Last Updated on February 8, 2025 by Arif Chowdhury

Are you struggling with how much to trade in the chaotic world of Forex?

Do you find yourself losing sleep over whether your position size is too big or too small?

You’re not alone.

Position sizing can make or break your trading journey.

The good news?

Mastering dynamic position sizing can lead you to consistent profitability.

Let’s dive in.

What is Dynamic Position Sizing?

Dynamic position sizing is the strategy of adjusting the size of your trades based on your account balance, volatility, and risk tolerance.

Instead of following a one-size-fits-all approach, you tailor your trade size to fit your current situation.

This method helps you manage risk more effectively.

Why Dynamic Position Sizing Matters

Here’s a shocking statistic: approximately 90% of retail traders lose money.

Why?

One major reason is improper risk management.

Dynamic position sizing can help you avoid being part of that statistic.

By adjusting your trade sizes, you can:

- Protect your capital: Prevent large losses that can wipe out your account.

- Maximize growth: Scale up your positions when you’re on a winning streak.

- Reduce emotional stress: Trade with confidence knowing you’re in control.

The Basics of Position Sizing

To get started with dynamic position sizing, you need to understand a few key concepts:

- Risk Percentage: Decide what percentage of your account you’re willing to risk on a single trade. Common figures range from 1% to 3%.

- Account Balance: This is the total amount in your trading account.

- Stop-Loss Distance: The number of pips between your entry point and stop-loss order.

The Formula

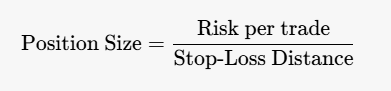

Here’s a simple formula to calculate your position size:

Determine your risk per trade: Risk per trade = Account Balance × Risk Percentage

Calculate the position size:

Using this formula ensures you’re not risking more than you can afford.

Adjusting for Volatility

Market conditions can change rapidly.

When volatility increases, it’s wise to reduce your position size.

Conversely, in a calm market, you could afford to increase your size.

To quantify volatility, consider using tools like the Average True Range (ATR).

Real-World Application

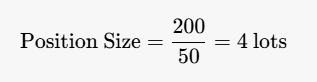

Let’s say you have a $10,000 account, and you’re willing to risk 2% per trade.

Your risk per trade would be $200.

If your stop-loss distance is 50 pips, your position size would be:

This means you’re trading 4 mini lots, which is manageable and within your risk tolerance.

The Power of Diversification

As someone who’s been trading since 2015, I can’t stress enough the importance of diversification.

I’ve developed a portfolio of 16 sophisticated trading bots that focus on four major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot is designed to minimize correlated losses through strategic diversification.

This way, even if one bot underperforms, others can still contribute to your overall profitability.

Tools to Help You Master Position Sizing

- Position Size Calculators: Use online calculators to simplify your calculations.

- Trading Journals: Keep track of your trades and analyze your position sizes.

- Backtesting: Validate your strategies over historical data to see how they would have performed.

Final Thoughts

Mastering dynamic position sizing isn’t just about numbers; it’s about mindset.

Understanding how to adjust your trade sizes can lead to a more sustainable trading approach.

As you refine your skills, consider exploring the best Forex brokers I’ve tested. They can enhance your trading experience and provide a solid foundation for your strategies. Check them out here: Most Trusted Forex Brokers.

And if you want to take your trading to the next level, don’t forget to explore my 16 trading bots portfolio. These bots are designed to work continuously, providing you with the opportunity for long-term profits while mitigating risks.

Happy trading! 🎉