Last Updated on February 11, 2025 by Arif Chowdhury

Are you tired of hit-or-miss trades? Frustrated with the unpredictability of the Forex market?

I feel you.

As a seasoned Forex trader since 2015, I’ve been there.

Finding consistent strategies that yield results is no easy feat.

But here’s the good news:

The ‘Three Drives’ pattern could be your ticket to precision entries.

Let’s dive into this powerful technique.

What is the Three Drives Pattern?

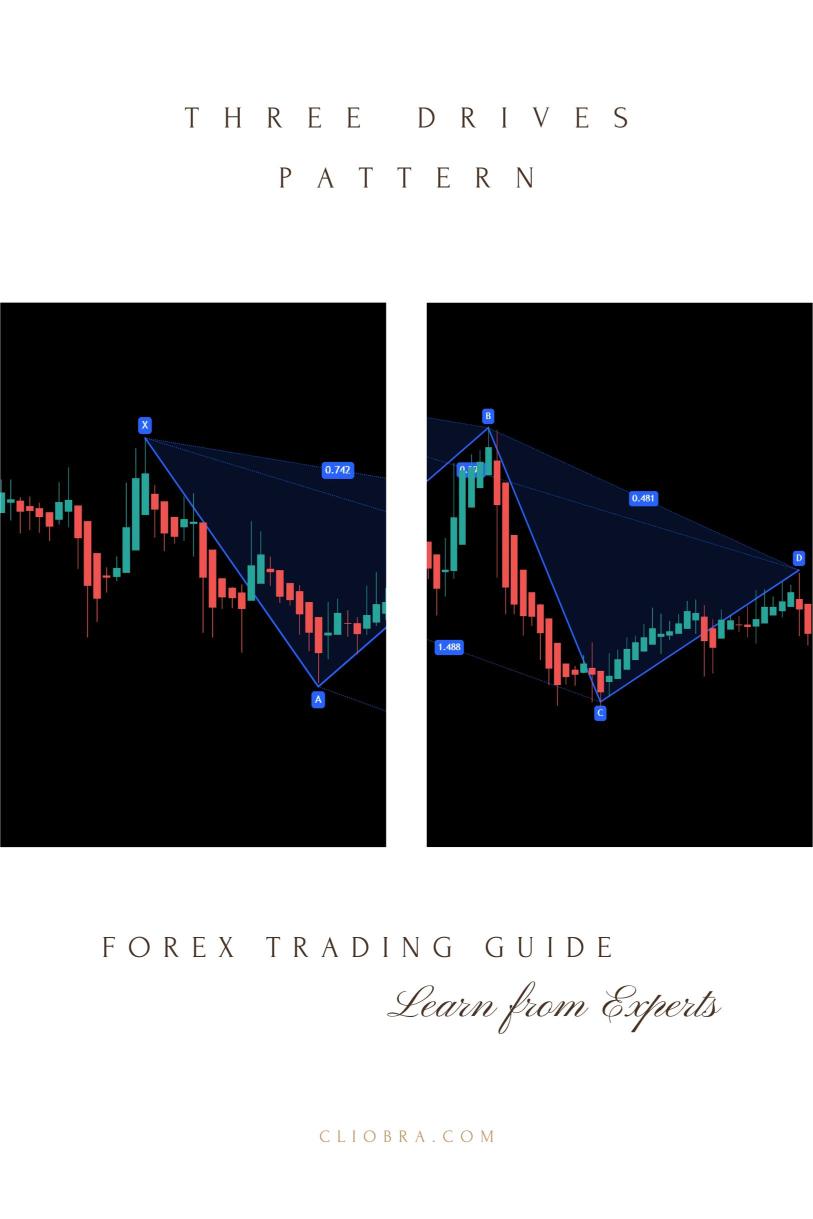

The ‘Three Drives’ pattern is a reversal pattern that highlights potential price reversals.

It’s made up of three distinct drives in the same direction, followed by a reversal.

Here’s the breakdown:

- First Drive: A strong price movement in one direction.

- Second Drive: A corrective movement that retraces the first drive.

- Third Drive: Another strong movement, often extending beyond the previous highs or lows.

This pattern gives you a clear visual cue for potential turning points in the market.

And guess what?

Statistically, reversal patterns like this can yield a success rate between 60% to 75% when combined with proper risk management.

Why the Three Drives Pattern Works

So, why should you consider this pattern?

- Market Psychology: The pattern reflects trader psychology. After a series of drives, traders may start to question the trend, leading to potential reversals.

- Clear Entry and Exit Points: It provides precise spots for entering and exiting trades. You can set your stop-loss just beyond the last drive, minimizing risk.

- Easy to Identify: With a little practice, you’ll recognize this pattern quickly. It’s like spotting a familiar face in a crowd.

Steps to Trade the Three Drives Pattern

Ready to get started?

Here’s how to trade this pattern effectively:

- Identify the Pattern: Look for three drives in the same direction on your charts.

- Confirm with Indicators: Use tools like Fibonacci retracements or RSI to validate your entry. These indicators can help confirm that a reversal is likely.

- Set Your Entry Point: Enter your trade at the end of the third drive.

- Place Your Stop-Loss: Set it just beyond the last drive to protect your capital.

- Target Profit: Aim for a risk-reward ratio of at least 1:2.

Enhance Your Trading with My Forex EAs

Want to take your trading to the next level?

Check out my exceptional portfolio of 16 trading EAs.

These algorithms are designed to trade across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot is carefully diversified to minimize correlated losses.

This means you’re not putting all your eggs in one basket.

Here are a few perks of using my EAs:

- Long-Term Performance: They’re designed to capture 200-350 pips over time.

- Robust System: My multi-layered approach significantly enhances profitability while mitigating risks.

- Free Access: I’m offering this EA portfolio for completely FREE!

Risk Management is Key

Now, let’s talk about one of the most critical aspects of trading: risk management.

Even with the best strategies, losses can occur.

Here are a few tips to keep your trading account safe:

- Limit Your Exposure: Don’t risk more than 1-2% of your trading capital on a single trade.

- Use Stop-Loss Orders: This will help you manage losses effectively.

- Keep a Trading Journal: Documenting your trades helps identify patterns in your performance.

Finding the Right Forex Brokers

Trading is only as good as the broker you choose.

It’s crucial to partner with a broker that fits your trading style and needs.

I’ve tested various brokers and recommend you check out the best ones I’ve found.

Visit this link to explore the top forex brokers: Most Trusted Forex Brokers.

Conclusion

Trading Forex using the ‘Three Drives’ pattern can be a game-changer.

It’s all about precision entries and understanding market psychology.

Combine this technique with my 16 trading EAs, and you’ll have a powerful trading arsenal.

Remember, trading is a journey.

Stay patient, keep learning, and don’t hesitate to reach out if you have questions.

You’ve got this!