Last Updated on February 7, 2025 by Arif Chowdhury

Ever wondered how the big players in Forex make their moves?

Why do some traders seem to always be one step ahead?

As a seasoned Forex trader since 2015, I’ve seen the highs and lows in this game.

I’ve honed my skills through deep dives into both fundamental and technical analysis.

But let’s talk about something that doesn’t get enough attention: Institutional Liquidity Engineering Concepts.

These concepts can be game-changers for anyone looking to elevate their trading.

Let’s break it down.

Understanding Institutional Liquidity

Institutional liquidity refers to the ability of large financial institutions to buy or sell massive amounts of currency without causing drastic price changes.

These institutions—banks, hedge funds, and other major players—thrive on understanding market dynamics.

They know how to manipulate liquidity to their advantage.

Why Should You Care?

- Market Moves: About 80% of Forex trading volume comes from these big players.

- Price Levels: They create key support and resistance levels.

- Market Sentiment: Their moves can give you insights into market trends.

If you can align your trades with the actions of these institutions, you can enhance your profitability.

Key Concepts to Consider

1. Supply and Demand Zones

These zones indicate where the market has a high probability of reversing.

- Look for: Areas where price has previously reversed significantly.

- Act on: Buying at demand zones and selling at supply zones.

2. Order Blocks

These represent areas where institutions have placed large orders.

- Identify: Look for candles with significant body size, often resulting from heavy buying or selling.

- Trade: Enter trades when price returns to these blocks.

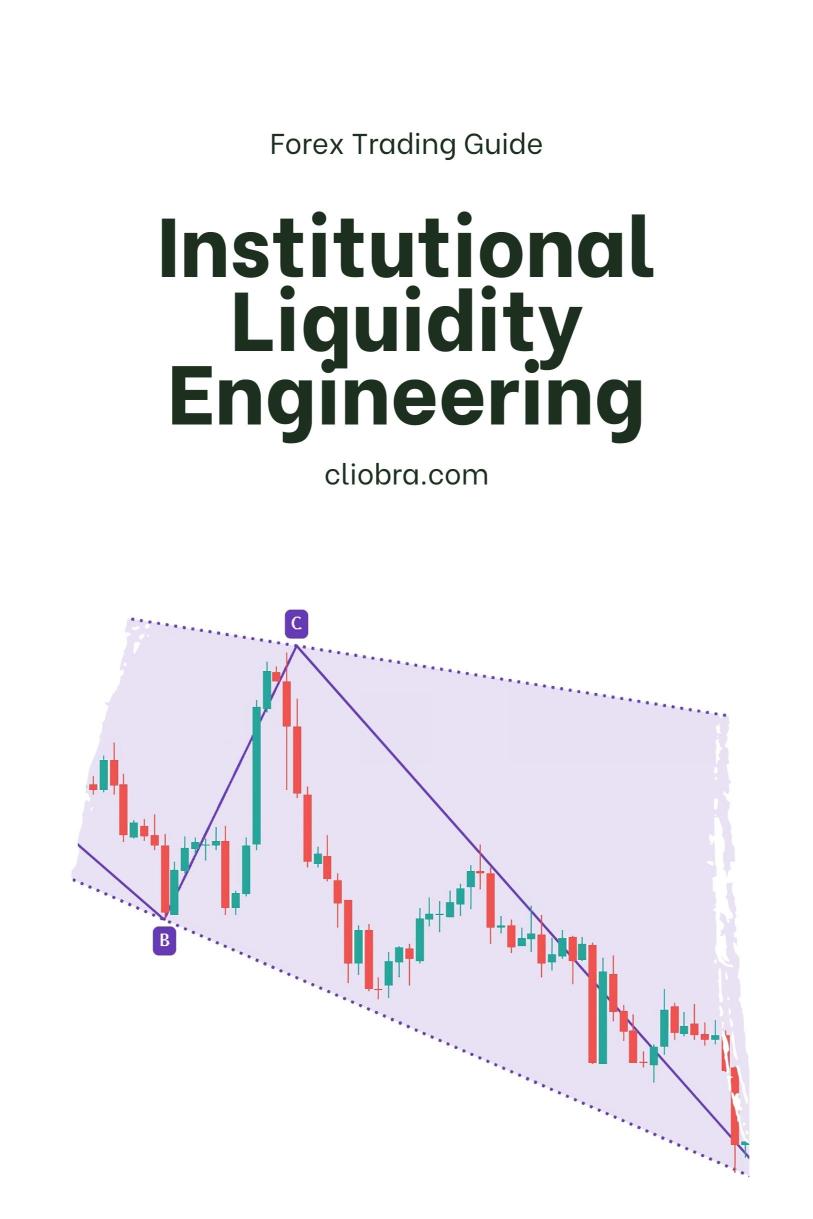

3. Market Structure

Understanding the market structure can help you predict future price movements.

- Higher Highs and Higher Lows: Indicates bullish momentum.

- Lower Highs and Lower Lows: Indicates bearish momentum.

Align your trades with the prevailing market structure for better odds.

Practical Steps to Implement These Concepts

Step 1: Analyze the Market

Use tools like:

- Charts: Focus on H4 charts for longer-term trends.

- News Events: Stay updated with economic news that can affect market liquidity.

Step 2: Identify Key Levels

Mark your supply and demand zones, and look for order blocks.

This will help you pinpoint entry and exit points.

Step 3: Use Risk Management

Never risk more than 2% of your account on a single trade.

This keeps your capital safe, allowing you to trade longer.

Step 4: Leverage Technology

Consider using trading bots that I’ve developed.

They’re designed to trade these concepts automatically across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

These bots are diversified to minimize risks and enhance profitability.

If you want to check them out, visit my trading bots portfolio.

Step 5: Find a Good Broker

A reliable broker is crucial for executing your trades effectively.

I’ve tested several, and you might want to explore some of the best Forex brokers I recommend.

Real-Life Example

Let’s say you spot a demand zone around 1.2000 on the EUR/USD.

You see a large bullish candle indicating institutional buying.

You place a buy order at that level with a stop loss just below the zone.

If the price goes up to 1.2500, that’s a solid 500 pips profit.

This is the power of understanding institutional liquidity.

Conclusion

Trading Forex using institutional liquidity engineering concepts isn’t just for the pros.

With the right tools and knowledge, you can make informed decisions.

Remember to analyze market trends, recognize key levels, and manage your risks effectively.

And don’t forget, using automated trading solutions like my trading bots can simplify your trading journey.

If you’re looking for a reliable partner in your trading adventure, check out the best Forex brokers I trust.

Get ready to elevate your trading game! 🚀