Last Updated on February 27, 2025 by Arif Chowdhury

Have you ever stared at your trading screen, wondering how to pick the best currency pairs?

Do you find yourself lost in a sea of indicators, unsure which ones truly matter?

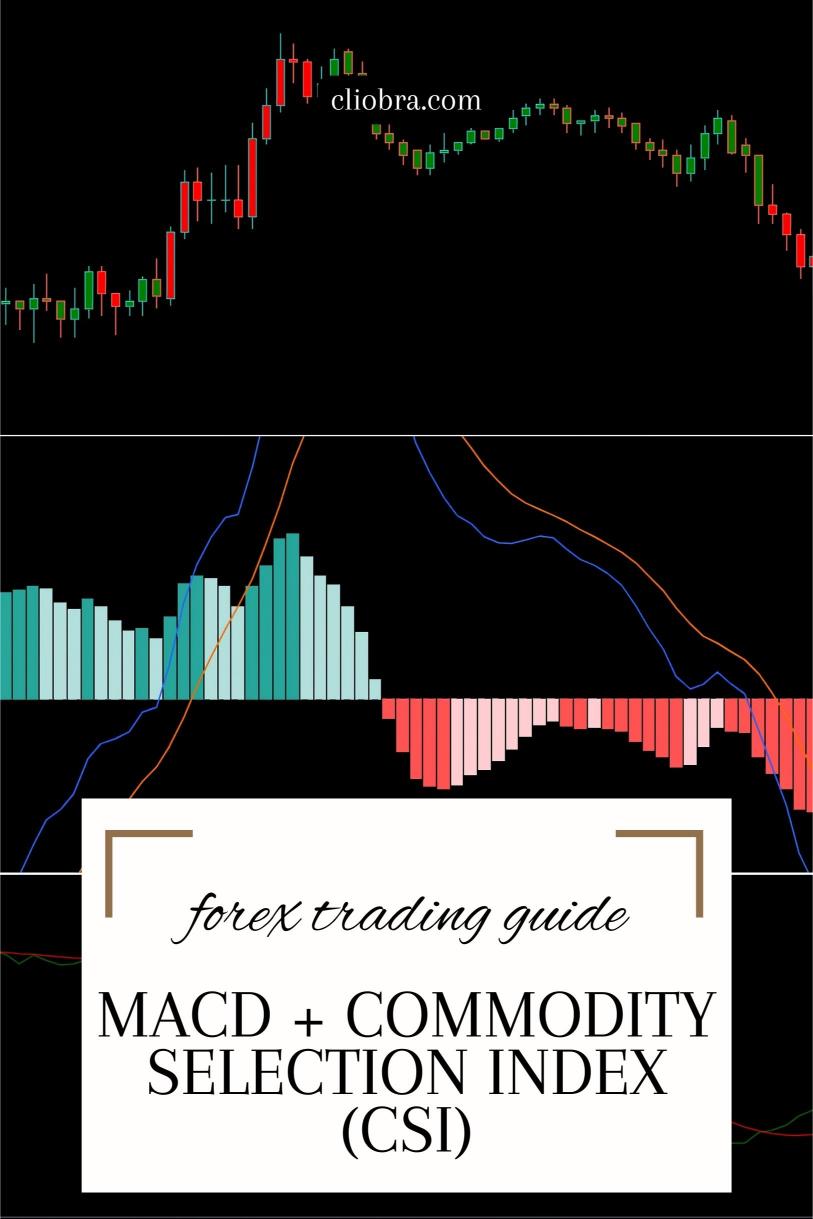

As a seasoned Forex trader since 2015, I’ve been right where you are. My journey has led me to develop a solid strategy that combines the MACD with the Commodity Selection Index (CSI). This approach not only simplifies decision-making but also enhances profitability.

Let’s break it down together.

Why Use the MACD and CSI?

The Moving Average Convergence Divergence (MACD) is a powerhouse in technical analysis.

- It helps identify momentum and trend direction.

- The MACD line crossing above the signal line can indicate a buy signal.

- Conversely, a cross below can signal a sell.

On the other hand, the Commodity Selection Index (CSI) focuses on tracking the strength of currency pairs based on commodity prices and market conditions.

- This makes it perfect for traders wanting to capitalize on shifts in economic fundamentals.

- The CSI ranks currency pairs based on their performance against others, giving you an edge in selection.

How to Combine Them

By merging these two strategies, you get a comprehensive view of the market. Here’s how I do it:

- Identify Strong Currency Pairs: Use the CSI to pinpoint which pairs are performing well.

- Analyze MACD Signals: For the selected pairs, check the MACD. Look for clear buy or sell signals.

- Filter for Optimal Trades: Combine insights from both tools to filter out the noise and focus on high-probability trades.

This approach doesn’t just sound good; it works.

Statistically, traders using MACD alongside other strategies see an increase in win rates. For instance, studies show that using MACD can improve trade accuracy by up to 20% when combined with solid fundamentals.

Diversification Is Key

One of the things I’ve learned over my trading years is the importance of diversification.

This is where my 16 trading EAs come into play.

These bots are strategically diversified across four major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each currency pair has 3-4 bots, all designed to minimize correlated losses.

- This multi-layered diversification creates a robust and resilient system.

- It significantly boosts profitability while lowering risks.

And here’s the kicker: all my bots utilize the MACD + CSI strategy among various others, ensuring that you maximize your gains.

Best of all, I’m offering this EA portfolio for FREE. You can check it out here.

Maximizing Your Trading Success

To truly leverage the MACD + CSI strategy, here are some practical tips:

- Stick to the H4 Charts: My bots only use H4 charts for trading. This timeframe smooths out volatility and helps identify longer-term trends.

- Aim for Large Moves: My EAs are designed to target long-term gains of 200-350 pips. This ensures that each trade has the potential for significant profit while reducing the impact of small fluctuations.

- Avoid Manual Interventions: Once your EAs are set up, let them run. Interfering can lead to missed opportunities and potential losses.

The Right Brokers Matter

Finding the best Forex brokers is crucial for your trading success.

I’ve tested several and can confidently recommend brokers that offer tight spreads and excellent customer support.

Make sure to choose a broker that aligns with your trading strategy and provides reliable execution. Check out my top picks here to ensure you’re starting on the right foot.

Final Thoughts

Navigating the Forex market can be daunting, but with the right strategy, it becomes manageable.

The MACD + Commodity Selection Index (CSI) strategy is a powerful combination that can help you select the best currency pairs effectively.

By incorporating this strategy with my robust portfolio of 16 trading EAs, you equip yourself with the tools needed to thrive in today’s market.

Remember, trading success comes from consistent application and learning. So, dive in, explore the markets, and don’t hesitate to leverage both the best Forex brokers and my trading bot portfolio for a smoother trading journey.