Last Updated on February 23, 2025 by Arif Chowdhury

Ever felt lost in the chaos of the Forex market?

You’re not alone.

Many traders struggle with knowing when to enter and exit trades.

That’s where Fibonacci retracements and the 100 EMA come into play.

These tools can transform your swing trading game.

Let’s break this down step by step.

Understanding Fibonacci Retracements

Fibonacci retracements are based on a mathematical sequence.

Here’s the gist:

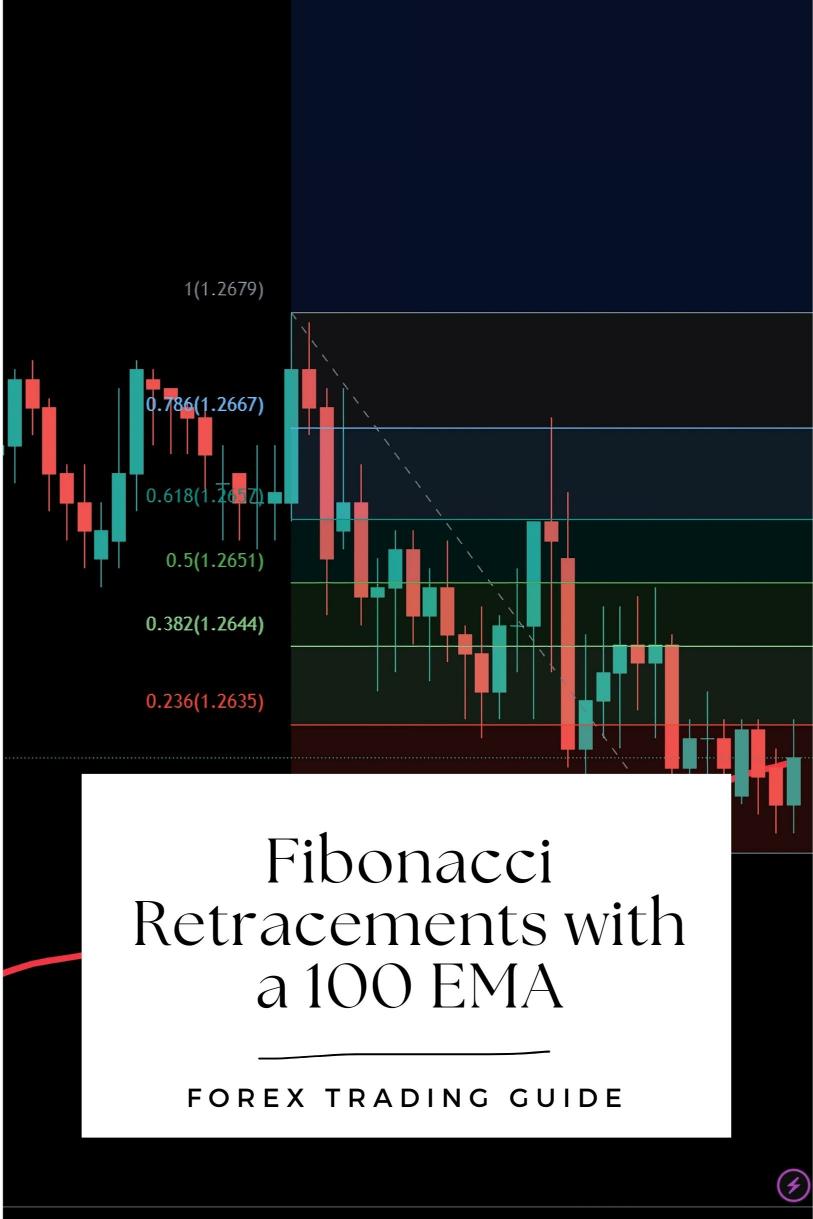

- The key levels are 23.6%, 38.2%, 50%, 61.8%, and 100%.

- These percentages help identify potential reversal points in the market.

Why is this important?

Statistically, about 61.8% of traders rely on Fibonacci levels for their trading decisions.

It’s a popular tool for a reason.

The 100 EMA Explained

The 100 Exponential Moving Average (EMA) smooths out price action.

It focuses on the last 100 periods, giving you a clearer picture of the trend.

Here’s why you should consider it:

- Trend Confirmation: The 100 EMA helps confirm whether the market is bullish or bearish.

- Dynamic Support/Resistance: Prices often bounce off the 100 EMA, making it a reliable level for entries and exits.

Combining Fibonacci with the 100 EMA

Now, let’s put these two powerful tools together.

Here’s how I use them in my trading strategy:

- Identify the Trend: Start by checking the direction of the 100 EMA. If the price is above it, you’re in a bullish trend. If it’s below, you’re in a bearish trend.

- Draw Fibonacci Levels: From the last swing high to swing low (or vice versa), plot your Fibonacci retracement levels.

- Look for Confluence:

- Check if the price retraces to any Fibonacci level near the 100 EMA.

- This convergence creates a strong potential reversal zone.

- Set Your Entry:

- Once you see price action confirming the reversal (like bullish candlesticks in a bullish trend), that’s your entry point.

- Manage Your Risk:

- Always set stop-loss orders below the last swing low (for buys) or above the swing high (for sells).

- Take Profit Levels:

- Use the next Fibonacci extension levels to set your targets.

A Winning Strategy

By combining these two methods, you can increase your chances of successful trades.

But it doesn’t stop there.

I’ve developed a portfolio of 16 sophisticated trading bots that utilize the Fibonacci retracement and 100 EMA strategy, among others.

These bots are designed for long-term trading, targeting 200-350 pips.

They’ve been backtested over 20 years, proving their effectiveness even in volatile conditions.

If you’re serious about improving your trading, consider checking out my trading bot portfolio for FREE at this link.

Why Use a Trading Bot?

Here’s why having a trading bot can elevate your trading experience:

- Automation: Bots execute trades for you, removing emotional decision-making.

- Diversification: My bots are strategically diversified across major pairs like EUR/USD and GBP/USD, minimizing correlated losses.

- Consistent Performance: They’re designed to trade on H4 charts, ensuring they capture significant price movements.

Choosing the Right Forex Broker

A solid trading strategy needs a reliable broker.

When selecting a broker, consider:

- Tight Spreads: Look for brokers offering low transaction costs.

- Execution Speed: Fast order execution can make a huge difference in your trading results.

- Customer Support: Responsive support is crucial, especially when issues arise.

I recommend checking out the best Forex brokers I’ve tested at this link.

Conclusion

Using Fibonacci retracements with a 100 EMA for swing trading can significantly enhance your trading strategy.

By understanding how to identify key levels and trends, you can make more informed decisions.

And remember, automation through my 16 trading bots can help you capitalize on these strategies effortlessly.

Don’t just trade; trade smart.

Explore your options today and elevate your trading journey!