Last Updated on February 12, 2025 by Arif Chowdhury

Ever sat staring at your charts, wondering where the market’s headed?

You’re not alone.

Many traders feel lost in the noise.

But here’s a game-changer: spotting ‘smart money trend continuations’ before they unfold.

What does that mean?

It’s about recognizing when the big players—the “smart money”—are backing a trend, giving you a solid edge.

Let’s dive into how you can start identifying these opportunities.

Understanding Smart Money

First off, who are the so-called smart money players?

They’re institutional investors, hedge funds, and large banks.

They have resources and information that the average trader doesn’t.

When they move, the market often follows.

So, how do we track their movements?

Key Indicators to Watch

- Volume Analysis

High volume during a price move signals strong interest.

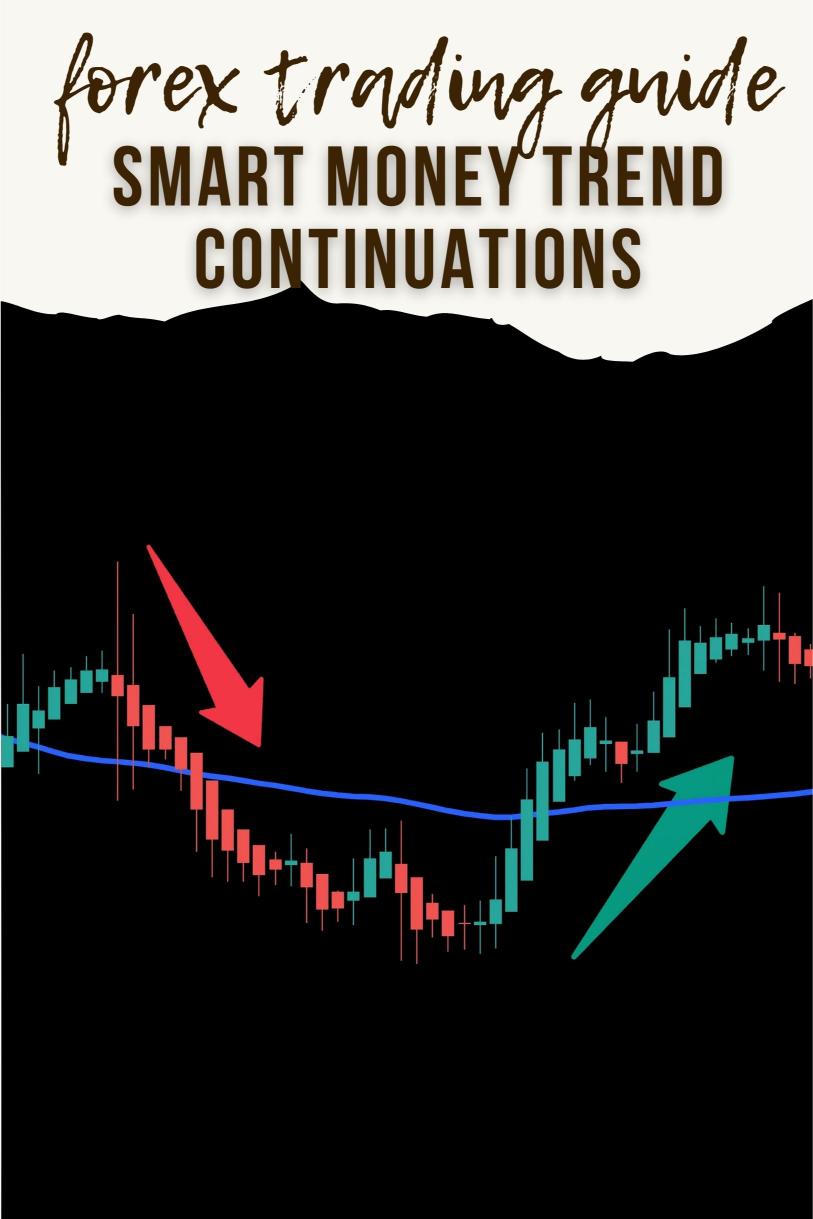

If a trend continues with increasing volume, it’s likely supported by smart money. - Price Action

Look for strong candlestick patterns that indicate buying or selling pressure.

Bullish engulfing patterns or strong close above resistance can signal a continuation. - Divergence

When price makes a new high but indicators like RSI don’t, it’s a red flag.

Conversely, if price is falling but indicators show strength, it might be time to buy. - Market Sentiment

Keep an eye on news and economic indicators.

Smart money often positions itself ahead of major events.

Timing is Everything

Identifying these trends is great, but timing your entry is crucial.

You want to get in just before the crowd.

Here are a few strategies:

- Wait for Pullbacks

After a strong move, look for a pullback to a key support level.

This is often where smart money accumulates. - Use Moving Averages

The 50-day and 200-day moving averages can help identify the trend.

When the price is above these averages, it’s generally bullish. - Set Alerts

Use your trading platform to set alerts for key price levels.

This way, you won’t miss the action.

My Trading Strategy

Since 2015, I’ve been in the Forex game, and I’ve developed a solid strategy.

I focus on technical analysis, blending indicators to spot those smart money moves.

But I didn’t stop there.

I’ve created a portfolio of 16 trading bots that automate this process.

These bots are fine-tuned for EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

That’s right—each currency pair has 3-4 bots, designed to minimize risk through diversification.

Here’s why it works:

- Long-Term Focus

My bots target 200-350 pips, giving them room to breathe. - Backtested Success

They’ve been tested over 20 years, performing well even in tough markets. - Free to Use

I’m offering this entire EA portfolio for FREE!

Imagine having a team of bots working around the clock, spotting trend continuations while you sleep.

Keep an Eye on the Best Brokers

Before diving in, you need a reliable broker.

I’ve tested several and found the best ones that offer tight spreads and excellent support.

Don’t settle for less.

Check out the top Forex brokers I recommend here.

Wrapping It Up

Identifying smart money trend continuations isn’t just a dream.

With the right tools and strategies, you can position yourself ahead of the crowd.

Remember:

- Monitor volume and price action.

- Watch for divergence.

- Time your entries wisely.

And don’t forget to leverage technology.

My 16 trading bots are here to help you navigate the Forex market with ease.

Ready to take your trading to the next level?

Check out my bots for FREE and find a top broker to support your journey.