Last Updated on February 9, 2025 by Arif Chowdhury

Ever feel overwhelmed by the chaos of trading?

Many traders struggle to make sense of price movements.

They ask questions like:

- Why did the price spike out of nowhere?

- What’s behind those sudden reversals?

- How do I navigate this sea of noise?

This is where market microstructure comes into play.

As a seasoned Forex trader since 2015, I’ve seen firsthand how crucial understanding microstructure is for success.

Let’s dive into why this knowledge can enhance your trading skills.

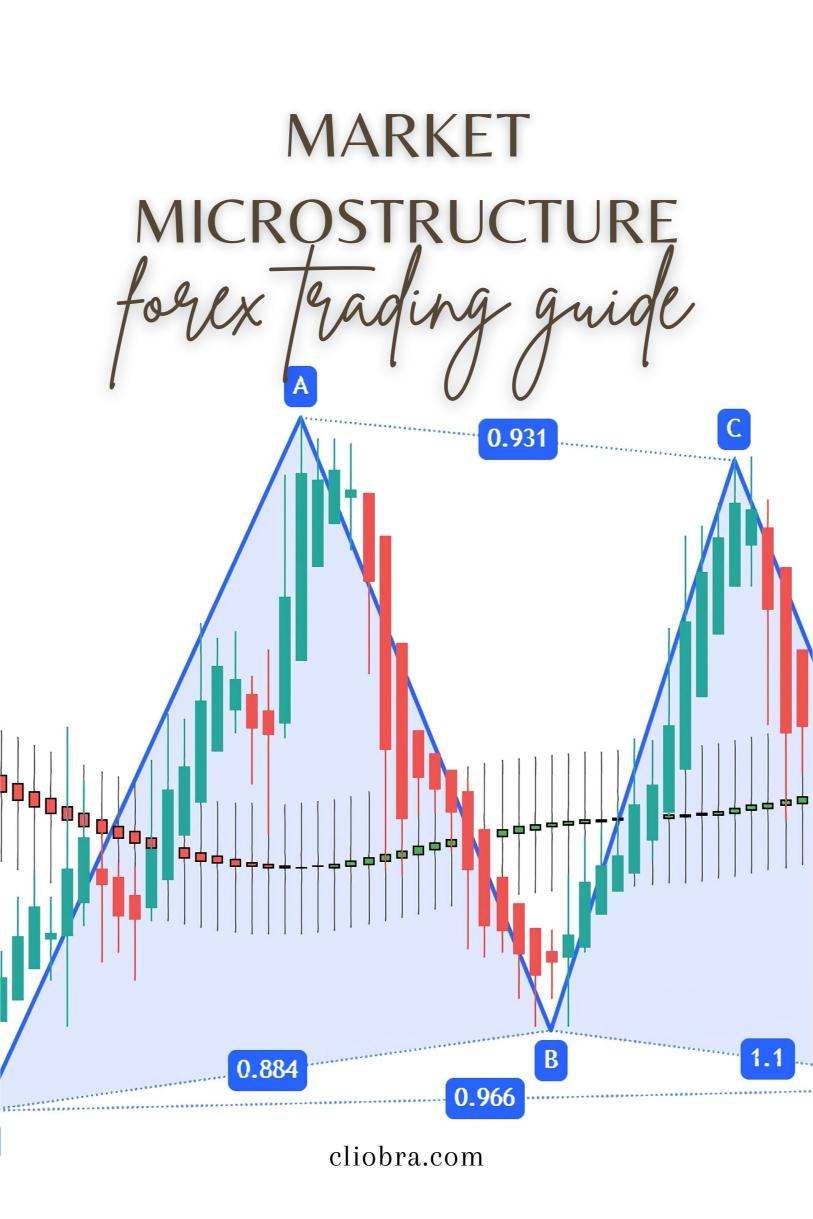

What is Market Microstructure?

Market microstructure refers to the mechanisms and rules that govern trading.

It’s about how orders are executed, how prices are formed, and how liquidity flows in the market.

Understanding this can give you an edge.

Here’s why:

- Order Types: Knowing how market orders, limit orders, and stop orders work can help you position yourself better.

- Liquidity: Understanding where liquidity resides helps you avoid trading in thin markets, which can be risky.

- Price Impact: Recognizing how large trades affect price can guide your entry and exit strategies.

Why Should You Care?

- Informed Decisions: By understanding microstructure, you make smarter trades.

You can predict price movements better and adjust your strategies accordingly. - Reduced Slippage: When you grasp how your broker executes trades, you can minimize slippage.

Slippage can eat into your profits, so knowing how to navigate it is vital. - Enhanced Risk Management: Understanding the dynamics of order flows helps you manage your risk more effectively.

You can identify when to scale back or ramp up your trading.

Key Concepts to Grasp

Let’s break down some essential concepts.

- Bid-Ask Spread: This is the difference between what buyers are willing to pay and what sellers are asking.

A tighter spread often means better execution. - Market Depth: This shows the number of buy and sell orders at different price levels.

Understanding market depth helps you gauge potential price movements. - Order Book Dynamics: The order book provides insight into supply and demand.

Monitoring it can give you clues about future price action.

Statistical Insights

Here’s a stat that might surprise you:

Approximately 70% of all trades in Forex are executed by algorithms.

This means understanding how these algorithms operate can drastically improve your trading strategy.

Another interesting fact:

The average bid-ask spread in Forex can range from 0.1 to 3 pips depending on market conditions and liquidity.

Being aware of this can help you choose the right broker and trading conditions.

How to Use This Knowledge

- Choose the Right Broker: Not all brokers offer the same execution speed or spread.

I’ve tested several, and you can check out the best ones I recommend. - Monitor Market Conditions: Keep an eye on economic calendars and news that can affect liquidity.

Major news releases often lead to increased volatility. - Utilize Technology: Leverage technology like trading bots.

My portfolio consists of 16 sophisticated trading bots designed to trade major currency pairs like EUR/USD and GBP/USD.

These bots are built for long-term performance, targeting 200-350 pips while minimizing risk through diversification.

Conclusion

Understanding market microstructure is not just a nice-to-have; it’s a game changer.

With this knowledge, you can make informed decisions, reduce slippage, and enhance your risk management.

And remember, trading isn’t just about the charts.

It’s about understanding the underlying mechanisms that drive those charts.

If you want to take your trading to the next level, consider exploring my trading bots portfolio.

These bots are free and can help you navigate the complexities of the market with more confidence.

Happy trading!