Last Updated on February 12, 2025 by Arif Chowdhury

Ever felt overwhelmed by the constant noise of the Forex market?

You’re not alone.

Many traders struggle with knowing when to jump into a trade.

The Volume Cluster method is a game-changer.

Let’s dive into how to use this method effectively and make smart trade entries.

What is the Volume Cluster Method?

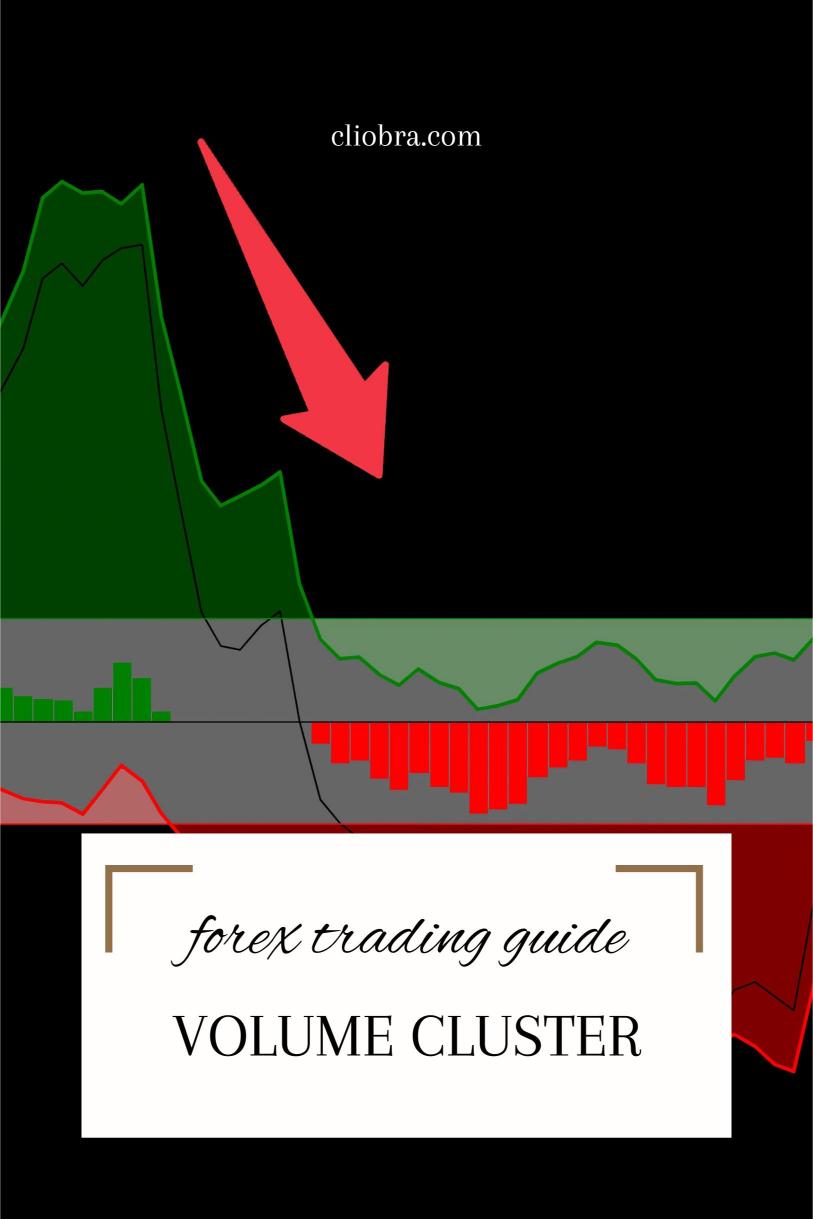

Simply put, the Volume Cluster method analyzes where the bulk of trading activity happens.

This helps identify potential support and resistance levels.

Think of it as a crowd gathering in a market.

Where the crowd is, that’s where the action is!

Why Volume Matters

Did you know that about 70% of all trading volume occurs during key market hours?

This statistic shows just how crucial volume is for making informed decisions.

More volume means more liquidity, which can lead to better price action.

When you track volume, you’re tuning into the market’s heartbeat.

Steps to Implement the Volume Cluster Method

Let’s break it down into simple steps.

- Choose Your Timeframe

Focus on higher timeframes like H4 or daily charts.

This reduces noise and gives you a clearer picture of market trends. - Identify Volume Clusters

Use tools like volume profile indicators.

Look for areas where volume spikes; these are your clusters. - Analyze Price Action

Check how price reacts around these clusters.

Is it bouncing off? Breaking through? This is crucial information. - Set Your Entry Points

Use the clusters to set entry points.

If the price approaches a high-volume area, consider it a potential trade entry. - Risk Management

Always set stop-loss orders.

Protect your capital, especially around these clusters.

Real Talk About Trade Entries

Now, I know you’re thinking: “How do I make sure this works for me?”

That’s where having the right tools comes into play.

This is why I developed my 16 trading EAs, which are designed to work seamlessly with the Volume Cluster method.

Each EA is tailored for major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

They’re diversified to minimize risk and maximize returns.

You can access this EA portfolio for FREE.

It’s like having a team of experts working for you 24/7.

Statistical Insights

Let’s spice it up with some stats.

Studies show that traders who use volume-based strategies can improve their win rate by 30% compared to those who don’t.

And over 60% of successful traders regularly analyze volume alongside other indicators.

These numbers aren’t just fluff; they reflect the effectiveness of incorporating volume into your strategy.

Enhancing Your Strategy

Using volume clusters is just one part of your trading toolkit.

Combine it with other strategies for a robust approach.

Here’s what I recommend:

- Stay Updated on Market News

News can cause sudden volume spikes. - Use Multiple Indicators

Combine volume with other indicators like RSI or MACD for confirmation. - Practice Patience

Wait for the right setups to form.

Finding the Right Brokers

As you master the Volume Cluster method, having a reliable broker is essential.

I’ve tested various brokers and can vouch for their reliability and performance.

To find the best options, check out my recommended Forex brokers.

These brokers have proven to offer tight spreads and excellent customer support, which can be crucial for your trading success.

Final Thoughts

The Volume Cluster method is a powerful tool for smart trade entries.

By following the steps I outlined, you can enhance your trading strategy significantly.

And remember, leveraging my 16 trading EAs can provide you with a significant edge.

You can grab this FREE EA portfolio.

Don’t leave your trading success to chance; utilize these strategies and tools to optimize your results.