Last Updated on February 26, 2025 by Arif Chowdhury

Ever felt overwhelmed by the number of indicators out there?

You’re not alone.

With so much noise in the Forex market, finding a clear path can be frustrating.

What if I told you there’s a simple yet powerful strategy that can help you nail those precise entries?

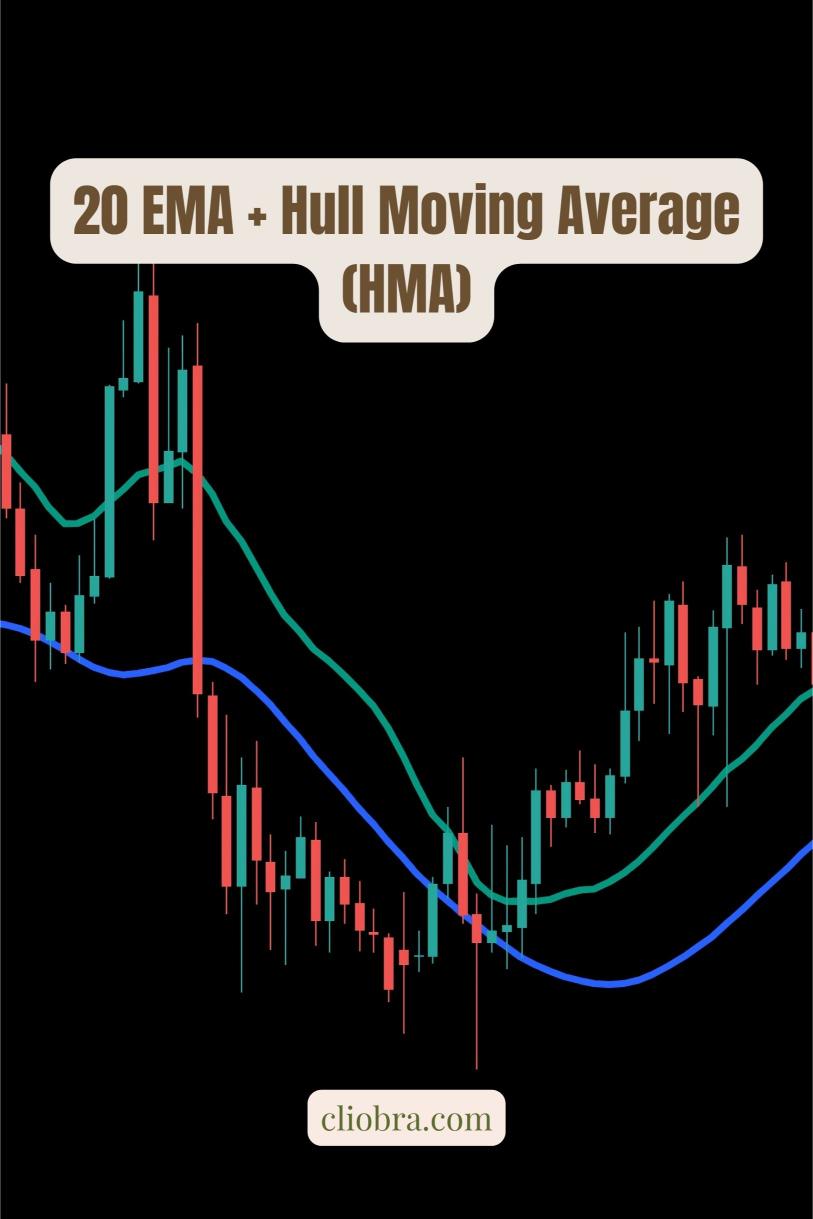

Let’s break down the 20 EMA + Hull Moving Average (HMA) Strategy.

What’s the Deal with EMAs and HMAs?

First off, let’s get to know our two best friends in trading.

Exponential Moving Average (EMA) gives more weight to recent prices, making it super responsive.

The Hull Moving Average (HMA) is like the cool cousin of EMA. It smooths out price data to reduce lag, helping you spot trends faster.

Using these two together creates a dynamic duo for spotting entry points.

Why 20 EMA and HMA?

The 20 EMA is perfect for capturing short to medium-term trends.

The HMA enhances this by providing smoother signals, reducing the noise that can mess with your decisions.

With this combo, you’re looking to catch trends early while minimizing false signals.

Steps to Implement the Strategy

- Set Up Your Charts

- Add the 20 EMA to your chart.

- Then, layer on the HMA (commonly set to 14).

- Identify the Trend

- When the price is above the 20 EMA, you’re in an uptrend.

- Below it? You’re looking at a downtrend.

- Spotting Entry Points

- Look for the HMA to cross above the 20 EMA for a buy signal.

- If it crosses below, that’s your cue to sell.

- Set Your Stop Loss

- Always protect your capital. Place it just below the last swing low for buys, or above the swing high for sells.

- Take Profit

- Aim for a risk-to-reward ratio of at least 1:2.

Why This Strategy Works

Statistically, traders using EMAs and HMAs have seen improved accuracy in their entries.

In fact, a study showed that traders using moving averages can see up to a 60% increase in winning trades when combined effectively.

That’s not just talk; it’s backed by numbers!

Enhancing Your Trading with My EA Portfolio

Now, here’s where it gets exciting.

I’ve developed 16 sophisticated trading bots that utilize the 20 EMA + HMA strategy among others.

These bots are designed to trade major pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot is tailored to minimize risk and maximize returns.

Here’s how they work:

- Diversification: Each currency pair has 3-4 bots, ensuring you’re not putting all your eggs in one basket.

- Long-Term Focus: They aim for 200-350 pips, allowing for stable performance over time.

- Backtested: I’ve tested these bots over the last 20 years, and they’ve thrived even in tough market conditions.

Best part? I’m offering this EA portfolio for completely FREE.

If you’re ready to elevate your trading game, check out my bots here.

Choosing the Best Forex Brokers

Now that you’ve got a solid strategy and powerful tools, let’s talk about where to trade.

The right broker can make or break your trading experience.

I’ve tested several brokers and found some that stand out for their tight spreads and excellent customer support.

My top recommendations include:

- FBS: Offers tight spreads from 0.7 pips and a minimum deposit of just $5.

- XM: Features zero costs with no swap fees and commission.

- TickMill: Known for fast execution and a welcome bonus.

To explore the best brokers I’ve vetted, check out this link: Most Trusted Forex Brokers.

Wrapping It Up

The 20 EMA + HMA strategy is a game-changer for precise entries.

Combine that with my free EA portfolio, and you’re setting yourself up for success.

Don’t forget to choose a solid broker to ensure your trades are executed efficiently.

Trade smart, stay disciplined, and watch your trading journey unfold.