Last Updated on February 22, 2025 by Arif Chowdhury

Ever felt like the market’s just sitting there, waiting for something big to happen?

You’re not alone.

As a seasoned Forex trader since 2015, I’ve seen my fair share of market stagnation.

But what if I told you there’s a way to spot explosive moves before they happen?

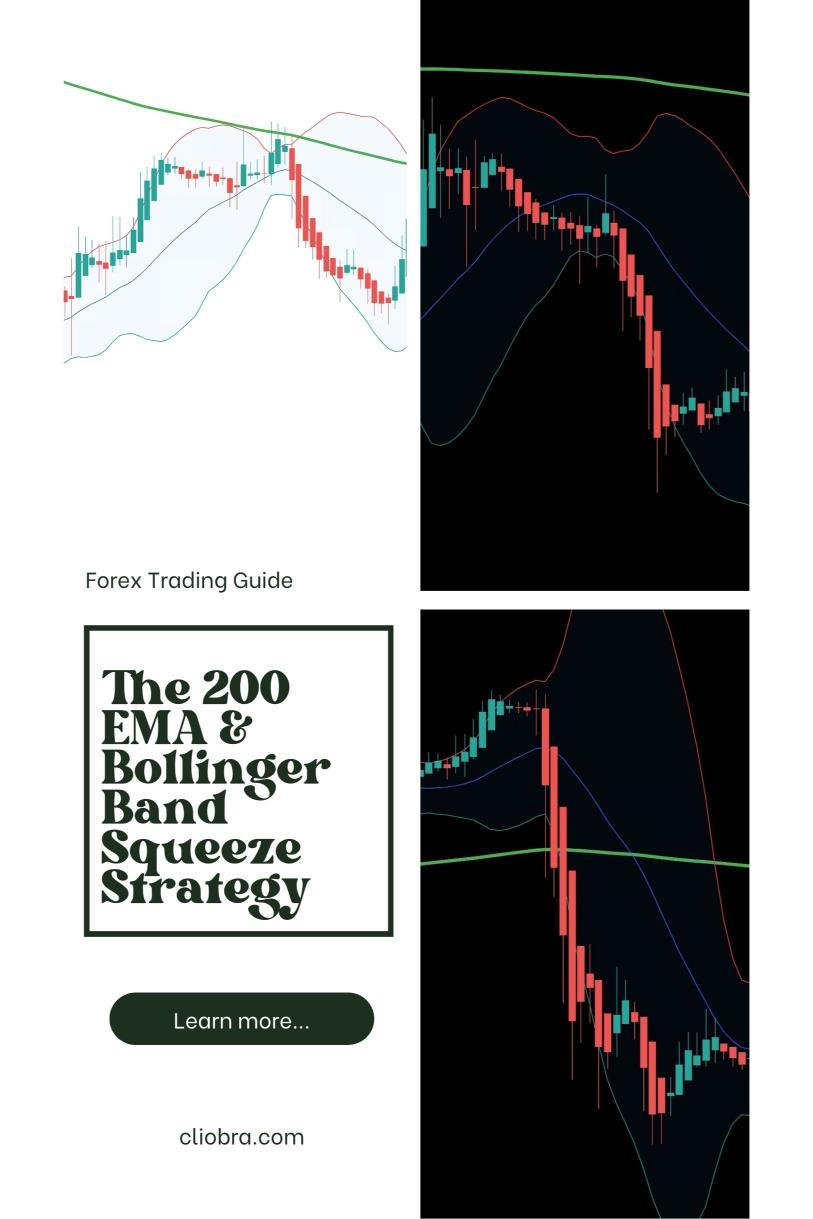

Let’s dive into the 200 EMA & Bollinger Band Squeeze Strategy.

This strategy isn’t just another method; it’s a game-changer.

Understanding the Basics

First, let’s break down the essentials.

200 EMA (Exponential Moving Average):

- It smooths out price data, giving you a clear trend direction.

- If prices are above the 200 EMA, we’re in an uptrend. Below? You guessed it—downtrend.

Bollinger Bands:

- These are volatility indicators.

- When the bands squeeze together, it signals low volatility.

- A squeeze often precedes a significant price move.

Why This Strategy Works

Statistically, about 70% of price movements happen after a squeeze on the Bollinger Bands.

That’s a powerful number.

When combined with the 200 EMA, you can pinpoint entries with greater confidence.

Spotting the Squeeze

Here’s how to identify that sweet spot:

- Watch the Bands: Look for the Bollinger Bands to tighten.

- Check the 200 EMA: Ensure the price is above or below this line for trend direction.

- Volume Matters: Increased volume during a squeeze often indicates a breakout is imminent.

Crafting Your Trading Plan

Now, let’s create a simple plan to implement this strategy effectively.

- Identify the Trend: Is the price above the 200 EMA? Great! Look for buy signals. Below? Focus on selling.

- Wait for the Squeeze: When the Bollinger Bands tighten, keep your eyes peeled.

- Confirm with Volume: Look for a surge in volume as the price breaks out of the squeeze.

- Set Your Stops: Always have a stop loss in place. This protects your capital.

- Take Profits Wisely: Set profit targets based on previous price action or a risk-reward ratio of at least 1:2.

This straightforward approach has yielded significant results for me.

My Experience with EAs

Now, here’s where things get interesting.

I’ve developed a portfolio of 16 trading EAs that utilize the 200 EMA & Bollinger Band strategy among other methods.

These bots are strategically diversified across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot trades using H4 charts, targeting long-term gains of 200-350 pips.

This long-term focus has proven effective, especially during volatile market conditions.

I offer this entire EA portfolio for FREE.

It’s designed to help you maximize profit while minimizing risk.

The Power of Diversification

The beauty of my trading bots lies in their multi-layered diversification.

- Each currency pair has 3-4 bots, internally diversified.

- This minimizes correlated losses, creating a robust trading system.

Statistically, diversified portfolios can reduce risk by up to 30%, allowing you to trade with peace of mind.

Choosing the Right Broker

Before you start trading, ensure you’re with a reliable broker.

I’ve tested several, and I recommend checking out the best forex brokers available on my site.

Find the right fit for your trading style and goals.

You can explore them here: Most Trusted Forex Brokers.

Conclusion

The 200 EMA & Bollinger Band Squeeze Strategy is a powerful tool in any trader’s arsenal.

By combining these indicators, you can spot explosive moves before they happen.

Don’t forget to leverage my 16 trading EAs to simplify your trading journey.

You can get started here: Forex EA Portfolio.

Start trading smarter, not harder, and watch your profits grow.