Last Updated on February 23, 2025 by Arif Chowdhury

Ever feel overwhelmed by the chaos of Forex trading?

You’re not alone.

Many traders grapple with the same questions: How do I find reliable entry and exit points?

How can I maximize my profits while minimizing risk?

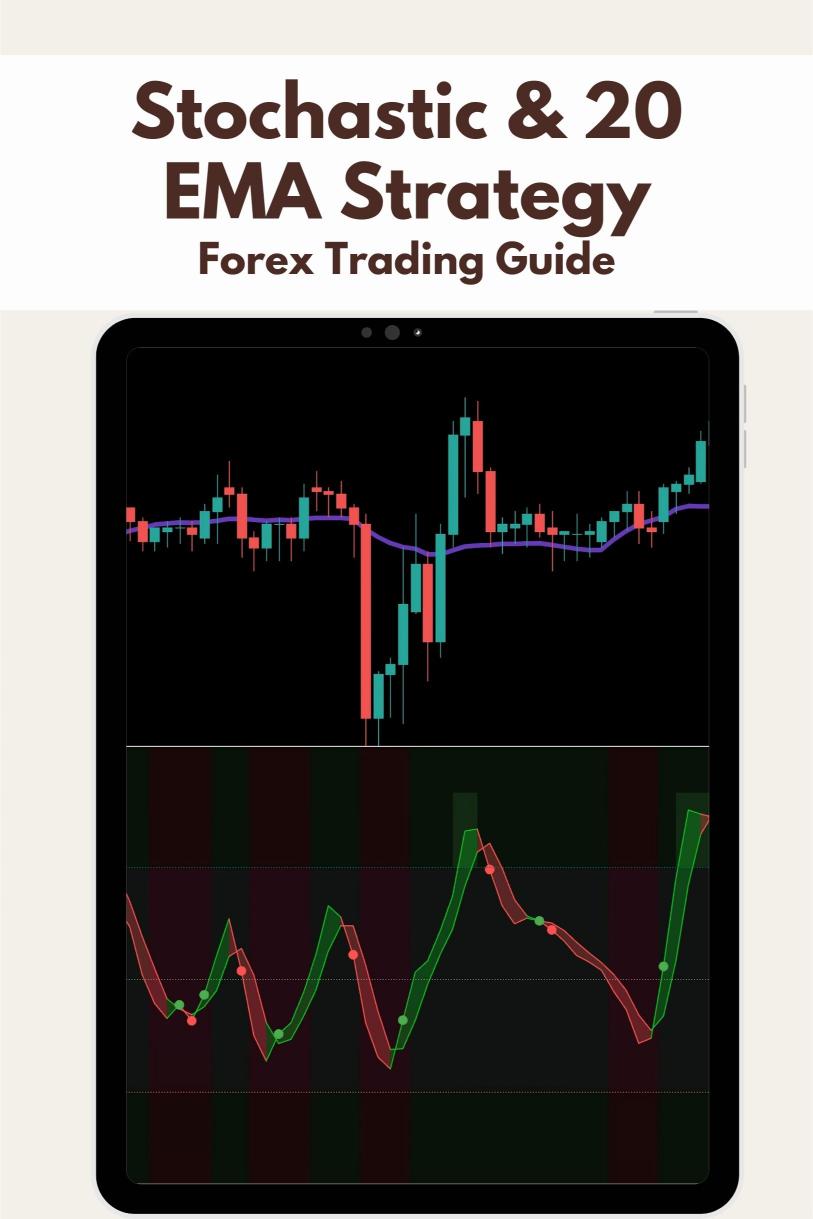

Let me share a strategy that has been a game-changer for me: combining the Stochastic oscillator with the 20 EMA (Exponential Moving Average).

What is the Stochastic Oscillator?

The Stochastic oscillator is a momentum indicator.

It measures the level of the close relative to the high-low range over a specific period.

This helps identify overbought or oversold conditions.

When the Stochastic is above 80, it indicates overbought.

Below 20 signals oversold.

Simple, right?

But here’s why it’s powerful.

Statistically, over 70% of traders miss crucial entry points because they don’t use confirmation tools.

That’s where the Stochastic shines.

Understanding the 20 EMA

The 20 EMA smooths out price data to give you a clearer view of the trend.

It reacts faster to price changes than the simple moving average.

This means you’ll get timely signals to enter or exit trades.

I’ve found that using the 20 EMA helps in identifying the trend direction quickly.

When the price is above the 20 EMA, you’re looking at a bullish trend.

Below it? Bearish.

How to Use the Stochastic & 20 EMA Strategy

Let’s break it down into actionable steps.

- Set Up Your Charts

- Use the H4 chart for a broader perspective.

- Add the 20 EMA to your chart.

- Add the Stochastic oscillator (set to 14, 3, 3).

- Identify Trend Direction

- Check if the price is above or below the 20 EMA.

- This tells you whether to look for buy or sell signals.

- Look for Entry Signals

- For Buying:

- Price is above the 20 EMA.

- Stochastic crosses above 20 (oversold).

- For Selling:

- Price is below the 20 EMA.

- Stochastic crosses below 80 (overbought).

- For Buying:

- Set Stop Loss and Take Profit

- Always have a plan.

- Set your stop loss below the most recent swing low for buys.

- For sells, set it above the swing high.

- Aim for a risk-reward ratio of at least 1:2.

- Stay Disciplined

- Don’t let emotions dictate your trades.

- Stick to your strategy.

- Trading is as much about psychology as it is about strategy.

Why This Strategy Works

The combination of the Stochastic and the 20 EMA provides a robust framework.

It minimizes false signals and helps you trade with the trend.

Did you know that over 60% of traders fail because they don’t have a solid strategy?

By using this method, you place yourself in a better position to succeed.

My 16 Trading Bots: A Game-Changer

Now, let’s talk about something exciting.

I’ve developed a portfolio of 16 sophisticated trading bots.

These bots are designed to work seamlessly with the Stochastic and 20 EMA strategy.

They’re focused on four major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot is diversified to minimize correlated losses.

This means you can trade with confidence, knowing your risk is spread out.

All my bots use H4 charts and aim for long-term gains of 200-350 pips.

I’ve backtested them for over 20 years, and they perform excellently under various market conditions.

Best of all? You can access my entire EA portfolio for FREE.

Finding the Right Forex Broker

To implement this strategy effectively, you need a reliable broker.

I’ve tested several, and I recommend choosing one with tight spreads and excellent customer support.

Here’s a great resource to find the best Forex brokers: Most Trusted Forex Brokers.

This will help you make informed decisions.

Final Thoughts

Trading Forex doesn’t have to be a guessing game.

With the right tools and strategies, you can enhance your trading journey.

The Stochastic and 20 EMA strategy is just one method that has worked wonders for me.

Combine it with my trading bots, and you’re looking at a powerful duo for profit.

Remember, success in trading comes down to discipline and the right strategies.

Start implementing this strategy today, and watch your trading skills soar!