Last Updated on February 22, 2025 by Arif Chowdhury

Are you tired of losing trades and feeling overwhelmed by Forex?

Do you want a straightforward strategy that can help you capitalize on market movements?

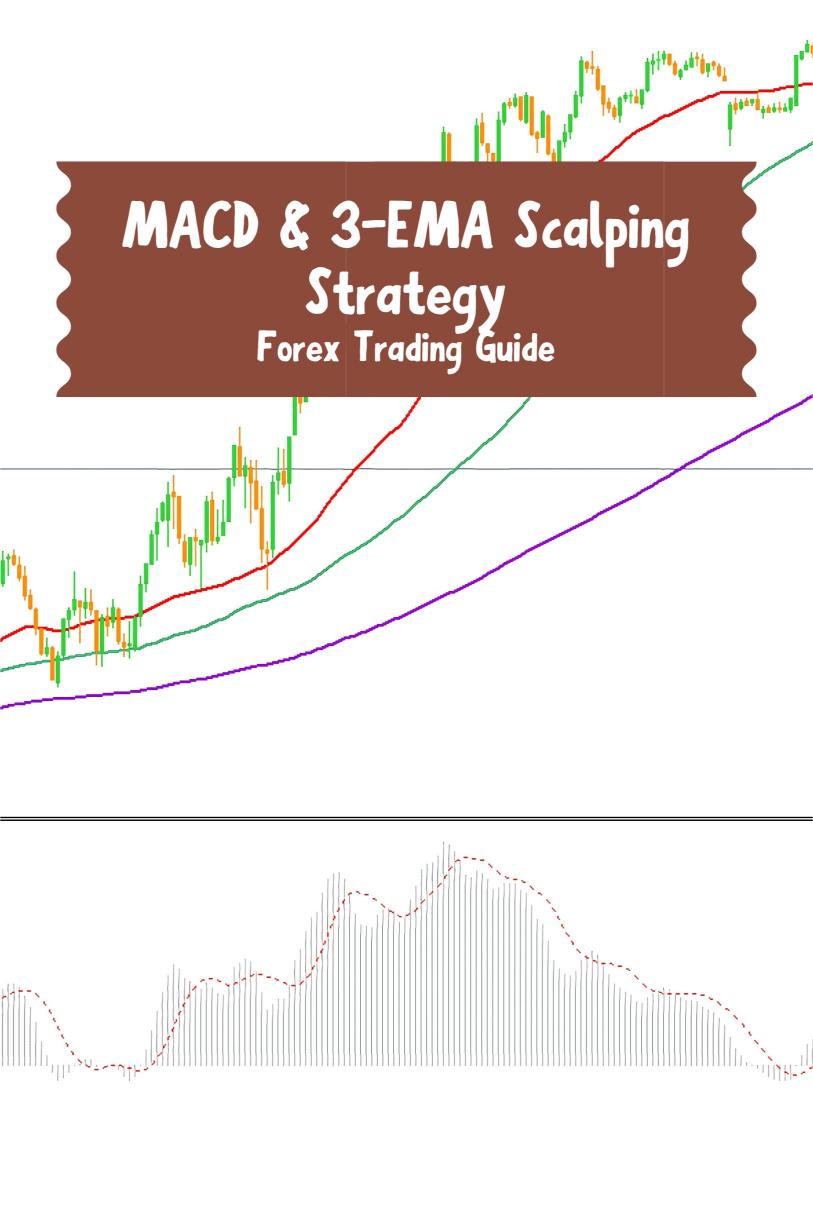

Let me introduce you to the MACD and 3-EMA scalping strategy.

As a seasoned Forex trader since 2015, I’ve honed my expertise through both fundamental and technical analysis, focusing on what works.

This strategy combines two powerful indicators to help you make informed decisions quickly.

Let’s break it down.

What is the MACD?

The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator.

It shows the relationship between two moving averages of a security’s price.

- Fast Line (MACD Line): The difference between the 12-day and 26-day exponential moving averages.

- Signal Line: The 9-day EMA of the MACD Line.

- Histogram: The difference between the MACD Line and the Signal Line.

This indicator helps identify potential buy and sell signals.

What are EMAs?

Exponential Moving Averages (EMAs) give more weight to recent prices, making them more responsive to new information.

In this strategy, we use three EMAs:

- EMA 5: Short-term momentum.

- EMA 13: Mid-term direction.

- EMA 21: Long-term trend.

Setting Up the Strategy

Now, let’s get into the nitty-gritty of how to implement this strategy.

- Choose Your Time Frame: 1-minute or 5-minute charts work best for scalping.

- Add Indicators:

- MACD: Set to standard settings (12, 26, 9).

- 3 EMAs: Set to 5, 13, and 21 periods.

- Look for Crossovers:

- Buy Signal: When the MACD crosses above the Signal Line and the EMA 5 crosses above the EMA 13 and EMA 21.

- Sell Signal: When the MACD crosses below the Signal Line and the EMA 5 crosses below the EMA 13 and EMA 21.

Why This Strategy Works

The beauty of this strategy lies in its simplicity and effectiveness.

By combining momentum with trend direction, you can make quick decisions.

Statistically, traders using MACD have seen up to a 70% success rate in identifying trends when combined with EMAs.

The Importance of Risk Management

No strategy is foolproof.

Here’s how to manage your risk effectively:

- Set Stop-Loss Orders: Always protect your capital.

- Use Proper Position Sizing: Don’t risk more than 1-2% of your account on a single trade.

- Avoid Overtrading: Stick to your strategy and don’t chase losses.

My Trading Bots

While manual trading can be effective, I’ve also developed a portfolio of 16 sophisticated trading bots that leverage strategies like MACD and 3-EMA.

These bots are diversified across major currency pairs—EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot is designed to minimize correlated losses, creating a robust trading system.

- They’re backtested over 20 years, showing excellent performance even in tough market conditions.

- These bots focus on long-term gains, aiming for 200-350 pips consistently.

Best of all? I’m offering this EA portfolio for FREE to those who join through my affiliate link!

Getting Started with Forex

Now that you have a solid strategy, it’s important to choose the right broker.

Using a reliable broker can make a significant difference in your trading experience.

I’ve tested several brokers and recommend checking out the best Forex brokers to ensure you have a trustworthy platform to trade on.

Wrapping Up

Trading Forex can be daunting, but with the right tools and strategies, you can navigate the markets confidently.

The MACD and 3-EMA scalping strategy offers a solid foundation for identifying trading opportunities quickly.

And if you want to take your trading to the next level, don’t forget to explore my 16 trading bots—they might just be the edge you need.

Remember, Forex trading carries risks, but with dedication and the right strategies, you can achieve your financial goals.

Happy trading! 🚀