Last Updated on February 18, 2025 by Arif Chowdhury

Are you feeling overwhelmed by how to size your Forex positions effectively?

Do you wonder how some traders seem to thrive while others struggle?

I’ve been in the Forex game since 2015, and let me tell you, mastering position sizing is key.

Volatility-Weighted Position Sizing is a game changer.

Let’s break it down, clear away the jargon, and get you on the right track.

What is Volatility-Weighted Position Sizing?

Simply put, this technique adjusts your position sizes based on market volatility.

When the market is volatile, you’ll trade smaller positions to manage risk.

When it’s calmer, you can afford to increase your position size.

This approach helps you avoid unnecessary losses while maximizing gains during favorable conditions.

Why Use Volatility-Weighted Position Sizing?

1. Control Your Risk:

It’s all about risk management.

By sizing your positions according to volatility, you can prevent large drawdowns.

2. Maximize Profits:

When the market presents opportunities, you’re ready to capitalize without overexposing yourself.

3. Adaptability:

Markets change, and so should your approach.

This method helps you adapt on the fly.

How to Implement It

Here’s a simple guide to get you started.

Step 1: Calculate Market Volatility

Use indicators like the Average True Range (ATR) to measure volatility.

The ATR provides a solid foundation for gauging how much a currency pair typically moves.

Step 2: Determine Risk Per Trade

Decide how much of your account you’re willing to risk on a single trade.

A common rule is to risk 1-2% of your trading capital.

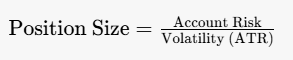

Step 3: Calculate Position Size

Now, let’s put it all together.

Use this formula:

This helps you adjust your position based on how much the market is moving.

Step 4: Monitor and Adjust

Keep an eye on market conditions.

If volatility spikes, be ready to reduce position sizes.

My Approach with Trading Bots

To further enhance risk management, I’ve developed a portfolio of 16 sophisticated trading bots.

Each bot is strategically diversified across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

These bots implement various strategies, including Volatility-Weighted Position Sizing, to minimize correlated losses.

This multi-layered diversification helps create a robust trading system.

For those looking for a powerful tool, my EA portfolio is available completely FREE.

Yes, you heard it right!

This portfolio can significantly boost your trading performance.

With these bots, you can trade long-term, targeting 200-350 pips, while enjoying the benefits of diversification and automation.

Key Statistics to Consider

Did you know that traders using effective position sizing can reduce their drawdowns by up to 30%?

This means less stress and more consistent growth.

Also, studies show that managing risk effectively can improve trading performance by as much as 40% over time.

Best Practices for Volatility-Weighted Position Sizing

- Stay Informed:

Regularly check market conditions and adjust your strategy. - Use Stop Losses:

Always implement stop losses to protect your capital. - Review Performance:

Analyze your trades to see what’s working and what isn’t.

Make adjustments accordingly.

Choosing the Right Forex Broker

Let’s wrap it up with a crucial element of your trading journey—your broker.

Finding a trustworthy broker can make a world of difference.

I’ve tested several brokers and can confidently recommend the best ones for a superior trading experience.

Check out these trusted Forex brokers that offer tight spreads, instant withdrawals, and exceptional customer support.

Final Thoughts

Implementing Volatility-Weighted Position Sizing can elevate your trading game.

It’s about managing risks while seizing opportunities.

Combine this strategy with my 16 trading bots for an edge in the market.

Remember, trading is a journey.

Stay curious, keep learning, and watch your skills grow.