Last Updated on February 9, 2025 by Arif Chowdhury

Are you feeling overwhelmed by the complexities of Forex trading?

Worried about how dealer algorithms might be affecting your trades?

You’re not alone.

As a seasoned Forex trader since 2015, I’ve faced these challenges head-on.

I’ve watched how algorithms can manipulate the market, and I’ve developed strategies to not just survive but thrive.

Let’s break it down together.

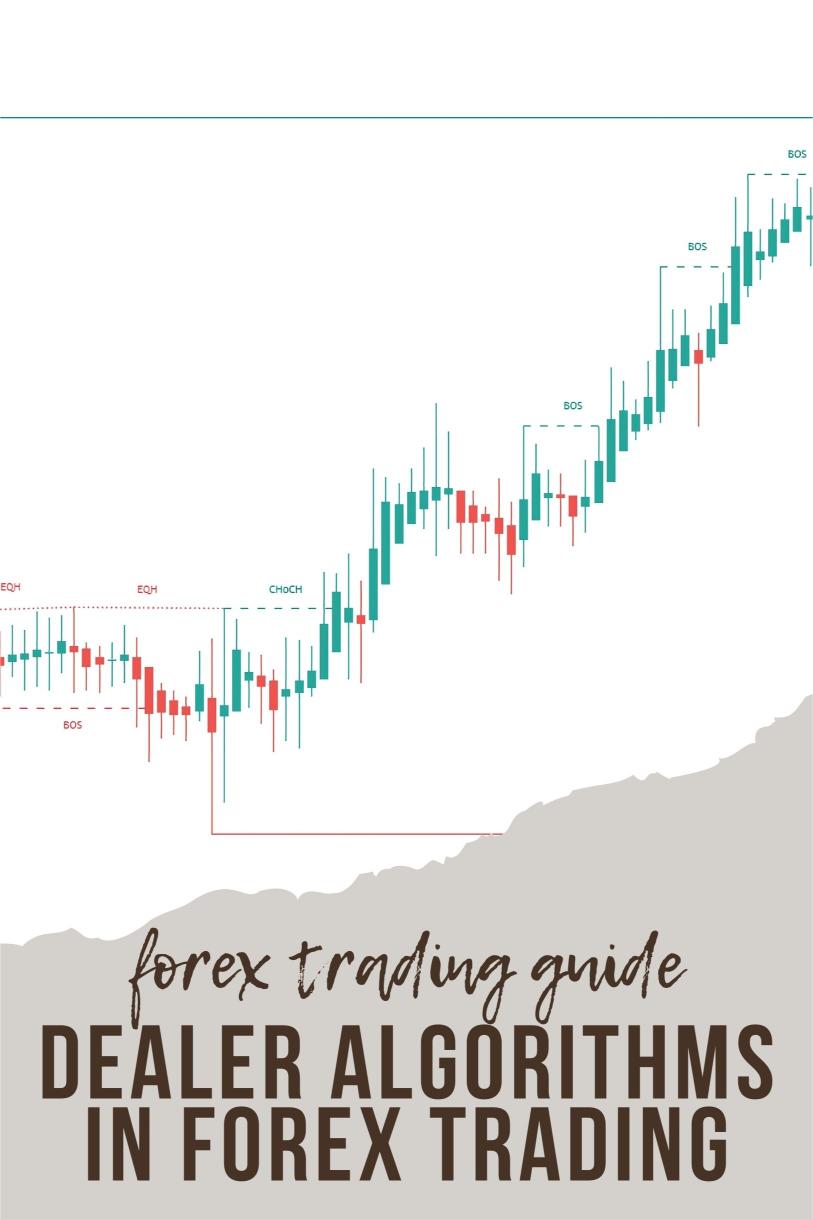

Understanding Dealer Algorithms

Dealer algorithms are automated systems used by brokers to execute trades.

They analyze market data and execute orders based on predefined criteria.

Here’s why they matter:

- Speed: They can execute trades in milliseconds, much faster than any human.

- Volume: They handle large volumes of trades, affecting market liquidity.

- Market Impact: Their strategies can influence price movements, making it crucial for retail traders to understand their operations.

Did you know that around 70% of all trades in the Forex market are executed by algorithms? 😲

How Dealer Algorithms Affect You

- Slippage: When you place an order, the price you see may not be the price you get. Algorithms can create slippage, impacting your profits.

- Market Requotes: Sometimes, the price changes before your order is executed, leading to delays or cancellations.

- Liquidity Gaps: Algorithms can manipulate liquidity, causing sudden spikes or drops in currency prices.

Understanding these factors is key to formulating a winning strategy.

Strategies to Beat the Algorithms

Now, how do we turn the tables? Here are some strategies that have worked for me:

- Use Technical Analysis: Focus on trends and patterns. Algorithms might miss nuances that can be exploited.

- Trade During Off-Peak Hours: When the market is less active, you can often avoid algorithmic manipulations.

- Diversify Your Portfolio: Just like I’ve created a robust portfolio with 16 sophisticated trading bots across major currency pairs, diversification can help minimize risk.

- Stay Informed: Keep an eye on news and economic indicators. Algorithms react to data releases, and being ahead of the curve can be a game-changer.

Why You Should Consider My Trading Bots

As I mentioned, I’ve developed a unique trading strategy that’s proven profitable.

My exceptional trading bot portfolio comprises 16 diverse algorithms across four major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each currency pair has a unique set of 3-4 bots, internally diversified to minimize correlated losses.

This multi-layered diversification enhances overall profitability while mitigating risk.

Here’s what makes my bots special:

- Long-term Focus: They are designed to trade for 200-350 pips, ensuring better performance in the long run.

- Backtested: I’ve backtested these bots over the past 20 years, and they excel under harsh conditions.

- Free Access: I’m offering this EA portfolio completely FREE, allowing you to leverage these algorithms without any upfront cost.

If you’re serious about improving your trading game, check out my trading bots portfolio here.

Choosing the Right Broker

Finding the right Forex broker is just as crucial.

I’ve tested numerous brokers, and I can confidently recommend only the best.

Consider factors like:

- Tight Spreads: Look for brokers with tight spreads to maximize your profits.

- No Hidden Fees: Ensure there are no swap fees or commissions that eat into your earnings.

- Reliable Customer Support: A good broker should have a responsive support team to assist you.

For a list of the most trusted Forex brokers I recommend, visit this link.

Conclusion

The Forex market can feel like a maze, especially with dealer algorithms at play.

But with the right strategies and tools, you can navigate it successfully.

By understanding how these algorithms work and leveraging my trading bots, you can put yourself in a strong position.

Remember, it’s all about adaptability and continuous learning.

So, are you ready to take your trading to the next level?