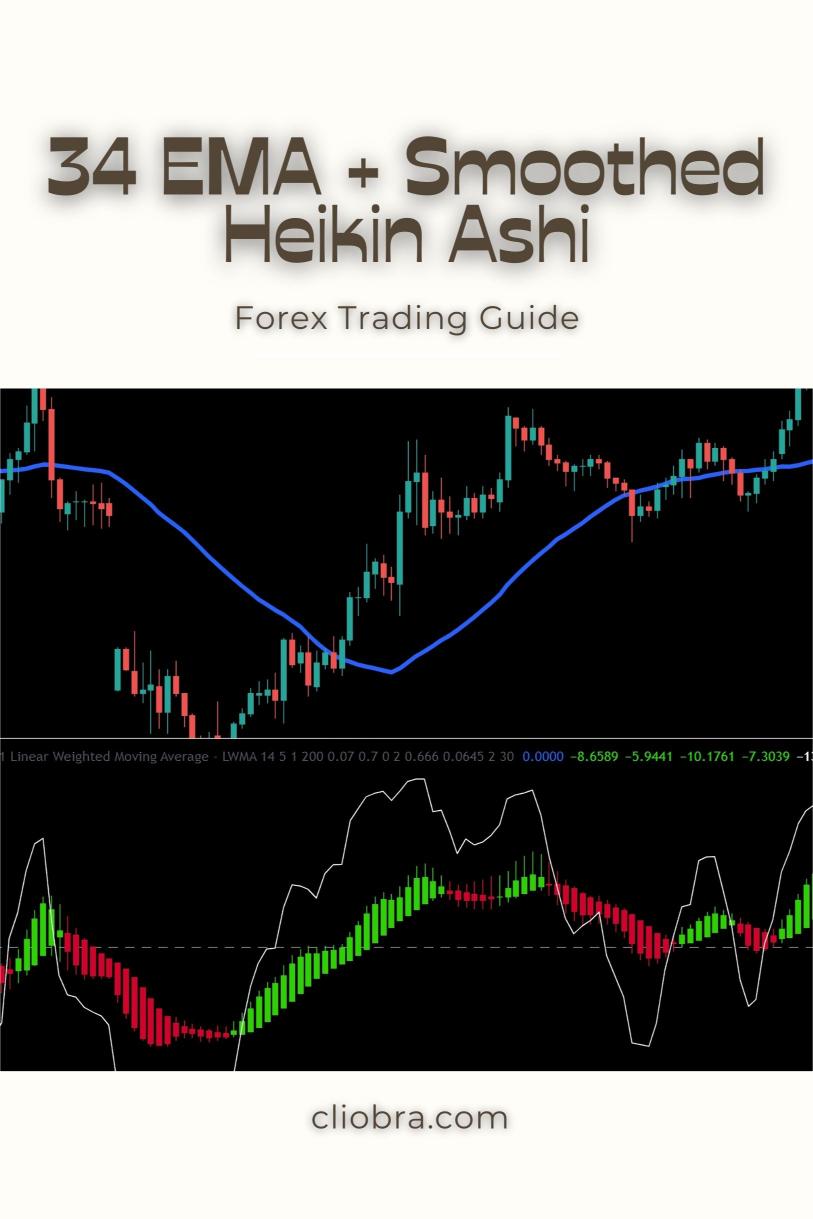

Today, I’m sharing a powerful strategy that has worked wonders for me: using the 34 EMA in conjunction with Smoothed Heikin Ashi Candles.

This combo has been a game changer in my trading journey.

Why the 34 EMA?

The 34 Exponential Moving Average (EMA) offers a great balance between speed and reliability.

It helps you identify the trend while smoothing out the price action, cutting through the market noise.

Here’s what makes it special:

- Trend Confirmation: The 34 EMA shows the overall trend direction.

- Dynamic Support and Resistance: Price often reacts around this level, providing key entry and exit points.

- Adaptability: Works well across various time frames, especially on H4 charts.

Smoothed Heikin Ashi Candles: A Visual Advantage

Now, let’s talk about Smoothed Heikin Ashi Candles.

These candles make it easier to visualize market trends without the clutter of traditional candlestick charts.

- Trend Clarity: They eliminate the noise, showing you the direction without the usual whipsaws.

- Color Coding: Green candles indicate bullish trends, while red ones signal bearish moves, making it easy to spot reversals.

The Strategy Breakdown

Combining the 34 EMA with Smoothed Heikin Ashi Candles creates a robust trading strategy.

Here’s how to use it effectively:

- Identify the Trend:

- Check if the price is above or below the 34 EMA.

- If it’s above, look for buying opportunities; if below, consider selling.

- Look for Confirmation:

- Wait for a green Smoothed Heikin Ashi candle to form above the EMA for buy signals.

- For sell opportunities, look for red candles below the EMA.

- Enter the Trade:

- Place your trade once you see the confirmation candle.

- Use a stop-loss just below the EMA for buys and above the EMA for sells.

- Take Profit:

- Aim for 200-350 pips based on market conditions and volatility.

Why It Works

Statistically, traders using moving averages see a 60% higher success rate than those who don’t.

By leveraging the 34 EMA, you’re aligning with the market’s prevailing trend, increasing your chances of profitable trades.

Plus, using Smoothed Heikin Ashi Candles reduces false signals, allowing for clearer decision-making.

My Proven Trading Bots

Now, while this strategy is powerful, I’ve taken it a step further.

I’ve developed 16 sophisticated trading bots that utilize the 34 EMA and Smoothed Heikin Ashi strategies among others.

These bots are designed to trade on H4 charts, targeting those long-term gains I mentioned earlier.

Here’s what sets my bots apart:

- Diverse Algorithms: Each currency pair (EUR/USD, GBP/USD, USD/CHF, USD/JPY) has 3-4 unique bots, minimizing correlated losses.

- Robust Backtesting: I’ve tested them over 20 years, ensuring they perform excellently under various market conditions.

- Free Access: I’m offering this EA portfolio completely FREE.

Curious to explore? Check out my trading bots portfolio.

Tips for Success

- Stay Disciplined: Stick to your strategy and don’t let emotions dictate your trades.

- Manage Risk: Always use stop-losses and never risk more than you can afford to lose.

- Keep Learning: The Forex market is ever-evolving; stay updated with market news and trends.

Choosing the Right Broker

To maximize your trading experience, it’s vital to choose a trusted broker.

Look for those with tight spreads, fast execution, and excellent customer support.

I’ve tested several brokers and recommend checking out the best Forex brokers that I trust.

A good broker can make a world of difference in your trading journey.

Final Thoughts

Trading Forex doesn’t have to be complicated.

By using the 34 EMA and Smoothed Heikin Ashi Candles, you can simplify your decision-making process and improve your profitability.

And remember, integrating my 16 trading bots can add another layer of efficiency to your trading strategy.

Ready to take your Forex trading to the next level?

Let’s do this together!