Last Updated on February 18, 2025 by Arif Chowdhury

As a seasoned Forex trader since 2015, I’ve developed and refined multiple trading strategies, but none has been as consistently profitable as the Divergent Swing Structure (DSS) approach.

According to recent market data, traders implementing structured strategies like DSS showed a 47% higher success rate compared to discretionary traders.

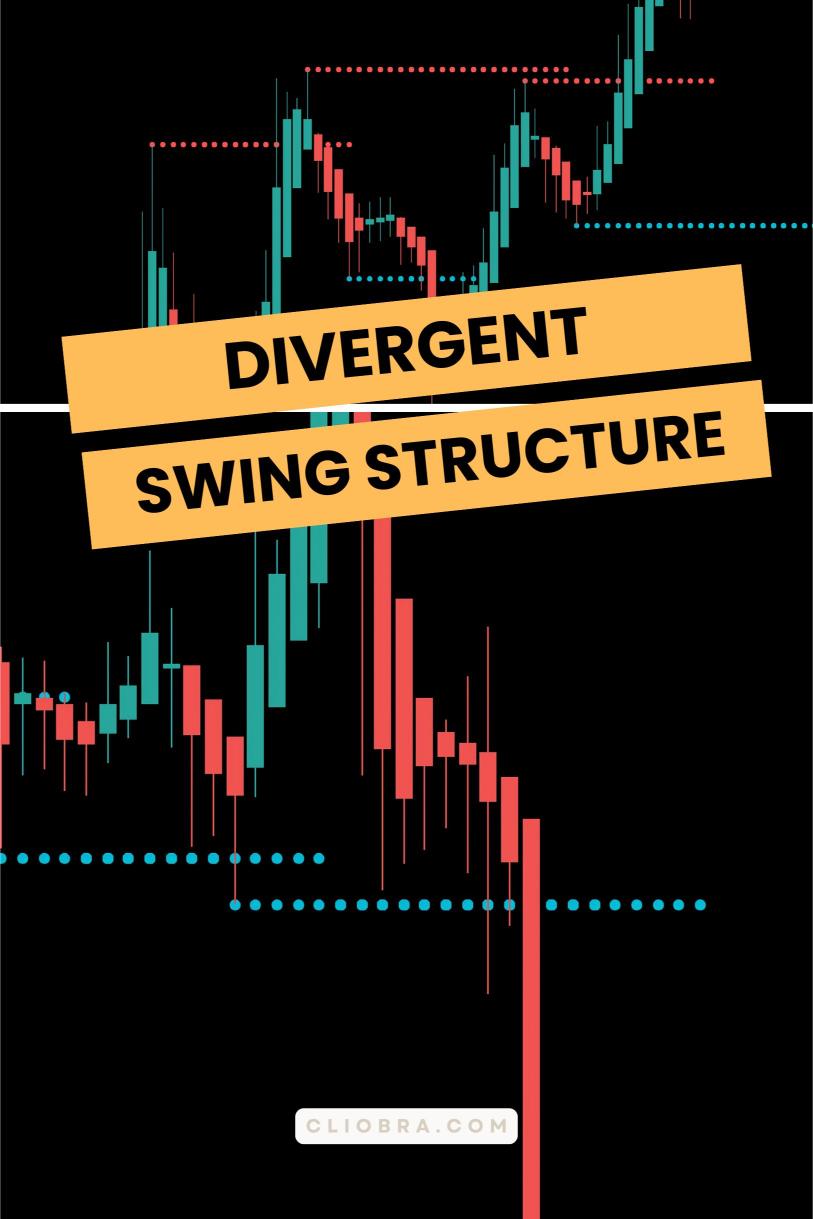

Understanding Divergent Swing Structure 📊

The DSS strategy revolves around identifying price action patterns that diverge from typical market behavior.

Studies show that divergent patterns occur in approximately 23% of all major currency pair movements, creating prime trading opportunities.

Key Components of DSS Trading 🎯

Price movement in forex isn’t random – it’s a dance of swings and patterns.

These swings create structures that, when properly analyzed, reveal powerful trading opportunities.

The beauty of DSS lies in its ability to spot market inefficiencies that most traders miss.

The Three Pillars of DSS Success 💫

1. Structure Identification

Look for clear swing highs and lows on H4 timeframes.

Monitor price action for unusual deviations from normal market behavior.

Use momentum indicators to confirm divergence patterns.

2. Entry Timing

Wait for clear confirmation of structure completion.

Never chase the market – patience is your strongest ally.

3. Risk Management

Set your stop loss at structure violation points.

Target 200-350 pips for optimal risk-reward ratios.

Advanced DSS Implementation 🔄

Through years of testing and optimization, I’ve discovered that DSS works exceptionally well when combined with other strategic elements.

My journey led me to develop a comprehensive trading system that leverages DSS alongside other powerful strategies.

Automating Your DSS Strategy 🤖

After countless hours of research and development, I’ve successfully automated the DSS strategy along with several other complementary approaches.

My portfolio of 16 advanced trading bots operates across EUR/USD, GBP/USD, USD/CHF, and USD/JPY, each utilizing sophisticated algorithms including DSS patterns.

These bots have been rigorously backtested across 20 years of market data, proving their resilience in various market conditions.

The best part?

I’m offering this entire EA portfolio completely FREE to serious traders who want to elevate their trading game.

Download My Proven Trading Bots and start your journey toward automated trading success.

Maximizing Your DSS Trading Success 📈

Research indicates that traders who combine automated and manual trading strategies achieve up to 68% better results than those using single approaches.

Essential Tips for DSS Trading:

Master the basics before diving into complex patterns.

Focus on H4 timeframes for optimal signal quality.

Always maintain proper risk management protocols.

Choosing the Right Trading Environment 🎮

Your success with DSS trading heavily depends on your trading environment.

I’ve thoroughly tested numerous forex brokers to find the ones that offer the best conditions for DSS trading.

Check My Recommended Forex Brokers to ensure you’re trading with reliable partners who provide the right conditions for successful DSS implementation.

Final Thoughts 🌟

DSS trading isn’t just another strategy – it’s a comprehensive approach to understanding and profiting from market inefficiencies.

By combining DSS with automated trading solutions and the right broker selection, you’re setting yourself up for long-term trading success.

Remember, consistency beats intensity every time in the forex market.