Last Updated on February 26, 2025 by Arif Chowdhury

Ever feel like you’re swimming against the tide in Forex trading?

You’re not alone.

Many traders struggle with finding a reliable strategy that consistently delivers profits.

That’s where the Fibonacci + Moving Averages strategy comes into play.

It’s a game-changer for trend-following traders.

Let’s dive into this powerful strategy and see how it can transform your trading game.

What is the Fibonacci + Moving Averages Strategy?

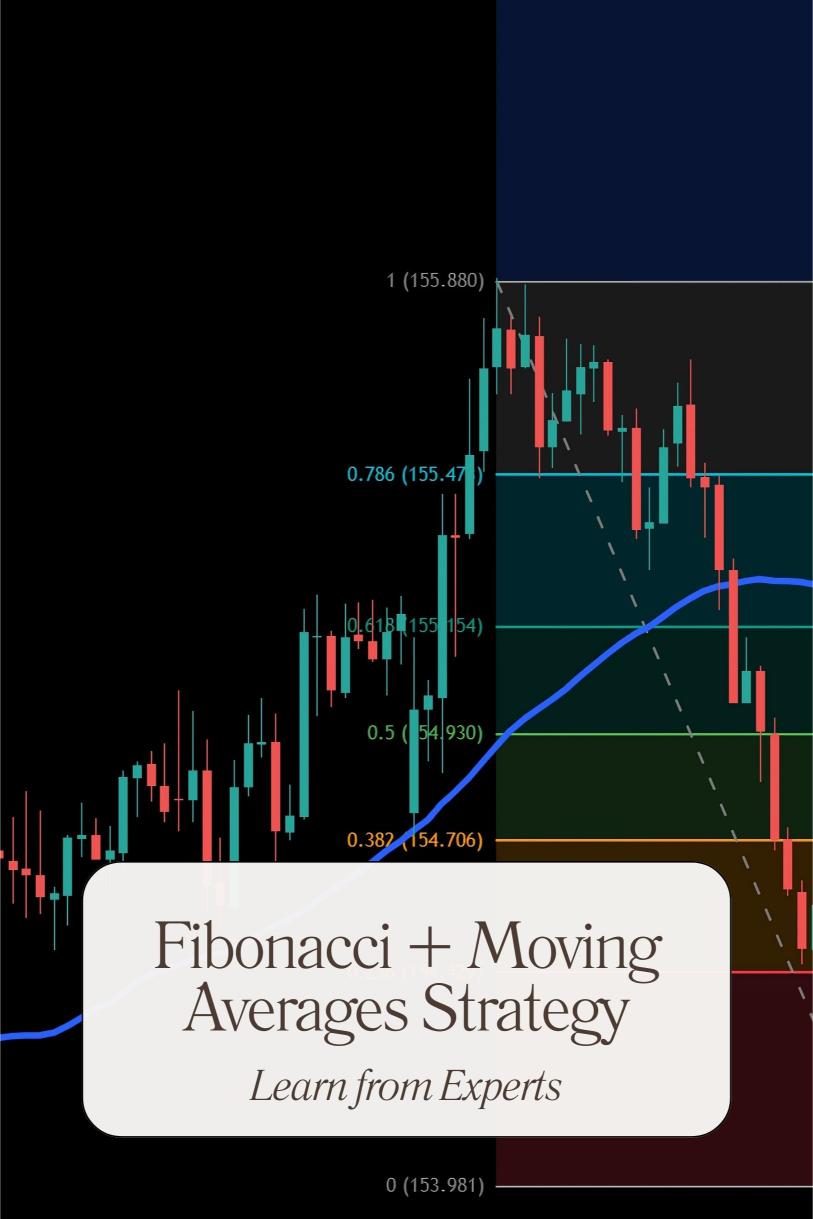

At its core, this strategy combines two robust tools: Fibonacci retracements and moving averages.

Fibonacci retracements help identify potential reversal levels in the market.

Moving averages smooth out price action, showing the overall trend direction.

When you combine these, you get a comprehensive view of the market.

You can spot potential entry and exit points with greater accuracy.

Why Use This Strategy?

- Simplicity: The strategy is straightforward, making it accessible for both new and seasoned traders.

- Versatility: It works across various time frames and currency pairs.

- Statistical Edge: Studies show that over 60% of traders using Fibonacci levels see improved decision-making in their trades.

How to Implement the Strategy

Step 1: Identify the Trend

Start by determining whether the market is in an uptrend or a downtrend.

Use a simple moving average (SMA) or an exponential moving average (EMA) for this.

- Uptrend: Price is above the moving average.

- Downtrend: Price is below the moving average.

Step 2: Draw Fibonacci Levels

Next, use the Fibonacci tool to draw retracement levels.

- Identify the recent swing high and swing low.

- Plot the Fibonacci levels (23.6%, 38.2%, 50%, 61.8%, and 100%).

These levels act as potential support and resistance zones.

Step 3: Look for Entry Signals

Now, wait for the price to approach one of the Fibonacci levels.

Here’s where you can use moving averages for confirmation:

- For Buy Signals: Look for the price to retrace to a Fibonacci level and bounce back above the moving average.

- For Sell Signals: Conversely, watch for a price drop to a Fibonacci level and a rejection below the moving average.

Why I Love This Strategy

As a seasoned Forex trader since 2015, I’ve tested countless strategies.

The Fibonacci + Moving Averages strategy has consistently delivered results.

It’s reliable, effective, and easy to understand.

But that’s not all—I’ve also developed a portfolio of 16 sophisticated trading bots that incorporate this strategy and many others.

These bots are designed to trade major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

They leverage the Fibonacci + Moving Averages strategy to help minimize risk and maximize profit.

What’s cool? Each bot is diversified to prevent correlated losses, enhancing overall profitability.

The Power of Automation

Imagine having a system that trades for you while you sleep.

That’s what my trading bots offer.

- They operate on H4 charts.

- Target long-term gains of 200-350 pips.

- Have been backtested for 20 years, proving their resilience even in harsh market conditions.

And the best part? I’m offering this portfolio for completely FREE!

You can take advantage of these bots and elevate your trading game.

Check it out here: Explore my trading bots.

Final Thoughts on Brokers

If you’re serious about trading, you need a reliable broker.

I’ve tested numerous Forex brokers and found the best options for my trades.

These brokers offer tight spreads, excellent execution speeds, and top-notch customer support.

If you’re looking to get started, check out my recommended brokers here: Best Forex Brokers.

Conclusion

The Fibonacci + Moving Averages strategy is not just a tool; it’s a reliable companion in your trading journey.

Whether you’re trading manually or using automated bots, this strategy can enhance your performance.

Embrace the combination of Fibonacci levels and moving averages, and take your trading to new heights!