Last Updated on February 26, 2025 by Arif Chowdhury

Are you struggling to pinpoint key market levels in your Forex trading?

Wondering how to improve your entries and exits for better profitability?

You’re not alone. Many traders grapple with these questions.

But what if I told you there’s a powerful way to combine two popular tools—Fibonacci levels and Volume Profile—to enhance your trading decisions?

Let’s dive in! 🚀

Understanding Fibonacci Levels

Fibonacci retracement levels are like magic lines on your charts.

They help you identify potential reversal points in the market.

Here’s how they work:

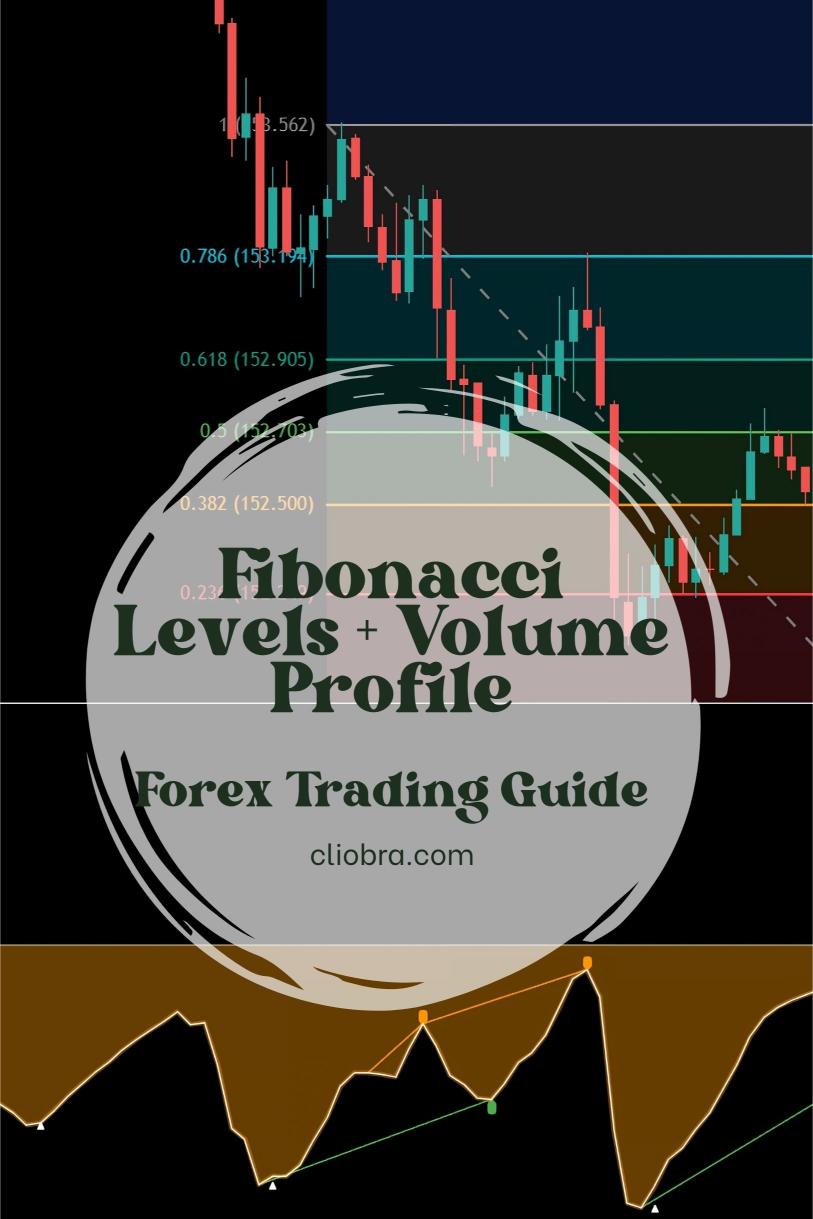

- Key Levels: The main Fibonacci levels to watch are 23.6%, 38.2%, 50%, 61.8%, and 76.4%.

- Retracement: Traders often use these levels to determine where a price might bounce back after a pullback.

- Psychological Levels: These numbers are derived from the Fibonacci sequence, making them psychologically significant.

Using these levels can help you spot potential support and resistance zones.

What is Volume Profile?

Now, let’s mix in Volume Profile.

This tool shows how much volume has traded at specific price levels over a set period.

Why does this matter?

- Market Sentiment: High volume at certain levels indicates strong interest, which can signal support or resistance.

- Value Areas: The “value area” is where 70% of the volume occurs, highlighting where most trading happens.

Combining these insights can give you a clearer picture of market dynamics.

How to Combine Fibonacci Levels and Volume Profile

Ready to supercharge your trading strategy?

Let’s break it down step-by-step:

- Identify the Trend: Use Fibonacci levels during an uptrend or downtrend. Recognize whether you’re looking for buying or selling opportunities.

- Draw Fibonacci Levels: Select the most recent swing high and low, then plot your Fibonacci retracement levels.

- Overlay Volume Profile: Add the Volume Profile to your chart. Look for high-volume nodes near your Fibonacci levels.

- Look for Confluence: When Fibonacci levels align with high-volume nodes, you have a potential key market level. This is where the magic happens!

- Set Alerts: Use alerts for when the price approaches these levels. This keeps you ready for action.

The Power of Diversification

As a seasoned Forex trader since 2015, I’ve developed a robust trading strategy that leverages these tools.

But that’s not all.

I’ve also created a portfolio of 16 trading bots that use this Fibonacci and Volume Profile strategy, among others.

These bots are designed to trade major currency pairs, including:

- EUR/USD

- GBP/USD

- USD/CHF

- USD/JPY

Each bot is diversified to minimize risk and maximize returns.

They operate on H4 charts, targeting long-term profits of 200-350 pips.

This systematic approach significantly enhances profitability while mitigating risks.

And the best part? You can access this entire EA portfolio for FREE!

Simply check out my trading bots portfolio here.

The Importance of Market Context

When using Fibonacci and Volume Profile, remember to consider the broader market context.

Market news, economic indicators, and geopolitical events can impact price levels.

Here are a couple of stats to keep in mind:

- 70% of traders lose money, often due to lack of a solid strategy.

- 85% of price movements are influenced by fundamental news.

Stay informed and be adaptable.

Choosing the Right Forex Broker

If you’re serious about your trading journey, you need a reliable broker.

A good broker can make a huge difference in your trading experience.

I’ve tested several brokers and can confidently recommend a few.

Find the best options that suit your trading style at my recommended Forex brokers.

Wrapping It Up

Combining Fibonacci levels with Volume Profile can be a game-changer for your trading strategy.

By identifying key market levels, you can make more informed decisions and improve your profitability.

And remember, integrating these tools into your trading toolkit will require practice, patience, and persistence.

Don’t forget to explore my FREE EA portfolio to enhance your trading experience even further!

Let’s elevate your trading game together! 🚀