Last Updated on February 8, 2025 by Arif Chowdhury

Have you ever felt the market just gets too far ahead of itself?

Like when a currency pair skyrockets, and you just know it’s going to come back down?

That’s where the mean reversion strategy comes into play.

As a seasoned Forex trader since 2015, I’ve seen this time and again.

Let’s break down what mean reversion is, how it works, and how you can effectively use it in Forex trading.

Understanding Mean Reversion

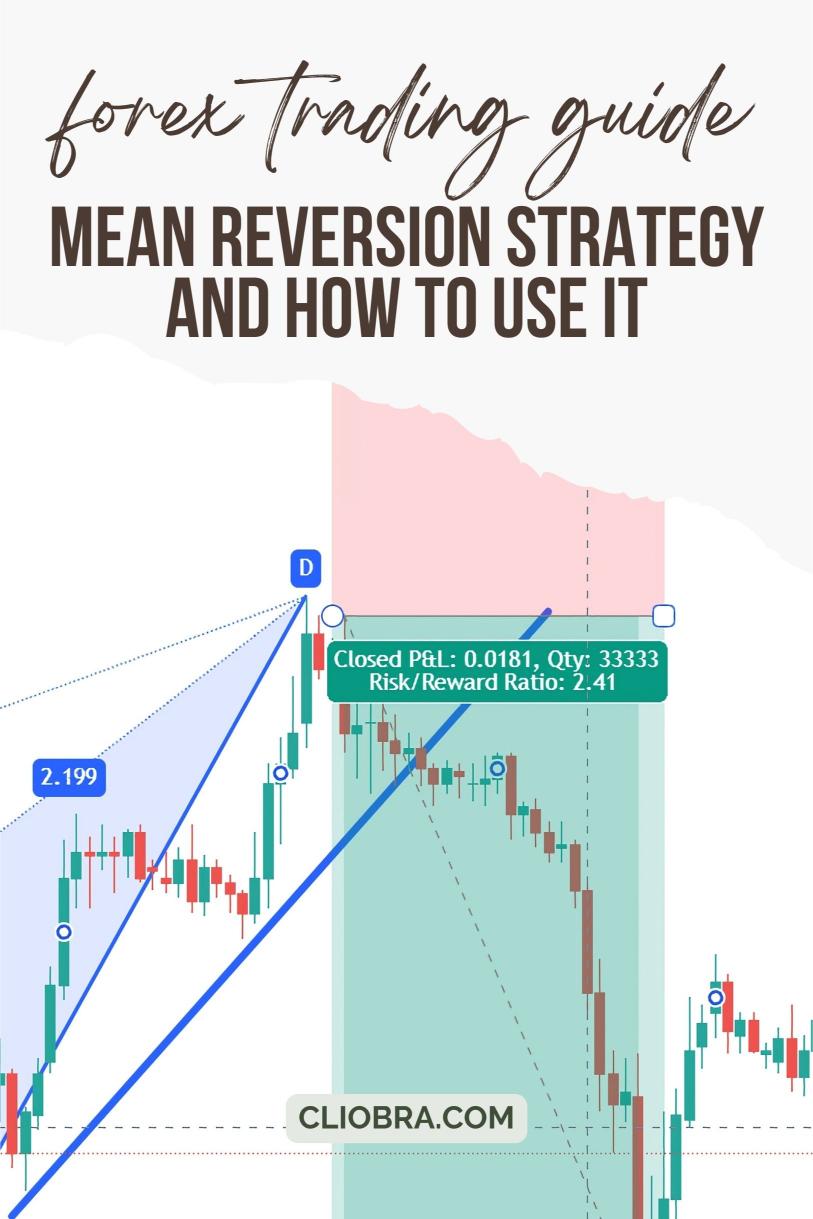

Mean reversion is based on a simple idea: prices will return to their average over time.

Think of it like this: if a currency pair has been trading at 1.2000 for a while and suddenly jumps to 1.2500, traders will start thinking, “This is too high.”

They’ll sell, pushing the price back down toward that mean.

Statistically, around 70% of price movements eventually revert to the mean.

That’s a solid reason to consider this strategy!

How to Identify Mean Reversion Opportunities

Here’s the fun part: spotting potential mean reversion trades.

- Use Technical Indicators:

- Bollinger Bands: When prices touch the outer bands, it’s often a signal they’re overbought or oversold.

- Relative Strength Index (RSI): An RSI above 70 indicates overbought conditions, while below 30 signals oversold.

- Set Your Timeframes:

- Mean reversion works best on higher timeframes, like H4 or daily charts.

- This reduces noise and gives you a clearer picture.

- Look for Divergence:

- If prices are hitting new highs or lows but indicators aren’t, it’s a red flag.

- This divergence can signal a potential reversal.

Executing the Mean Reversion Strategy

Now that you know how to find these opportunities, let’s talk execution.

- Entry Points:

- Wait for confirmation from your indicators.

- If RSI shows overbought and price hits the upper Bollinger Band, it might be time to sell.

- Stop Losses:

- Always set stop losses to protect your capital.

- A good rule of thumb is to place it just beyond the recent high or low.

- Take Profit:

- Aim for a return to the mean.

- If you entered on a sell at 1.2500, look to take profit around 1.2000.

Tips for Success

- Practice Patience:

- Mean reversion isn’t a get-rich-quick scheme.

- Sometimes it takes time for prices to revert.

- Stay Informed:

- Market news can impact price movements.

- Be aware of economic indicators that might affect the currency pairs you’re trading.

- Diversify Your Portfolio:

- Don’t put all your eggs in one basket.

- Consider my 16 trading bots designed to trade across multiple currency pairs, which helps mitigate risk.

Why Combine Mean Reversion with Automated Trading?

I’ve developed a unique portfolio of 16 sophisticated trading bots that utilize mean reversion principles, strategically diversified across major pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

This diversification minimizes correlated losses and enhances overall profitability.

Here’s the kicker: my bots are designed to trade on H4 charts, targeting long-term gains of 200-350 pips.

They have been backtested for the past 20 years and perform excellently, even under harsh market conditions.

If you want to maximize your potential, consider checking out my bots.

Final Thoughts

Mean reversion is a powerful strategy.

It’s all about understanding market dynamics and using the right tools.

With proper execution, it can lead to consistent profitability.

Remember, trading isn’t just about winning; it’s about managing risk and setting yourself up for long-term success.

If you’re serious about Forex trading, check out the best Forex brokers I’ve tested, and consider incorporating my trading bots into your strategy.