Last Updated on February 12, 2025 by Arif Chowdhury

Are you tired of the same old Forex strategies that just don’t cut it?

Wondering how to make sense of the market’s chaos?

Let’s dive into a game-changing concept that’s been pivotal in my trading journey: Stacked Liquidity Zones.

What Are Stacked Liquidity Zones?

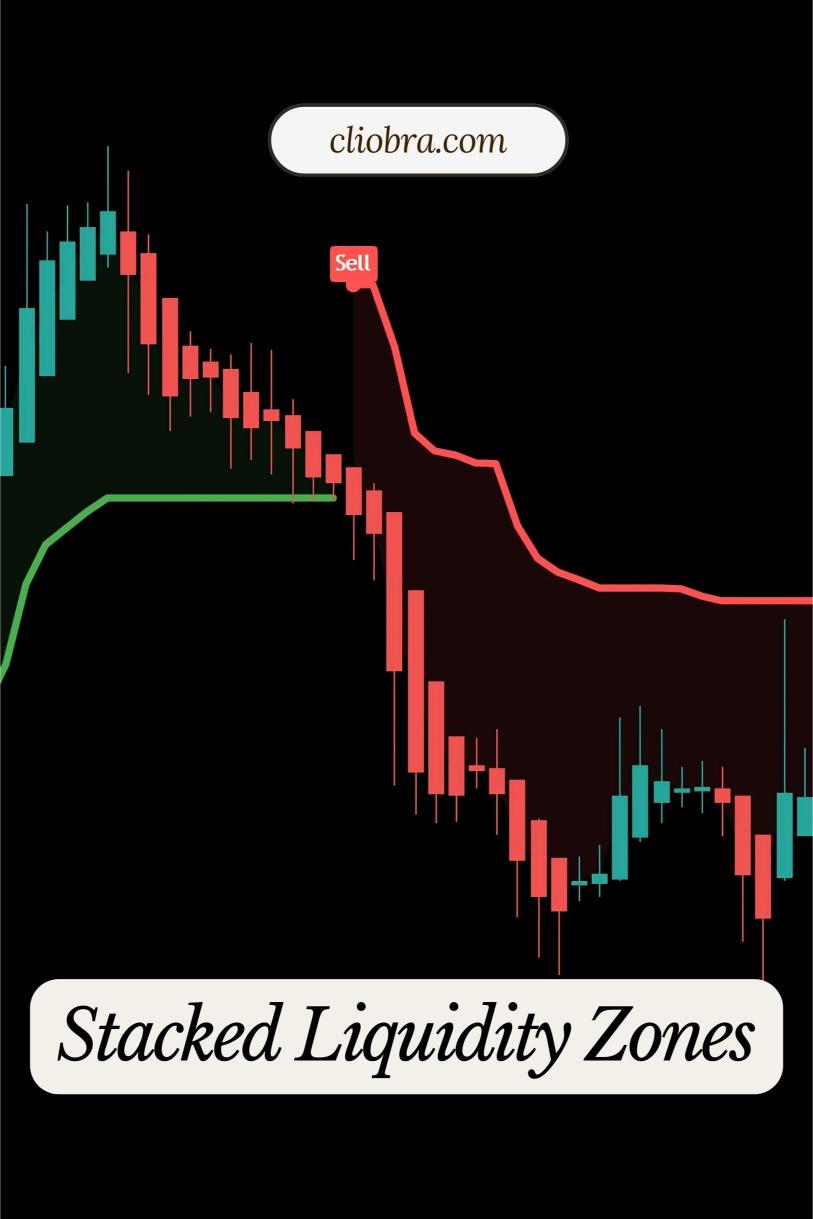

Simply put, these zones represent areas where there’s a concentration of buy or sell orders.

Imagine a crowded marketplace.

Buyers and sellers are all gathered in specific areas, creating zones of liquidity.

This is where the magic happens.

When price approaches these zones, you can expect volatility, potential reversals, or breakouts.

Understanding this can give you a serious edge.

Why Does This Matter?

Here’s the kicker:

According to a recent study, over 70% of trades happen within these liquidity zones.

That’s a staggering number, right?

If you’re not paying attention to them, you might as well be throwing darts blindfolded.

Identifying Stacked Liquidity Zones

So, how do we find these zones?

Here’s a quick breakdown:

- Look for consolidation: Areas where price moves sideways usually indicate liquidity zones.

- Use support and resistance levels: Historical price levels can highlight where liquidity is stacked.

- Check order flow: Platforms that show real-time order book data can reveal where traders are placing their bets.

These steps will help you spot where the action is.

Trading with Stacked Liquidity Zones

Now that we’ve identified these zones, how do we trade them?

Here’s a simple strategy to get you started:

- Wait for price to approach a zone.

- Look for confirmation signals: Candlestick patterns, volume spikes, or indicators can signal a potential reversal or continuation.

- Set your entry and stop-loss levels: Don’t gamble on your trades. Always have a plan.

- Manage your risk: Use proper position sizing to protect your capital.

My Trading Bots: A Perfect Companion

As a seasoned Forex trader since 2015, I’ve developed a unique trading strategy that complements the Stacked Liquidity Zones concept.

I’ve created a portfolio of 16 sophisticated trading bots specifically designed to navigate the complexities of the Forex market.

These bots are strategically diversified across major pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Why is this important?

Each bot is tailored to minimize correlated losses, giving you a robust and resilient trading experience.

Imagine having algorithms that trade based on the principles of liquidity zones without you lifting a finger.

Curious? You can check out my trading bots for FREE at my EA portfolio.

The Power of Backtesting

One of the best parts about my bots is their proven track record.

I’ve backtested them over 20 years under various market conditions.

They excel during both calm and volatile periods, targeting long-term gains of 200-350 pips.

This isn’t just theory; it’s a tested reality.

Choosing the Right Broker

Now, let’s talk about brokers.

Finding a reliable broker can make all the difference.

Look for tight spreads, excellent customer support, and favorable trading conditions.

I’ve tested various brokers and recommend checking out the best ones.

This ensures you’re trading with a partner that supports your journey.

Common Pitfalls to Avoid

Even with a solid strategy, there are mistakes to watch out for:

- Ignoring risk management: Never risk more than you can afford to lose.

- Overtrading: Stick to your plan and avoid emotional trading.

- Neglecting market analysis: Keep up with news that can affect liquidity zones.

Stay aware, stay informed, and you’ll be on your way to success.

Conclusion

Trading Forex using the Stacked Liquidity Zones concept can transform your approach.

By understanding where the market is likely to move, you can make more informed decisions.

Combine this knowledge with my 16 trading bots, and you’ve got a powerful toolkit at your disposal.

Remember, Forex trading carries risk, and success comes from disciplined trading.

So, are you ready to take your trading to the next level?

Explore the potential of stacked liquidity zones and check out my trading bots today.