Last Updated on November 1, 2025 by Arif Chowdhury

Ever feel like the market is just too unpredictable?

You’re not alone.

Many traders grapple with the chaos of price movements, often wondering how to make sense of it all.

What if I told you there’s a way to navigate these waters more confidently?

Let’s dive into the Bollinger Band + 50 EMA Mean Reversion Strategy.

This strategy isn’t just a buzzword; it’s a game-changer for traders looking to capitalize on market volatility.

What Is the Bollinger Band + 50 EMA Mean Reversion Strategy?

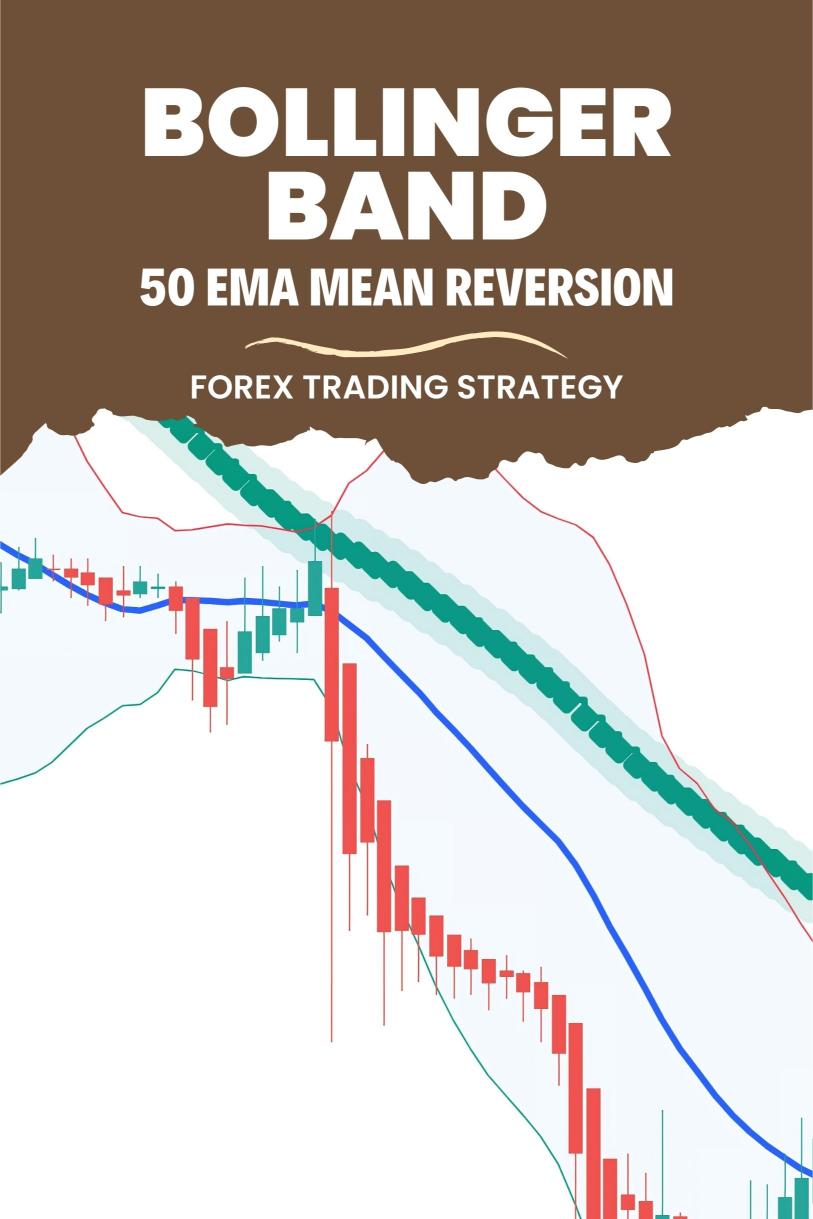

At its core, this strategy combines two powerful tools: Bollinger Bands and the 50-period Exponential Moving Average (EMA).

Bollinger Bands help you visualize volatility and price levels, while the 50 EMA provides a dynamic trend line that smooths out price data.

Together, they create a robust framework for identifying potential price reversions.

How Does It Work?

Here’s the magic:

- Bollinger Bands consist of a middle band (the 50 EMA) and two outer bands that adjust based on volatility.

- When price touches or exceeds the upper band, it may signal that the market is overbought.

- Conversely, touching or falling below the lower band suggests the market might be oversold.

- The strategy aims to enter trades when the price heads back toward the 50 EMA after hitting the outer bands.

Key Steps to Implement the Strategy

- Set Up Your Chart:

- Add Bollinger Bands to your chart with a standard deviation of 2.

- Overlay the 50 EMA.

- Identify Entry Points:

- Look for price action that touches or exceeds the Bollinger Bands.

- Confirm with the 50 EMA to see if a mean reversion is likely.

- Manage Your Trades:

- Use stop-loss orders to protect your capital.

- Consider taking profits when price approaches the opposite Bollinger Band.

Why This Strategy Works

Statistically speaking, price tends to revert to the mean after extreme movements.

- Studies show that about 68% of price movements occur within one standard deviation of the mean.

- This means that using the Bollinger Bands can significantly increase your chances of making profitable trades.

But there’s more!

My Trading Bots and the Bollinger Band Strategy

I’ve been trading Forex since 2015, and through my journey, I developed 16 trading bots that use the Bollinger Band + 50 EMA Mean Reversion Strategy among other techniques.

These bots are finely tuned to trade across four major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Here’s what makes these bots stand out:

- Each currency pair has 3-4 unique bots.

- They’re diversified to minimize correlated losses.

- Designed for long-term trades, targeting 200-350 pips.

I’ve backtested these bots for the past 20 years, and they perform exceptionally well even under harsh market conditions.

The best part?

You can access my entire EA portfolio for FREE! 🎉

Check out my trading bots here: Trading Bots Portfolio.

Key Takeaways

- The Bollinger Band + 50 EMA Mean Reversion Strategy can help traders navigate volatility.

- Utilize this strategy to enhance your trading accuracy.

- Leverage my 16 trading bots to automate your trading experience and maximize returns.

Best Forex Brokers for Your Trading Needs

Finding the right broker can be a game-changer for your trading experience.

I’ve tested several brokers, and here are a few that stand out:

- Tight spreads and no commission.

- Excellent customer support.

- Instant withdrawals and flexible leverage options.

To explore the best Forex brokers I recommend, check out this link: Most Trusted Forex Brokers.

These brokers will help you execute your strategies effectively and efficiently.

Conclusion

In the unpredictable world of Forex trading, having a solid strategy and the right tools is crucial.

The Bollinger Band + 50 EMA Mean Reversion Strategy offers a structured approach to capitalize on market reversals.

Pair this strategy with my 16 trading bots for a more hands-off trading experience and consistent profitability.

And don’t forget to choose a reliable broker to support your trading journey.

Happy trading! 🚀