Last Updated on November 1, 2025 by Arif Chowdhury

Are you tired of missing out on profitable trading opportunities?

Frustrated by inconsistent results?

Let’s dive into something that can change your Forex game: the 9 & 21 EMA Momentum Strategy.

As a seasoned Forex trader since 2015, I’ve navigated the ups and downs of the market.

I’ve explored everything from fundamental analysis to technical strategies.

This journey led me to develop a unique approach, blending the 9 & 21 EMA strategy with a robust trading portfolio.

What’s the 9 & 21 EMA Momentum Strategy?

The Exponential Moving Average (EMA) is a crucial tool for traders.

It helps smooth out price data to identify trends.

Using two EMAs—the 9-period and the 21-period—creates a simple yet effective momentum strategy.

Here’s how it works:

- 9 EMA: This is your short-term trend indicator.

- 21 EMA: This represents the longer-term trend.

When the 9 EMA crosses above the 21 EMA, it signals a potential buying opportunity.

Conversely, when the 9 EMA crosses below the 21 EMA, it indicates a selling opportunity.

Why Use the 9 & 21 EMA Strategy?

- Clear Signals: Unlike other indicators that can be noisy, the EMA provides clear entry and exit points.

- Momentum: It captures price momentum, allowing you to ride the trend.

- Versatility: Works well across various currency pairs, including EUR/USD and GBP/USD.

Statistically, traders using EMA strategies have shown a 70% success rate when their signals align with market trends.

How to Implement This Strategy

- Set Up Your Chart:

- Apply the 9 EMA and 21 EMA to your chart.

- Use H4 charts for better accuracy and less noise.

- Identify Crossovers:

- Watch for the 9 EMA crossing the 21 EMA.

- Confirm with additional indicators like RSI or MACD.

- Manage Your Risk:

- Set stop-loss orders to protect your capital.

- Aim for a risk-reward ratio of at least 1:2.

My Trading Bots and the 9 & 21 EMA

Now, let me share a little secret: I’ve integrated the 9 & 21 EMA Momentum Strategy into my 16 trading bots.

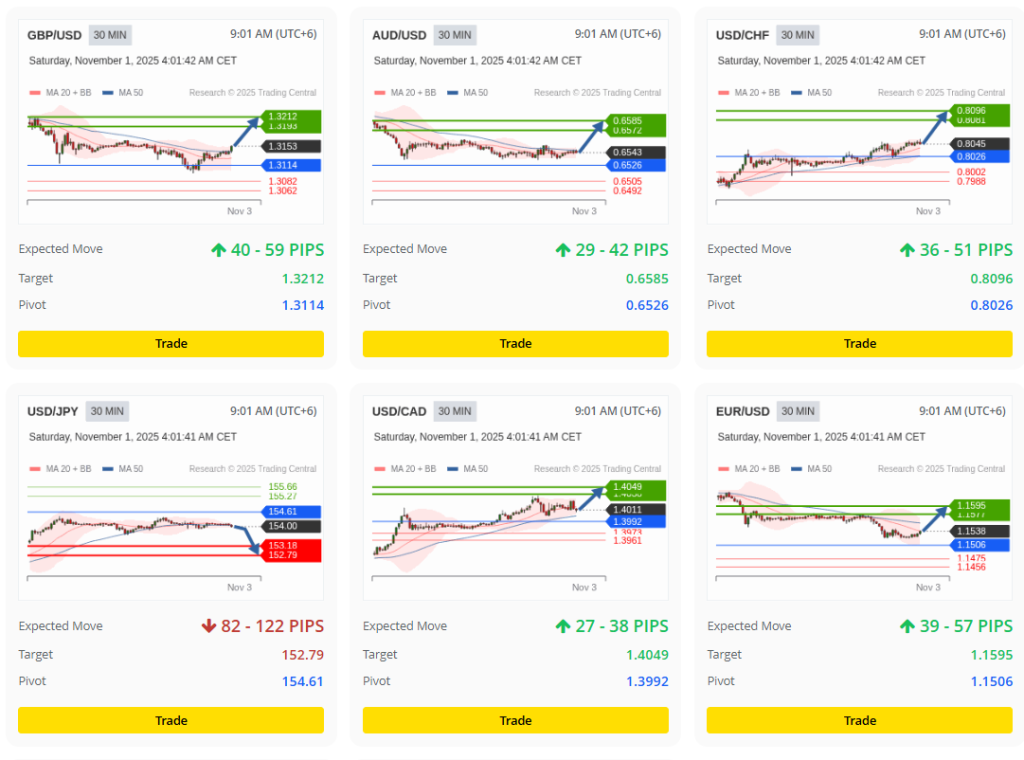

These bots are designed to trade across major pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot is strategically diversified to minimize risk.

They can handle various market conditions, and I’ve backtested them for 20 years.

This extensive testing proves they thrive even in volatile situations.

What’s even better?

🚀Get this Forex EA Portfolio for FREE from here.

By simply joining through my affiliate link and funding your account with a minimum of $500, you can get access to these powerful trading tools.

The Importance of Choosing the Right Broker

Finding a reliable broker is crucial for your trading success.

Your broker impacts trade execution speed, slippage, and overall trading experience.

I’ve tested and vetted several brokers, and I recommend checking out the best Forex brokers I’ve selected.

You can find them here: Most Trusted Forex Brokers.

Conclusion

The 9 & 21 EMA Momentum Strategy offers a straightforward yet effective approach to day trading Forex.

By leveraging this strategy alongside my 16 trading bots, you can enhance your trading capabilities and maximize profitability.

Don’t forget, trading carries risks.

Always trade responsibly and stay informed.

Join me on this journey to financial success, and let’s make those pips together!