Last Updated on February 9, 2025 by Arif Chowdhury

Are you tired of getting mixed signals in your Forex trades?

Feeling overwhelmed by market noise?

Wondering how to pinpoint entries and exits with confidence?

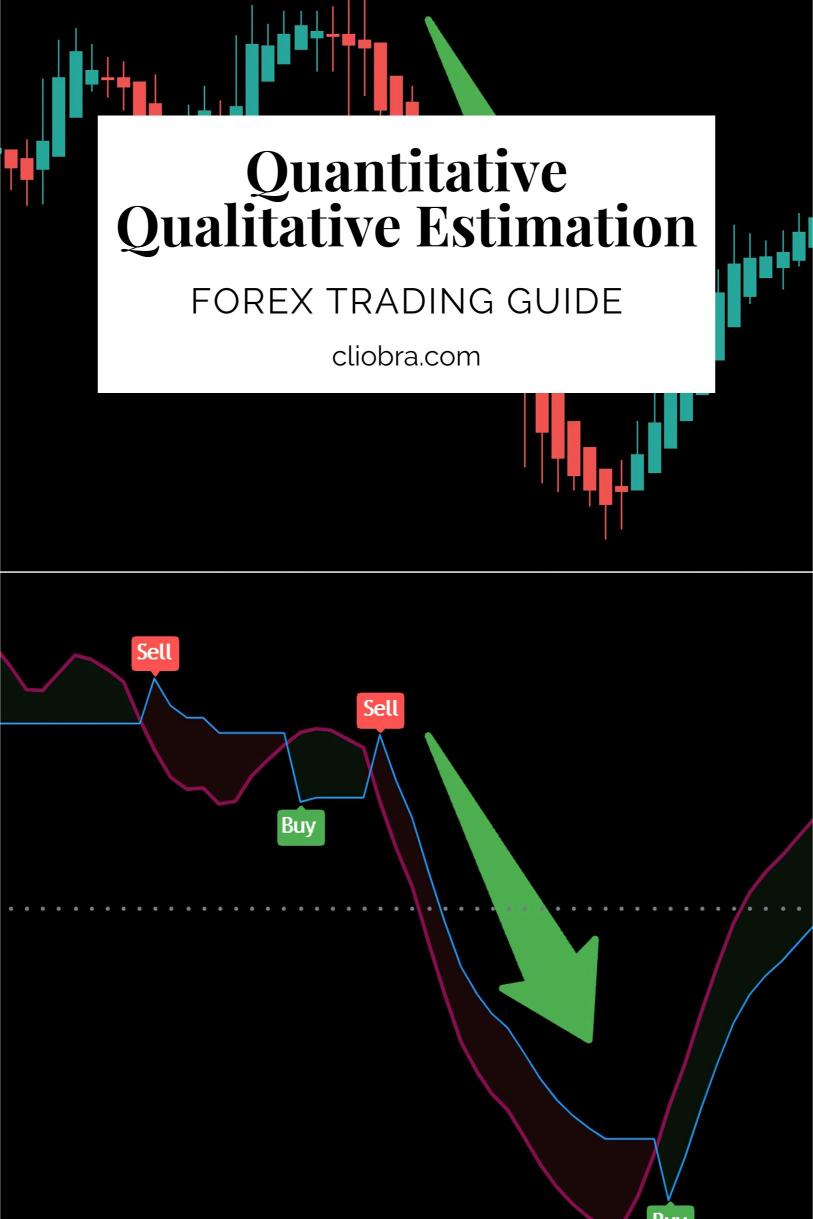

Let’s talk about the QQE (Quantitative Qualitative Estimation) indicator.

I’ve been trading since 2015, and this tool has become a crucial part of my strategy.

Let’s dive into how you can leverage QQE to enhance your trading.

What is the QQE Indicator?

The QQE indicator combines both quantitative and qualitative aspects of price movement.

It’s derived from the RSI (Relative Strength Index) but adds a smoothing factor, making it a powerful tool for spotting trends and reversals.

Here’s why I love it:

- Easy to Understand: No complex math or coding required.

- Versatile: Works on various timeframes.

- Effective: Helps filter out false signals.

Why Use QQE in Your Trading?

Statistics show that over 70% of new traders fail within the first year.

One of the main reasons? They struggle with timing their entries and exits.

QQE can help you avoid that pitfall by providing clearer signals.

Here’s how it works:

- Trend Identification: QQE helps you see whether the market is trending up or down.

- Entry and Exit Points: It provides specific points to enter or exit trades.

- Filter for Other Indicators: Use it alongside your favorite tools to increase accuracy.

Setting Up the QQE Indicator

Setting up QQE is straightforward.

Follow these steps:

- Add QQE to Your Chart: Most trading platforms have it available in their indicators list.

- Adjust Settings: The default settings work fine, but tweaking the smoothing factor can help suit your trading style.

- Common Settings:

- RSI period: 14

- Smoothing: 5

- Common Settings:

- Choose Your Timeframe: I recommend starting with H4 charts for longer-term trades.

Interpreting QQE Signals

Understanding QQE signals is crucial for effective trading.

Here’s a simple breakdown:

- QQE Line Crosses Signal Line:

- Bullish Signal: When the QQE line crosses above the signal line.

- Bearish Signal: When it crosses below.

- Divergence:

- If price makes a new high while QQE doesn’t, it could be a sign of a reversal.

- Trend Strength:

- The distance between the QQE line and the signal line indicates the strength of the trend.

Tips for Maximizing QQE Effectiveness

- Combine with Other Indicators: Use QQE with Moving Averages or MACD for more confirmation.

- Watch for Market News: Economic events can shift trends, so stay updated.

- Practice on a Demo Account: Before risking real money, test your strategy.

Why You Should Consider My Trading Bots

While learning QQE is fantastic, automating your strategy can take your trading to the next level.

I’ve developed 16 sophisticated trading bots that strategically diversify across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

These bots are designed for long-term trading, focusing on 200-350 pips.

And the best part? You can access this entire EA portfolio for FREE!

Imagine having the power of automation while you learn and apply strategies like QQE.

Choosing the Right Forex Broker

To get started, you’ll need a reliable broker.

I’ve tested several, and I recommend choosing one that offers low spreads and excellent support.

Check out the most trusted Forex brokers I’ve vetted to ensure you’re in good hands.

Final Thoughts

Using the QQE indicator can significantly enhance your Forex trading.

It provides clearer signals, helping you navigate the complexities of the market.

Combine it with automation through my 16 trading bots, and you’re setting yourself up for success.

Remember, trading is about consistency and making informed decisions.

Start leveraging QQE today, and watch how it transforms your trading game!