Last Updated on February 18, 2025 by Arif Chowdhury

Are you tired of the emotional rollercoaster that comes with Forex trading?

Worried about consistent losses or missed opportunities?

You’re not alone.

As a seasoned Forex trader since 2015, I’ve been through the ups and downs.

I’ve explored every nook and cranny of trading strategies, with a keen focus on technical analysis.

One approach that stands out is Eigenvector Analysis.

It’s powerful, and when used in developing trading algorithms, it can change the game.

Let’s break it down.

What is Eigenvector Analysis?

In simple terms, Eigenvector Analysis can help identify the most significant factors affecting currency prices.

This mathematical approach allows us to analyze multiple variables simultaneously, giving us insights into market dynamics.

It’s like having a magnifying glass that reveals hidden patterns in the chaos of Forex trading.

Why Use Eigenvector Analysis?

- Risk Reduction:

By identifying key market drivers, you can minimize risk.

You focus on what really matters, rather than getting lost in noise. - Enhanced Profitability:

The analysis helps in fine-tuning your trading strategies.

It can lead to more profitable trades by focusing on the strongest correlations. - Data-Driven Decisions:

Say goodbye to guesswork.

Eigenvector Analysis equips you with data to make informed trading choices.

Steps to Develop Your Forex Trading Algorithm

Step 1: Data Collection

Start by gathering historical price data.

You’ll need data for various currency pairs—EUR/USD, GBP/USD, USD/CHF, and USD/JPY are great choices.

Make sure you have at least 5-10 years of data for better accuracy.

Step 2: Data Preprocessing

Clean the data to remove any inconsistencies.

Normalize it to ensure that different variables are on the same scale.

This step is crucial because it impacts the results of your analysis.

Step 3: Apply Eigenvector Analysis

- Calculate Covariance Matrix:

This matrix shows how different variables relate to one another. - Eigenvalue Decomposition:

Identify the eigenvalues and eigenvectors.

The eigenvectors will tell you the most important factors driving your currency pairs. - Select Relevant Features:

Choose the top eigenvectors based on their eigenvalues.

These will form the backbone of your trading algorithm.

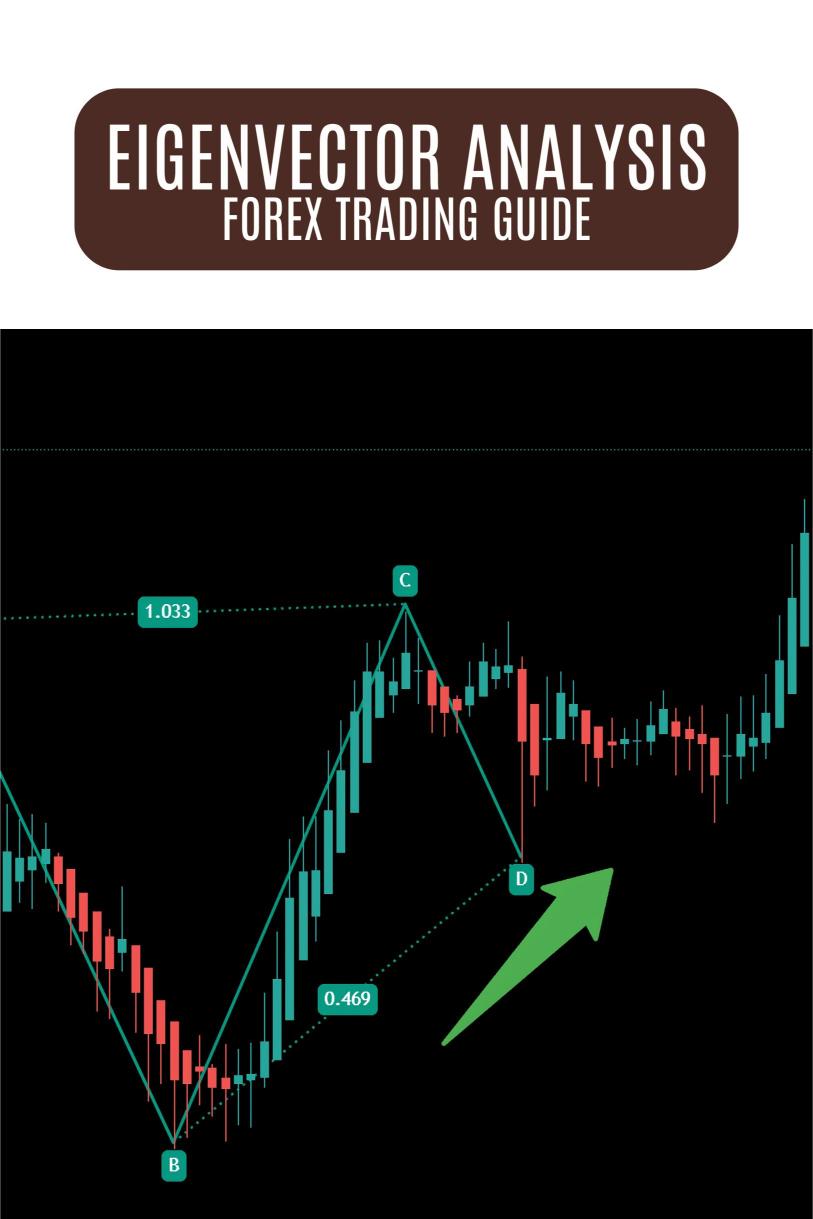

Step 4: Develop Your Trading Strategy

Now it’s time to create your trading rules.

Use the insights gained from Eigenvector Analysis to define entry and exit points.

For instance, if a particular currency pair shows strong correlation with economic indicators, use that to time your trades.

Step 5: Backtesting

Once your algorithm is set, backtest it against historical data.

I’ve backtested my trading strategies for the past 20 years, and it’s essential to see how your algorithm performs under various market conditions.

Look for at least a 60-70% success rate to consider it viable.

My Proven Trading Bots

Now, let’s talk about something that complements all this hard work.

I’ve developed 16 sophisticated trading bots that utilize not just Eigenvector Analysis but also a myriad of other strategies.

These bots are diversified across four major currency pairs, each with 3-4 unique algorithms.

Here’s what’s cool:

- Risk Mitigation: The bots are designed to minimize correlated losses.

- Long-Term Focus: They target moves of 200-350 pips, ensuring better performance over time.

- Free Portfolio: Yes, you heard that right.

I’m offering this EA portfolio completely FREE!

You can find it here: Check out my trading bots.

Final Thoughts on Forex Brokers

Once your algorithm is solid, you need a reliable broker to execute your trades.

I’ve tested various brokers, and I can confidently recommend a few.

They offer tight spreads, excellent customer service, and instant withdrawals.

Explore the best Forex brokers I trust to enhance your trading experience.

Remember, Forex trading is risky, and there’s no guaranteed profit.

But with a solid strategy and the right tools, the odds can be in your favor.

Now, go ahead and dive into Eigenvector Analysis.

Your trading journey is about to get a serious upgrade!