Last Updated on February 26, 2025 by Arif Chowdhury

Are you tired of guessing where the market might turn?

Do you often find yourself on the wrong side of a trade, wondering where you went wrong?

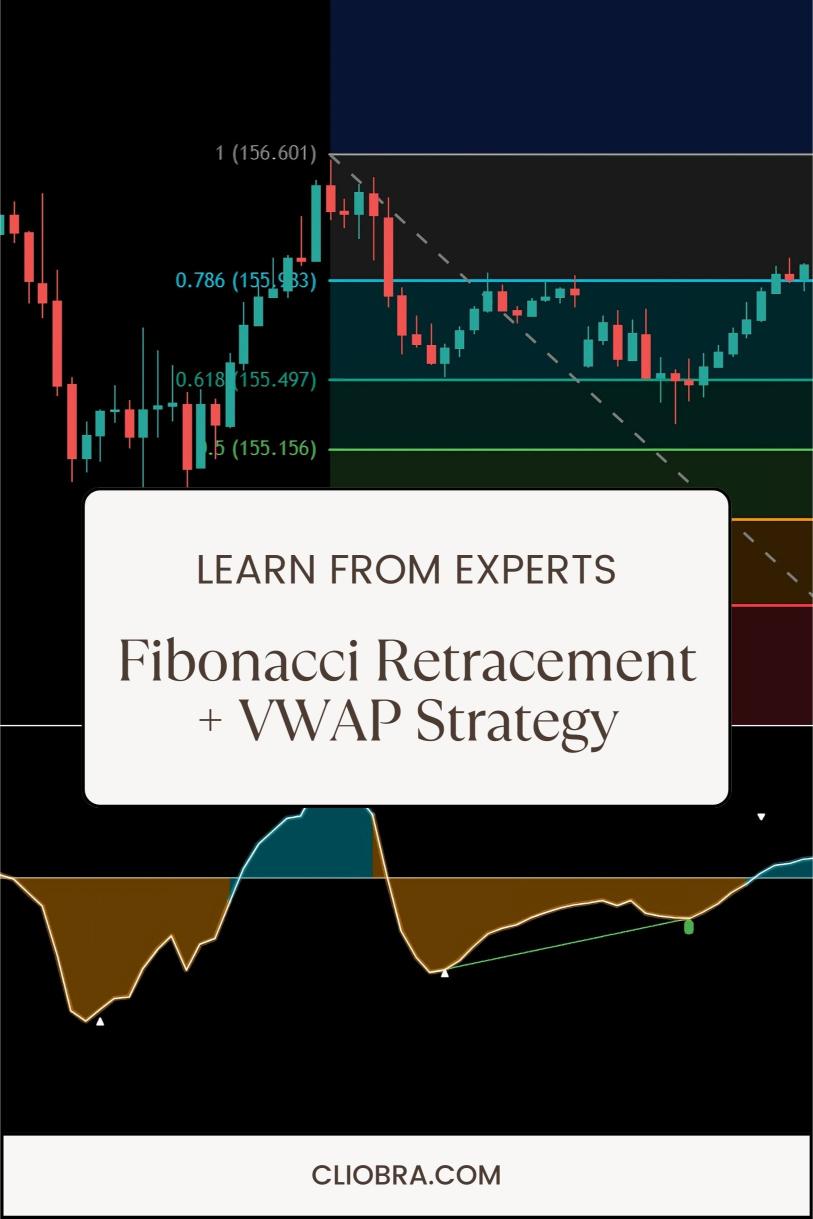

Let’s break down a powerful strategy that can help you identify key levels in the market: the Fibonacci Retracement combined with the Volume Weighted Average Price (VWAP).

As a seasoned Forex trader since 2015, I’ve developed a keen sense for these tools, and they’ve become staples in my trading arsenal. Let’s dive in.

Why Fibonacci and VWAP?

Fibonacci Retracement levels are derived from the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones.

These levels are a great way to determine potential reversal points.

- Common levels include: 23.6%, 38.2%, 50%, 61.8%, and 76.4%.

- They help traders spot where the price might bounce or retrace.

On the other hand, VWAP provides an average price of a security, weighted by volume.

Why is this important?

- It helps gauge the market’s direction.

- Institutions often use VWAP for their trading strategies, making it a crucial indicator for retail traders.

How to Use the Fibonacci Retracement + VWAP Strategy

- Identify the Trend:

- Start by determining if the market is in an uptrend or downtrend.

- Use higher time frames (like H4 or Daily) for clarity.

- Draw Fibonacci Levels:

- In an uptrend, draw from the lowest point to the highest point.

- In a downtrend, draw from the highest to the lowest.

- Add the VWAP:

- Plot the VWAP on your chart.

- Look for confluence between the Fibonacci levels and the VWAP.

- Spotting Support/Resistance:

- When Fibonacci levels align with the VWAP, you’ve found a strong support or resistance zone.

- Watch for price action to confirm the bounce or reversal.

Why This Strategy Works

Statistically, Fibonacci levels are respected by many traders.

Research shows that around 61.8% of price reversals occur near these levels.

Combining this with VWAP, which reflects institutional trading behavior, gives you a robust edge.

My Proven Trading Bots

Now, let’s talk about something that complements this strategy perfectly—my portfolio of 16 trading bots.

These bots leverage the Fibonacci Retracement + VWAP strategy among other techniques to optimize performance.

Here’s how they stand out:

- Multi-layered Diversification: Each currency pair (EUR/USD, GBP/USD, USD/CHF, USD/JPY) has 3-4 bots tailored to minimize correlated losses.

- Long-term Focus: Designed to target 200-350 pips, they excel in stable, long-term trading.

- Backtested for Success: I’ve tested these bots over the last 20 years under various market conditions, ensuring they perform well even when the market gets tough.

And the best part?

I’m offering this EA portfolio completely FREE.

You can get started with the same strategies that have helped me maintain consistent profitability.

The Importance of Choosing the Right Broker

To effectively implement the Fibonacci + VWAP strategy, you need a reliable broker.

I’ve tested several brokers and want to share my top recommendations.

These brokers provide:

- Tight spreads

- Fast execution times

- Excellent customer support

If you want a superior trading experience, check out the most trusted forex brokers I recommend.

Final Thoughts

Understanding the Fibonacci Retracement and VWAP strategy can significantly enhance your trading.

By identifying key support and resistance levels, you increase your chances of making profitable trades.

And don’t forget about my 16 trading bots.

They’re designed to help you capitalize on these strategies without the stress.

Remember, trading is about making informed decisions.

Use these tools to your advantage, and you’ll be well on your way to success in the Forex market.