Last Updated on February 14, 2025 by Arif Chowdhury

Have you ever felt like the market is rigged against you?

You place your trades, but it seems like institutional players always get the upper hand.

What’s the deal with this “institutional laddering,” and how does it impact you, the retail trader?

Let’s break it down.

What Is Institutional Laddering?

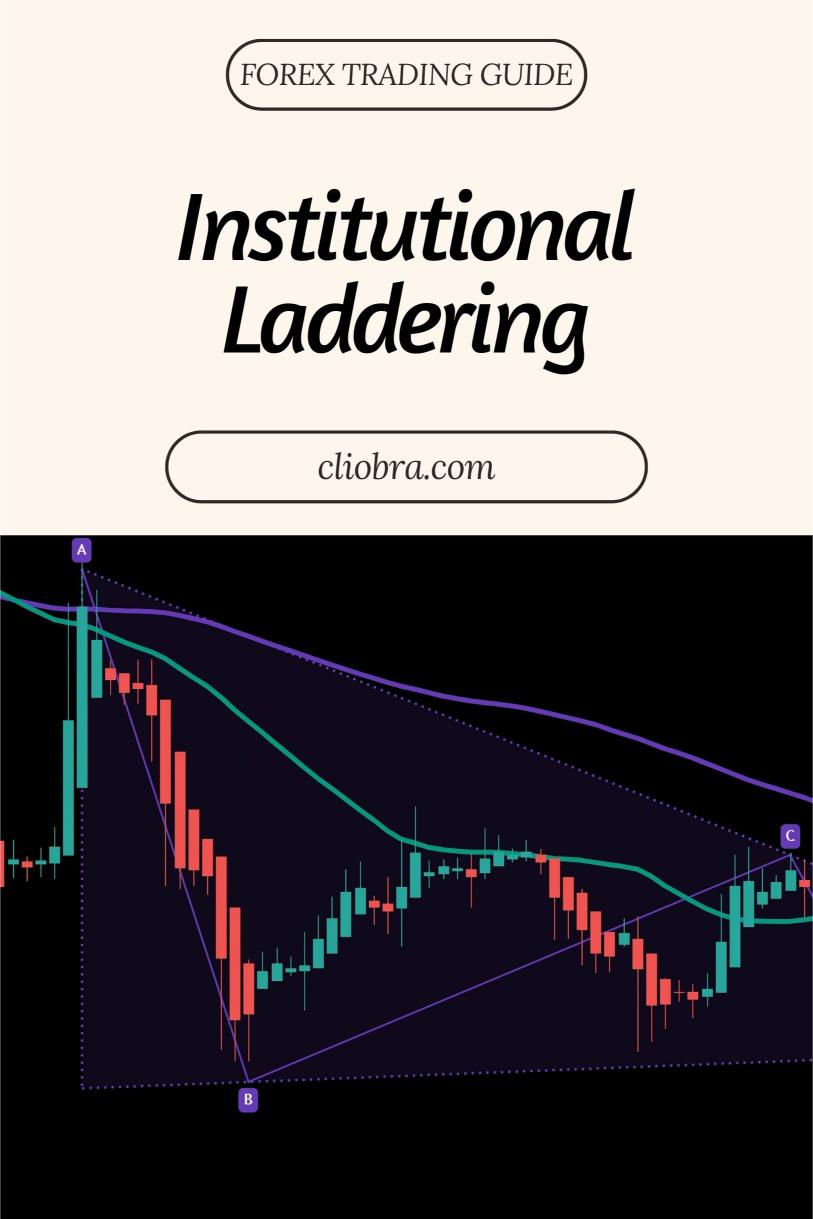

Institutional laddering is a strategy used by large financial institutions to manipulate markets.

They place buy and sell orders at various price levels.

This creates a ladder effect, allowing them to control price movements without revealing their true intentions.

Why should you care?

Because it affects your trading decisions.

When institutions ladder, they can create fake support and resistance levels, leading retail traders to make poor choices.

The Impact on Retail Traders

- False Signals:

Institutional laddering can create misleading signals.

You might see a price bounce off a level and think it’s a solid support.

But it could just be the institutions manipulating the market. - Increased Volatility:

When institutions pull their orders, you might see sudden price spikes or drops.

This can trigger your stop-loss orders, leading to unexpected losses. - Market Psychology:

Knowing that institutions are laddering can mess with your head.

You might hesitate to enter a trade, thinking the big players know something you don’t.

Stats That Matter

Did you know that around 75% of forex trading volume is controlled by institutions?

That’s a staggering number.

As a retail trader, understanding this can help you navigate the market more intelligently.

My Journey as a Forex Trader

I’ve been in the Forex game since 2015.

Over the years, I’ve refined my approach through deep dives into both fundamental and technical analysis.

I focus on technical analysis, and it’s served me well.

I developed a unique trading strategy that has led to consistent profitability.

This success enabled me to create 16 sophisticated trading bots that are strategically diversified across major pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot is designed to minimize risk while maximizing returns.

How My Trading Bots Help

Here’s how my bots can give you an edge:

- Diverse Strategies:

Each of my 16 trading bots has its own unique approach, reducing the risk of correlated losses. - Long-Term Focus:

These bots are built to target long-term trades, aiming for 200-350 pips. - Backtested Performance:

I’ve backtested them over 20 years. They’ve shown impressive performance even in tough market conditions. - Completely FREE:

Yes, you read that right. I’m offering this EA portfolio for FREE.

If you want to level up your trading game, check out my trading bots portfolio.

Tips to Navigate Institutional Laddering

- Stay Informed:

Keep an eye on market news and institutional flows. - Use Technical Analysis:

Understand chart patterns and indicators to make informed decisions. - Set Realistic Targets:

Don’t chase every price movement. Stick to your strategy and set achievable targets.

Choosing the Right Forex Broker

Your choice of broker can make or break your trading experience.

Look for brokers that offer:

- Tight Spreads:

Lower spreads mean more profit in your pocket. - Fast Execution:

Speed is crucial, especially when the market is volatile. - Robust Customer Support:

You need help when things go sideways.

I’ve tested various brokers, and I recommend checking out the best ones through my Forex Brokers page.

Wrapping It Up

Understanding institutional laddering is crucial for retail traders.

It’s not just about placing trades; it’s about understanding the market dynamics at play.

By leveraging tools like my 16 trading bots, you can enhance your trading strategy and navigate the complexities of the forex market.

Remember, knowledge is power.

Equip yourself with the right tools and insights, and you’ll be better prepared to face the challenges of trading.