Last Updated on February 26, 2025 by Arif Chowdhury

Have you ever felt overwhelmed by market volatility?

Or maybe you’ve struggled to find the perfect entry point in your trades?

I get it. As a seasoned Forex trader since 2015, I’ve faced those challenges head-on.

But here’s the good news: I’ve discovered a powerful combination that has transformed my trading game.

Let me introduce you to The Fibonacci Retracement + Stochastic Oscillator.

This duo is like peanut butter and jelly for traders looking to pinpoint their entries with precision.

Why Fibonacci and Stochastic?

First off, let’s break down why these two tools work so well together.

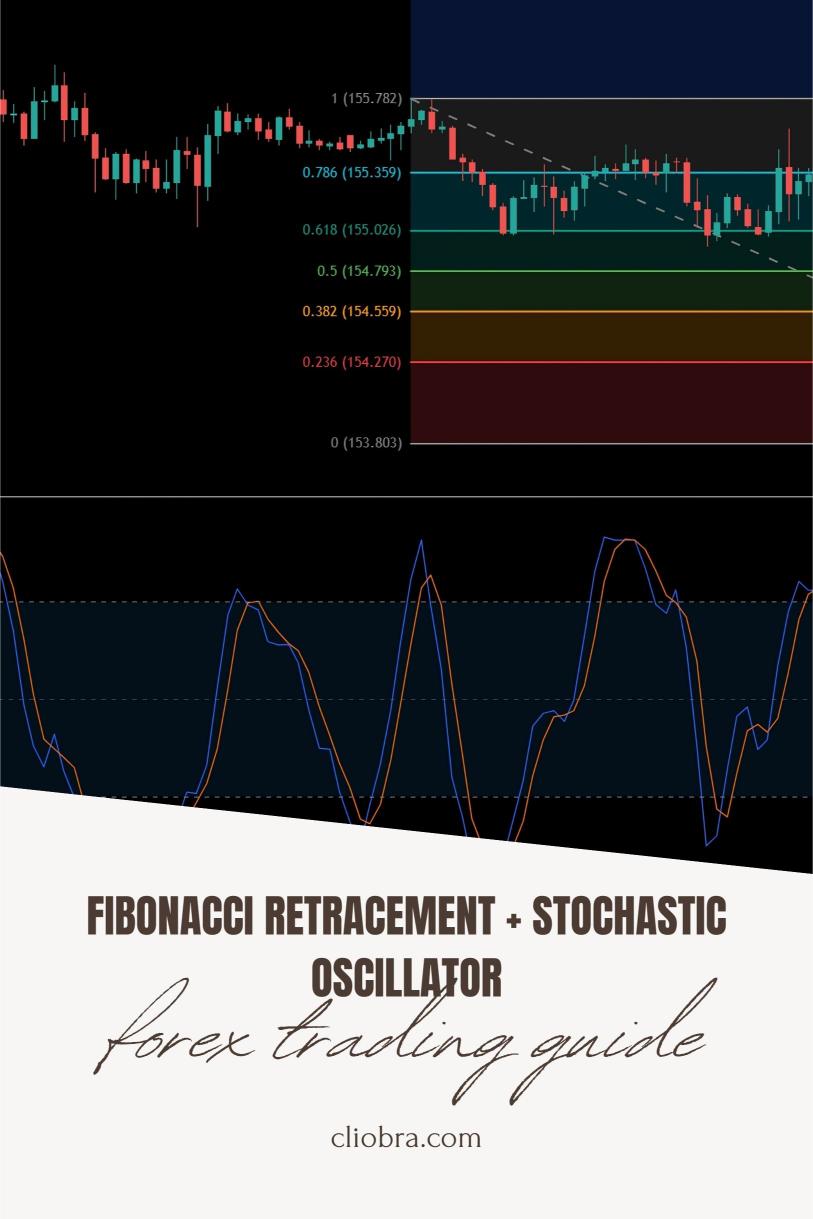

Fibonacci Retracement helps identify key support and resistance levels.

It’s based on the idea that markets will retrace a predictable portion of a move before continuing in the original direction.

On the other hand, the Stochastic Oscillator is a momentum indicator that compares a particular closing price of a security to a range of its prices over a certain period.

When these two are combined, they create a robust system for entry and exit points.

The Power of Fibonacci Retracement

- Identify Key Levels: Fibonacci levels (23.6%, 38.2%, 50%, 61.8%, and 100%) act as psychological barriers.

- Market Psychology: Traders often place their buy/sell orders at these levels, creating self-fulfilling prophecies.

- Statistical Insight: Studies show that 61.8% retracement levels often lead to strong reversals.

The Stochastic Oscillator Breakdown

- Momentum Measurement: It shows whether an asset is overbought or oversold.

- Thresholds: Readings above 80 indicate overbought conditions, while below 20 indicates oversold.

- Signal Confirmation: When combined with Fibonacci levels, it confirms potential reversals, giving you that extra edge.

Putting It Together: The Strategy

- Identify the Trend: Determine if the market is in an uptrend or downtrend.

- Draw Fibonacci Levels: Use the most recent swing high and low to draw your Fibonacci retracement.

- Wait for the Retracement: Look for price action around the key Fibonacci levels.

- Check Stochastic: Ensure the Stochastic is in overbought/oversold territory.

- Enter the Trade: If conditions align, execute your trade.

This method isn’t just theory; it’s a strategy I’ve tested extensively.

My Trading Bots and Their Secret Sauce

Now, you might be wondering how I’ve managed to stay consistently profitable in this game.

Well, I’ve developed a portfolio of 16 sophisticated trading bots that leverage various strategies, including the Fibonacci Retracement + Stochastic Oscillator.

Each of these bots is designed to operate across four major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Here’s what makes them special:

- Diverse Algorithms: Each currency pair has a unique set of 3-4 trading bots.

- Robust Risk Management: They are internally diversified to minimize correlated losses.

- Long-Term Focus: My bots target long-term trades of 200-350 pips, ensuring better performance over time.

And the best part? I’m offering this entire EA portfolio for FREE!

You can check it out here: My Trading Bots Portfolio.

Why You Should Start Trading Now

Investing in Forex can be daunting, but with the right tools, it becomes manageable.

Using the Fibonacci Retracement and Stochastic Oscillator can help demystify the markets.

Plus, if you’re looking for a trading platform, make sure you check out the best Forex brokers I’ve tested.

They offer tight spreads, instant withdrawals, and excellent customer support.

Final Thoughts

Trading is a journey filled with ups and downs.

But by leveraging effective strategies like the Fibonacci Retracement + Stochastic Oscillator, you can gain a significant edge.

Pair that with my FREE trading bots and the right broker, and you’ll be well on your way to consistent profitability.

Remember, the market rewards those who are prepared.

So, gear up, and let’s make those pinpoint entries together!