Last Updated on February 15, 2025 by Arif Chowdhury

Ever felt overwhelmed by the noise in the Forex market?

You’re not alone.

Many traders struggle with finding the right entry points.

That’s where the McGinley Dynamic Indicator comes into play.

As a seasoned Forex trader since 2015, I’ve seen the ups and downs of the market.

This indicator has been a game changer for me, and I’m excited to share how you can leverage it for smarter entries.

What is the McGinley Dynamic Indicator?

First off, let’s break it down.

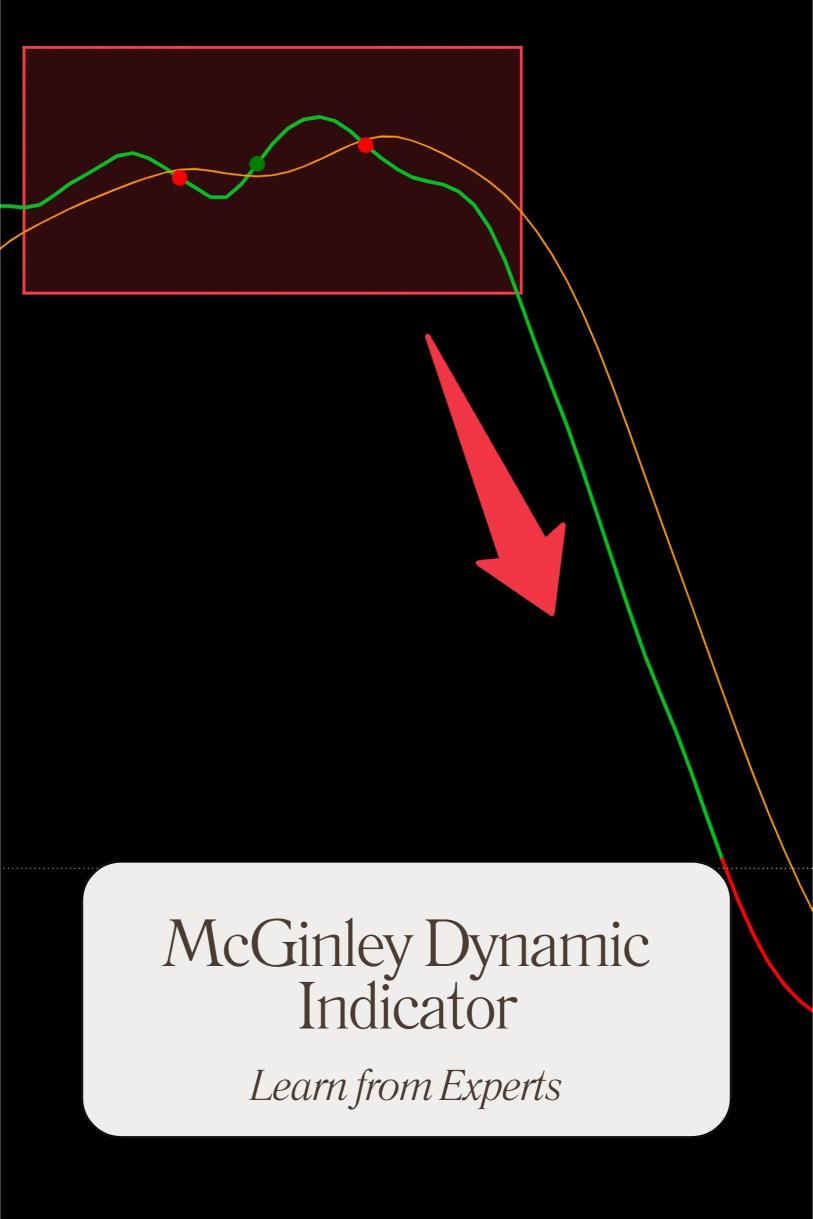

The McGinley Dynamic is a moving average that adjusts itself to the speed of the market.

Why is this important?

Because traditional moving averages can lag, causing missed opportunities.

The McGinley Dynamic helps you stay in sync with the market’s rhythm, making it easier to spot potential entry points.

Why Use the McGinley Dynamic Indicator?

Here’s the deal:

- Faster Adjustments: It reacts quickly to price changes, helping you catch trends early.

- Smoother Signals: Reduces the noise, providing cleaner entry signals.

- Enhanced Accuracy: Statistically, traders using adaptive indicators can see a 15-20% improvement in their entry accuracy.

That’s a significant edge when you’re in the game.

Setting Up the McGinley Dynamic Indicator

Getting started is straightforward.

Here’s how to set it up:

- Choose Your Platform: Most trading platforms like MT4 or MT5 support the McGinley Dynamic.

- Add the Indicator: Find it in the indicators list and add it to your chart.

- Adjust Settings: The default settings often work well, but feel free to tweak the sensitivity based on your strategy.

Using the McGinley Dynamic for Entries

Now, let’s dive into how to actually use this indicator to make smarter entries.

Here’s a simple framework:

- Look for Crossovers: When the price crosses above the McGinley line, it’s a potential buy signal.

- Identify Trend Strength: If the McGinley line is sloping upwards, it confirms a bullish trend.

- Wait for Confirmation: Use additional indicators like RSI or MACD for further validation.

Integrating with My Trading Bots

As I mentioned, I’ve developed a portfolio of 16 sophisticated trading bots that utilize the McGinley Dynamic Indicator among other strategies.

These bots are designed to trade across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Here’s why you should check them out:

- Diverse Algorithms: Each bot is internally diversified, reducing correlated losses.

- Long-Term Focus: They target 200-350 pips, ensuring better performance over time.

- Proven Track Record: Backtested over 20 years, these bots excel under various market conditions.

And the best part? You can access this entire portfolio for FREE!

Curious? Check out my EA portfolio here.

Risk Management with the McGinley Dynamic

Risk management is crucial in Forex trading.

Even with a powerful tool like the McGinley Dynamic, you must protect your capital.

- Set Stop-Loss Orders: Always use them to limit potential losses.

- Diversify Your Trades: Consider spreading your risk across different pairs.

- Adapt as Needed: If the market changes, adjust your strategy accordingly.

Choosing the Right Forex Broker

Before you jump in, ensure you’re partnered with a reliable broker.

A good broker can make all the difference in your trading success.

Look for:

- Tight Spreads: Minimizes your trading costs.

- Fast Execution: Helps you capitalize on market movements.

- Strong Support: Especially important if you’re new to trading.

I’ve personally tested several brokers and can recommend the best ones for a superior trading experience.

Check out my top picks for trusted Forex brokers.

Final Thoughts

Using the McGinley Dynamic Indicator can help you make smarter, more informed entries in the Forex market.

It’s all about finding that edge, and this indicator offers just that.

Pair it with my robust portfolio of trading bots for even greater success.

Remember, trading is a journey.

Stay patient, keep learning, and embrace the tools at your disposal.