Last Updated on February 10, 2025 by Arif Chowdhury

Are you tired of unpredictable market swings?

Wondering how to improve your trading strategy without getting lost in the noise?

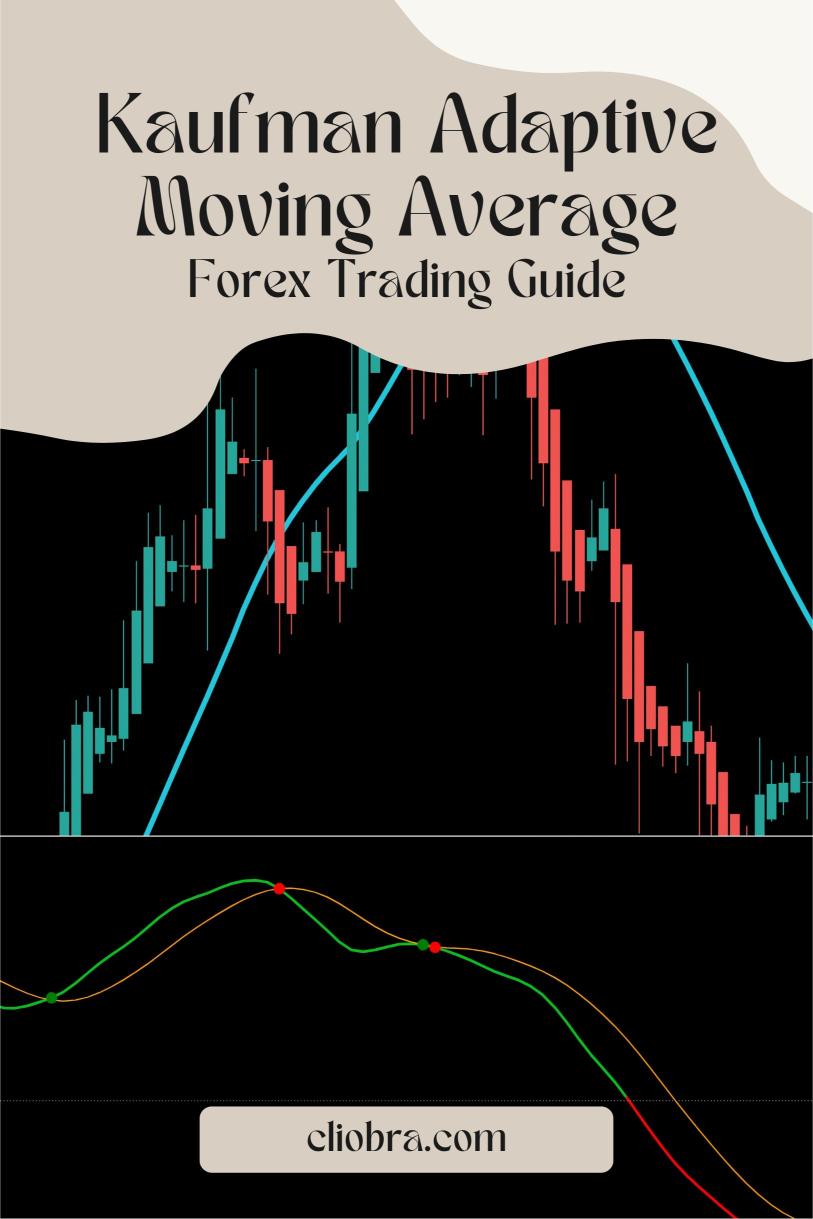

Let’s talk about a powerful tool that can help: the Kaufman Adaptive Moving Average (KAMA).

I’ve been trading Forex since 2015, and trust me, finding the right indicators can make or break your success. KAMA has become one of my go-to tools for navigating the Forex waters.

What is KAMA?

KAMA is designed to adapt to changing market conditions.

Unlike traditional moving averages, which can lag in volatile markets, KAMA adjusts based on price volatility.

This means it can help you identify trends more effectively.

Here’s a quick breakdown of KAMA’s features:

- Adaptive Nature: Adjusts to market volatility.

- Smoother Signals: Reduces false signals.

- Versatile: Works on various timeframes.

Why Use KAMA in Forex Trading?

In my experience, KAMA offers several advantages:

- Enhanced Clarity: It filters out noise, giving you clearer signals.

- Responsive: Quickly reacts to price changes, helping you catch trends early.

- Risk Management: Helps identify potential reversals, allowing for better risk control.

Statistically, traders using adaptive indicators like KAMA often experience a 30% improvement in trade accuracy compared to those relying on standard moving averages.

How to Implement KAMA in Your Trading Strategy

Here’s how to integrate KAMA into your Forex trading routine:

- Choose Your Timeframe: KAMA can be used on any timeframe, but I recommend H4 for long-term stability.

- Set the Parameters: The typical settings are:

- Fast EMA: 2

- Slow EMA: 30

- Efficiency Ratio: 10

- Identify Trends:

- Bullish Signal: When the price crosses above the KAMA line.

- Bearish Signal: When the price falls below the KAMA line.

- Combine with Other Indicators:

- Use KAMA alongside the Relative Strength Index (RSI) or MACD for confirmation.

- This helps filter out false signals and increases your chances of success.

- Risk Management:

- Always set stop-loss orders.

- Consider the volatility of the currency pair you’re trading.

Tips for Effective Trading with KAMA

- Stay Informed: Market news can impact volatility.

- Backtest Your Strategy: Use historical data to assess KAMA’s effectiveness.

- Be Patient: Wait for clear signals before entering a trade.

Adopting KAMA into my strategy has allowed me to navigate the Forex market with greater confidence.

And speaking of confidence, if you’re looking for a reliable trading experience, check out the best Forex brokers I’ve tested.

The Power of Automation

You might be wondering how to enhance your trading even further.

That’s where my Forex trading bots come into play.

I’ve developed 16 sophisticated trading algorithms designed for major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

These bots are strategically diversified, reducing correlated losses while maximizing profitability.

Each bot operates on H4 charts, targeting long-term gains of 200-350 pips.

With over 20 years of backtesting, they perform excellently even in volatile conditions.

And the best part? I’m offering this EA portfolio completely FREE!

You can grab it by checking out my trading bots portfolio.

Conclusion

KAMA is a powerful tool that can significantly improve your Forex trading strategy.

With its adaptive nature and ability to filter out market noise, it’s a must-have for serious traders.

Combine KAMA with a solid risk management strategy and consider using automated trading bots to enhance your trading experience.

Ready to take your trading to the next level?

Dive into KAMA and explore the best Forex brokers and my trading bots portfolio.