Last Updated on February 18, 2025 by Arif Chowdhury

Are you tired of seeing your Forex trades go south?

Feeling the sting of losses and wondering if there’s a way to protect your hard-earned capital?

Trust me, I’ve been there. As a seasoned Forex trader since 2015, I’ve explored countless strategies to keep my portfolio intact while aiming for consistent profitability.

One powerful tactic I’ve come to rely on is Rolling Equity Protection.

Let’s dive into how it works and how you can implement it in your trading strategy.

What is Rolling Equity Protection?

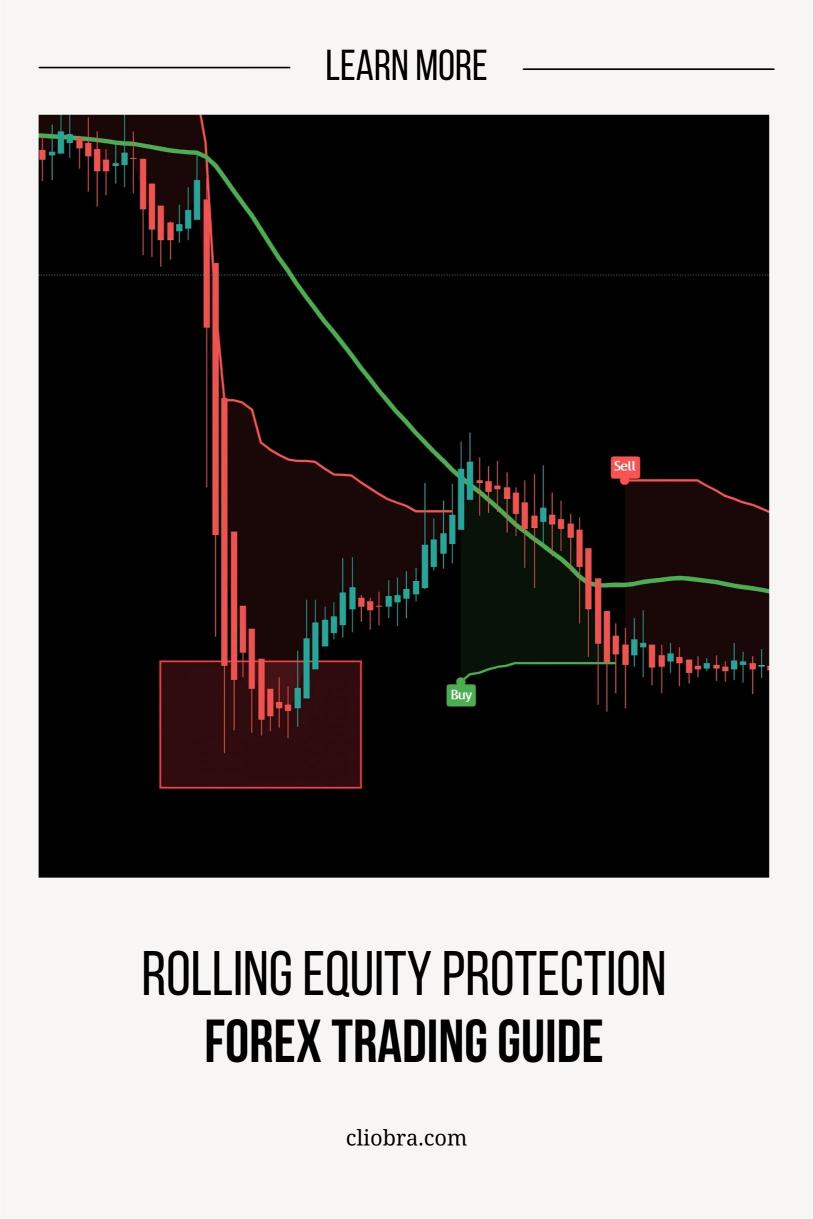

Rolling Equity Protection is a dynamic risk management strategy designed to safeguard your trading capital.

Here’s how it works:

- It involves adjusting your stop-loss levels based on your current equity.

- As your account balance grows, your stop-loss moves up, locking in profits.

- If your equity dips, the stop-loss adapts, preventing catastrophic losses.

This technique is all about maintaining a safety net while still allowing for growth.

Why Use Rolling Equity Protection?

The Forex market is unpredictable.

- Did you know that over 70% of retail traders lose money?

- And according to studies, 95% of traders quit within the first year due to losses.

These stats are sobering, but they highlight the importance of effective risk management.

By employing Rolling Equity Protection, you create a buffer against those inevitable downturns.

How to Implement Rolling Equity Protection

Here’s a straightforward way to set it up:

- Determine Your Initial Stop-Loss:

Start with a stop-loss based on your trading strategy. - Set a Profit Target:

Decide how much profit you want to lock in before adjusting your stop-loss. - Adjust the Stop-Loss:

As your account grows, move your stop-loss to the new equity level. - Monitor and Adapt:

Keep a close eye on your trades and be prepared to make adjustments as market conditions change. - Stay Disciplined:

Stick to your plan. Don’t let emotions drive your decisions.

Diversifying Your Portfolio

While Rolling Equity Protection is essential, it’s not the only tool in your toolkit.

This is where my 16 trading bots come into play.

Utilizing a multi-layered diversification strategy, I’ve designed these bots to minimize correlated losses across four major currency pairs:

- EUR/USD

- GBP/USD

- USD/CHF

- USD/JPY

Each currency pair has a dedicated set of 3-4 bots, ensuring that even if one bot faces challenges, others can catch the fall.

My trading bots only use H4 charts, targeting long-term gains of 200-350 pips.

This long-term strategy has proven effective, especially after backing them for over 20 years under various market conditions.

And guess what?

You can access my entire EA portfolio for FREE.

Check it out here: 16 Trading Bots Portfolio.

Combining Strategies for Maximum Effect

Imagine using Rolling Equity Protection alongside my trading bots.

You’re not just setting stop-losses; you’re leveraging automated strategies that adapt and evolve with market conditions.

This combination allows you to:

- Minimize losses while maximizing potential gains.

- Achieve consistent profitability over the long haul.

Choosing the Right Forex Broker

Of course, a solid strategy needs a trustworthy broker.

When selecting a broker, look for:

- Tight spreads: This reduces your trading costs.

- Fast execution: Ensure your trades are executed swiftly to capitalize on market movements.

- Excellent customer support: You want a broker that’s there for you when needed.

I’ve tested some of the best brokers in the market, and I recommend checking out the top options available.

Explore them here: Best Forex Brokers.

Conclusion

Using Rolling Equity Protection can significantly reduce your Forex losses.

When combined with a diversified trading strategy and trustworthy brokers, you’re setting yourself up for success.

Remember, the goal is to protect your capital while aiming for growth.

Take control of your trading journey today.

And don’t forget to check out my FREE EA portfolio!

Your path to consistent profitability starts now.