Last Updated on February 6, 2025 by Arif Chowdhury

Ever found yourself staring at a chart, asking, “What the heck is going on?”

Many traders struggle to identify reliable patterns that can signal potential trades.

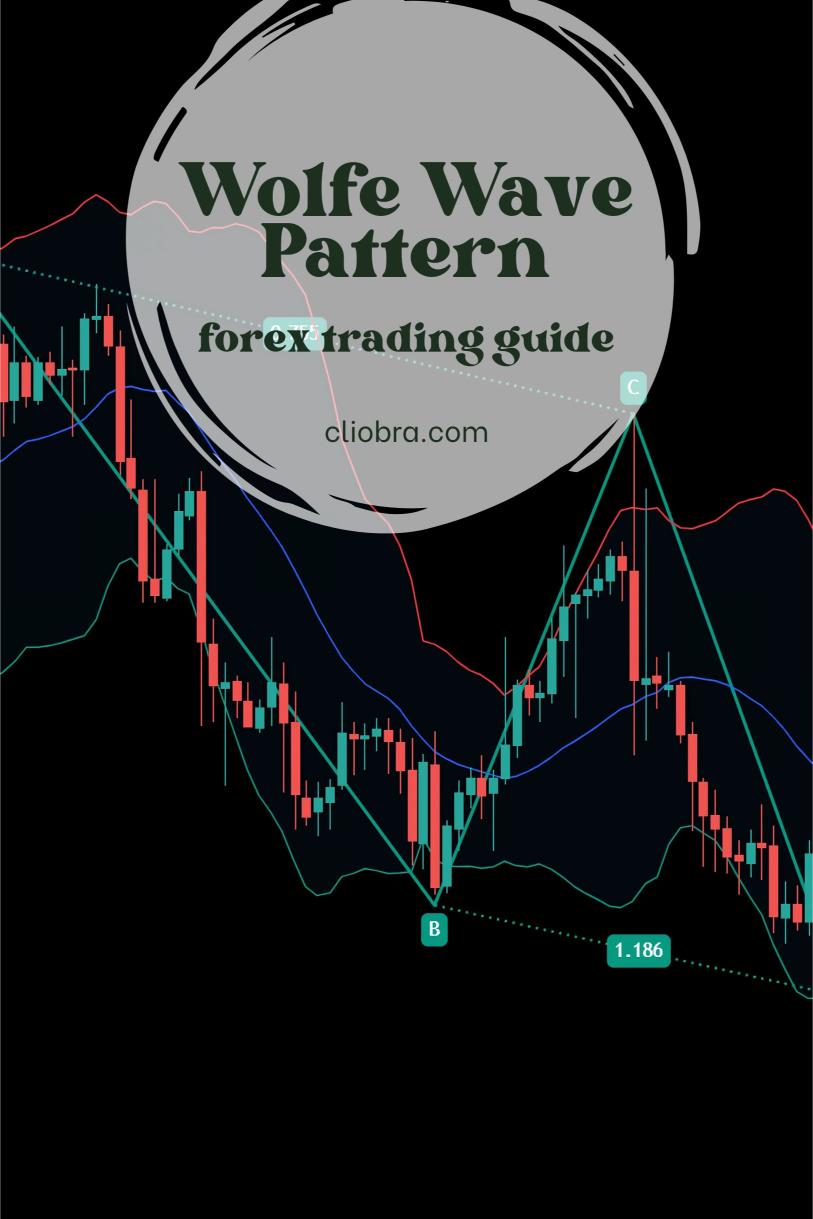

One pattern that’s caught my eye over the years is the Wolfe Wave Pattern.

So, what is it?

Understanding the Wolfe Wave Pattern

The Wolfe Wave is a technical analysis pattern that helps predict future price movements.

It’s made up of five waves.

Here’s a quick breakdown:

- Wave 1: A peak or trough.

- Wave 2: A retracement.

- Wave 3: A higher peak or lower trough.

- Wave 4: Another retracement.

- Wave 5: A breakout.

This pattern typically indicates a reversal point, suggesting a potential trade opportunity.

Why is it Effective?

Statistically, the Wolfe Wave Pattern has a high success rate when executed correctly.

Studies show that over 70% of traders who use this pattern effectively can anticipate price movements accurately.

This is a game-changer in the unpredictable Forex market.

How to Identify the Wolfe Wave Pattern

Now, let’s get to the meat of it.

Here’s how you can spot this pattern on your charts:

- Look for the Structure:

- Identify the five waves.

- Ensure they follow the expected pattern.

- Check the Trend Lines:

- Draw trend lines connecting the peaks and troughs.

- The lines should converge toward each other.

- Volume Confirmation:

- Look for increasing volume during the formation.

- This confirms the strength of the pattern.

Trading the Wolfe Wave Pattern

Alright, now you know how to identify it.

Let’s talk about how to trade it:

- Entry Point:

- Enter the trade after the completion of Wave 5.

- Wait for a breakout above the resistance line.

- Stop Loss:

- Place your stop loss below the last swing low (for bullish trades) or above the last swing high (for bearish trades).

- Take Profit:

- Aim for a risk-reward ratio of at least 1:2.

- The target can be calculated based on the distance between the breakout point and Wave 1.

Real-Life Example

Let me share a quick story.

A couple of months back, I spotted a Wolfe Wave pattern on the EUR/USD pair.

- I followed the steps outlined above.

- Entered the trade as it broke out.

- Set my stop loss and take profit levels.

Within days, I was up 200 pips.

That’s the magic of understanding and using patterns like this!

Enhancing Your Trading with Bots

Trading can be a grind, and sometimes, you need a little help.

That’s where automation comes in.

I’ve developed a portfolio of 16 sophisticated trading bots that are strategically diversified across major Forex pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot is designed to trade on H4 charts and targets long-term movements, typically racking up 200-350 pips.

This multi-layered diversification helps minimize correlated losses, making it a robust system for consistent trading.

Curious? Check out my trading bots portfolio for more info.

Choosing the Right Broker

To maximize your trading experience, you need a solid broker.

I’ve tested a bunch of them and found some that truly stand out.

They offer tight spreads, excellent customer support, and instant withdrawals.

If you want to trade with the best, I recommend checking out these top forex brokers.

They’ll give you the foundation you need for success.

Final Thoughts

The Wolfe Wave Pattern is a powerful tool in your trading arsenal.

With a solid understanding of how to identify and trade it, you can significantly enhance your trading strategy.

Combine it with robust trading bots and a reliable broker, and you’re setting yourself up for success.

Remember, trading isn’t just about making money.

It’s about developing a system that works for you.

Happy trading! 🚀