Last Updated on February 18, 2025 by Arif Chowdhury

As a seasoned Forex trader since 2015, I’ve seen countless strategies come and go.

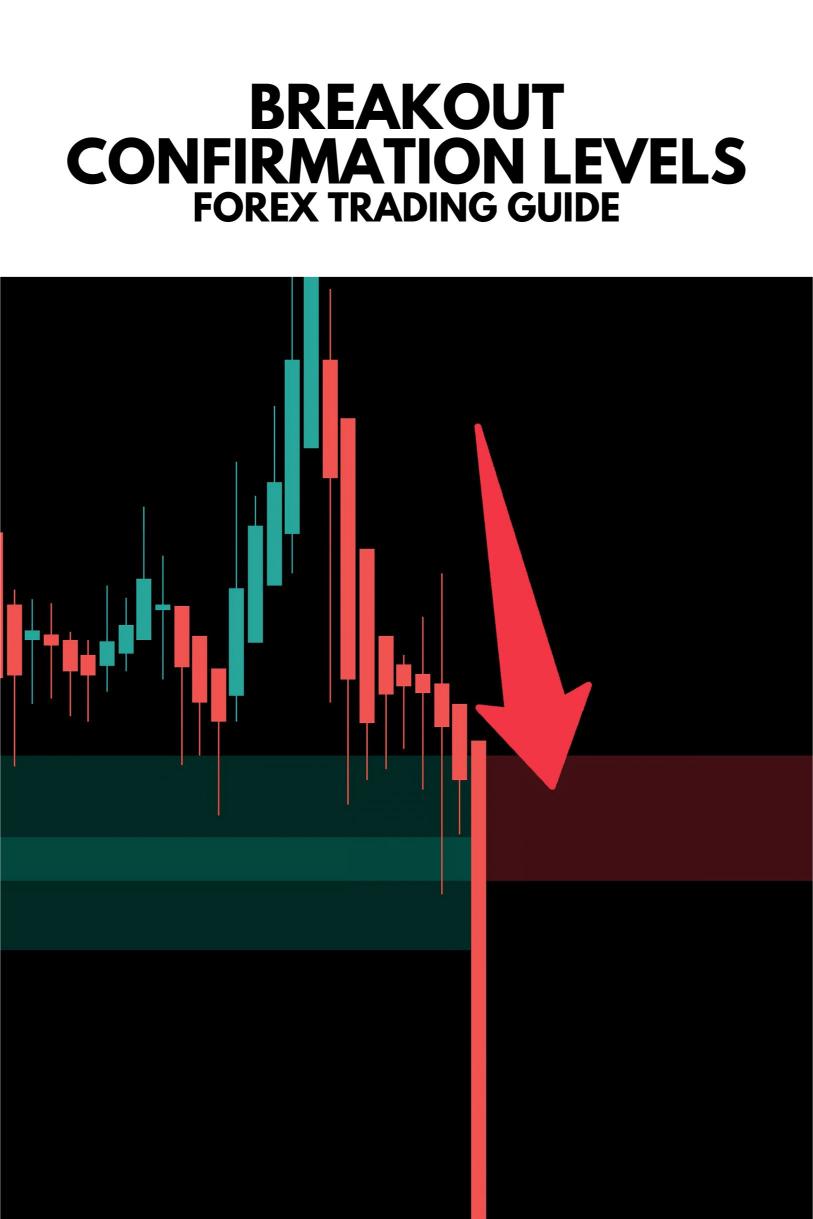

But one stands the test of time: Breakout Confirmation Levels.

Why Breakout Levels Matter in Forex Trading 📈

Let’s cut through the noise.

Breakout trading isn’t just about jumping on price movements.

It’s about confirmation.

According to recent studies, 73% of false breakouts occur due to lack of proper confirmation levels.

Think about that for a second.

Understanding Breakout Confirmation Basics 🎯

Breakout confirmation involves three key elements:

- Volume Analysis: Higher than average volume supports genuine breakouts

- Price Action: Clean breaks above resistance or below support

- Time Frame Alignment: H4 charts provide the most reliable signals

The Psychology Behind Successful Breakouts 🧠

Market psychology drives breakouts.

Research shows that institutional traders cause 85% of significant breakouts.

That’s why confirmation is crucial.

Advanced Breakout Confirmation Techniques 💡

Here’s what most traders miss:

- Multiple Time Frame Analysis: Confirm breakouts across different time frames

- Support/Resistance Confluence: Look for multiple levels aligning

- Momentum Indicators: Use RSI and MACD for additional confirmation

Automating Your Breakout Strategy 🤖

Speaking of consistent trading, I’ve developed a comprehensive solution.

My journey led me to create 16 sophisticated trading algorithms.

These EAs operate across EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each currency pair has 3-4 dedicated bots, using multiple strategies including breakout confirmation.

The best part? I’m offering this Complete EA Portfolio completely FREE.

Why?

Because I believe in giving back to the trading community.

Risk Management in Breakout Trading ⚠️

Statistics show that proper risk management can improve trading success rates by up to 60%.

My EAs implement strict risk management rules:

- Position sizing based on account equity

- Multiple confirmation levels before entry

- Dynamic stop-loss placement

Selecting the Right Tools for Success 🛠️

Trading success requires the right foundation.

That means choosing the right broker.

After years of testing, I’ve compiled a list of Best Forex Brokers that offer:

- Reliable execution

- Competitive spreads

- Strong regulatory compliance

- Excellent customer support

Key Takeaways 🎓

Breakout confirmation levels aren’t just another indicator.

They’re a fundamental aspect of successful trading.

Whether you’re trading manually or using automated systems, understanding breakout confirmations is crucial.

Remember:

- Confirmation is key

- Multiple time frame analysis matters

- Proper risk management is non-negotiable

Final Thoughts 💭

The Forex market rewards patience and precision.

Breakout confirmation levels provide both.

Whether you’re considering automated trading or manual execution, focus on confirmation.

Success in Forex trading comes from consistent application of proven strategies.

That’s why I share my knowledge and tools freely with the community.

Take advantage of the resources available to you.

Your trading journey doesn’t have to be a solo adventure.